There has been a significant capital switch from mutual fund investing to ETFs, from active to passive investing. This has been a significant positive for many investors because there are many “active” managers who are closet indexers and active managers who do not show skill.

It is often easier and cheaper to gain exposure through ETFs but the active to passive debate is not the same as the active to buy and hold debate. There will come a time when equities go into a bear market and interest rates start to climb quickly. Investors will have to make choices, stay with a diversified buy and hold portfolio and weather the performance storm or make some asset allocation adjustment. There should be concern that the dynamics of a new bear market will be different from the past.

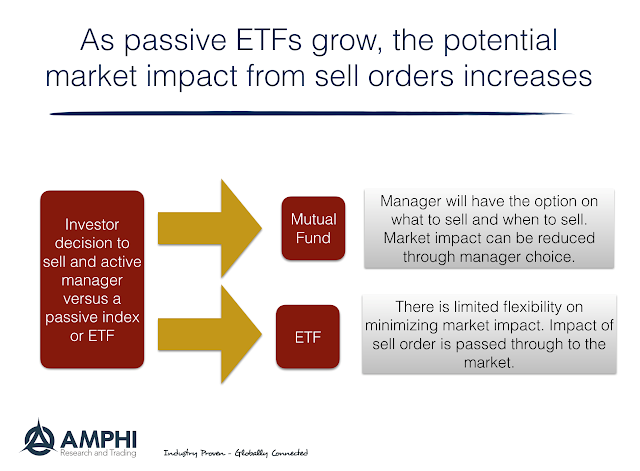

We have to think through scenarios of what will happen if there is a downturn with the current market structure. In particular, active money management of a fund in a market downturn gives trading authority, within investment guidelines, to the manager who may be able to adjust quickly, cut risk exposures, raise cash, and adjust the portfolio mix based on available liquidity. An investment in a passive investment is a blunt instrument when making buy or sell decisions.

Passive managers has no authority to adjust risk in a portfolio since the allocations and guidelines are set. There are rules and passive funds will not adjust behavior to market conditions. A sell order in an ETF will trigger orders across a spectrum of markets without concern for liquidity or nuances across markets. The market adjustments will implicitly be in the hands of the investor with respect to holding the ETF, but there will be no buffer from an active manager to reduce market impact.

This may not seem like a large problem when ETF allocations were small, but it could be a real problem now. It is compounded if the ETF portfolios invest in assets that may be less liquid in a market downturn. The significant amount invested in LQD and HYG, two of the largest credit and high yield ETF, could make this problem a reality. Investors should be checking for the exits before an investment fire begins.