“I am not an optimist. I am a very serious possibilist.” – late statistician Hans Rosling.

“I am a trend-follower for both price and fundamentals. I am also a very serious scenario realist.”

How do investors reconcile potential storm clouds with optimistic trends in markets. There is ongoing information of long-term economic problems from a wide variety of sources today, yet many markets have continued to move higher and followed trends. There often seems to be disconnects between long-term peril or risks and shorter-term optimism. Some says this is the essence of a bubble market, a disconnect between price and fundamentals, yet avoiding trends based on yet to be realized threats can easily cause investors to avoid profitable opportunities.

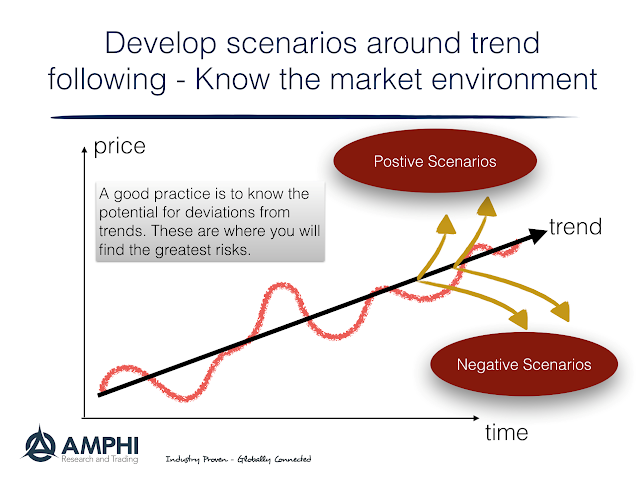

It makes sense to follow trends in the short-run (weeks or months), but also realize that at some point long-term negative events will be brought forward into the present. The bringing forward of alternative possibilities that are counter to trends is the point when momentum crashes will occur. For example, excess credit and leverage are a macro problem, but trends can continue for a long-time before credit concerns are pushed forward and cause price adjustments.

To avoid momentum crashes the investor has three options for protection. One, diversify across assets so that any one momentum crash will not damage the portfolio. Two, use risk management stops to exit positions that reverse direction. When the momentum crash comes, there is a process for exit regardless of what are the market conditions. Three, track fundamental possibilities to determine when or if negative scenarios may become reality and use this for strategic allocation adjustments.

The first two choices are strongly systematic. Diversification and portfolio structuring can done well before a negative event. Similarly, stop-loses can be added before any action is necessary albeit there is evidence that stop-loss triggers may be sub-optimal. Many systematic managers find the third option problematic. Engaging in scenario analysis can be disciplined but it is not a systematic activity. There is no easy way to add rules to account for scenarios, yet this can be a very effective exercise.

Why are scenarios relevant? The catalysts for any change in trends are usually, although not always, known or within our grasp. Prices are primal and condense all information, but their weighting of probabilities change through time. Past prices can be wrong about the future.

Scenario analysis can tell us something about the potential correlation of risks. A Fed tightening shock will likely have an impact on all emerging market debt. An oil shock will have an impact on the real economy and equity markets. Consequently, scenario analysis may help change the strategic weights or leverage within a portfolio. Although difficult, the mapping of scenarios to asset classes could be done systematically. Scenarios are a fundamental component of risk analysis. The biggest disconnects between trends and weighted scenarios are also likely the greatest risks. One can follow trends but still engage in scenario analysis to measure potential risks.

See also:

Using scenario analysis to help with asset allocation – A simple solution to a complex problem

Scenario Analysis for Systematic Managers? Absolutely!

A simple taxonomy of diversification – All diversifiers are not alike

Accept the investment environment – Just use the right tools to describe it, cases and scenarios