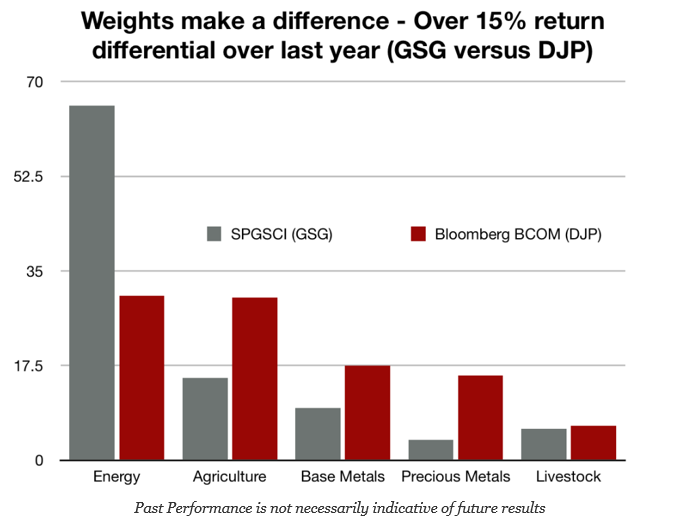

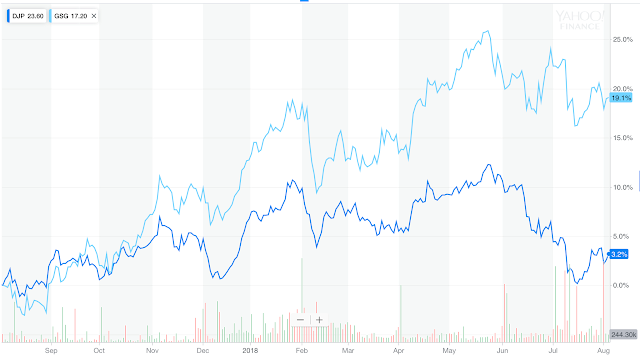

Commodities, as an asset class, have had exciting performance year; well maybe, if you had the right index. A quick look at returns over the last year shows that if you held the SPGSCI index through the GSG ETF, you would have gained a very attractive 19 percent return. If you held the broader-based Bloomberg commodity index (BCOMM) (DJP ETF) you would have received only 3.2%. Both are well-defined indices, but the performance difference would have been in the double digits. This is all based on the weighting of the index. SPGSCI has a 2/3rds weighting in energy while the BCOMM only has a 30 percent energy weighting. If you liked energy, you would have been a star. If you preferred diversity, you would have been made only a slightly positive gain.

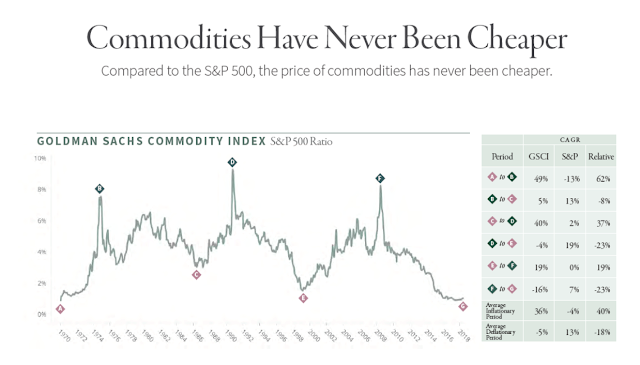

More analysts have talked about commodities being a good bet versus equities, yet care is needed in finding the right vehicle. See the latest chart from Goehring and Rozencwajg.

Nevertheless, there is a gap between picking the right or wrong index. There is still high dispersion between commodity indices. A better approach may be to hold an index with a portfolio of commodity risk premiums that will smooth out returns and provide added diversification by style through carry, value, momentum, and volatility strategies. There may not be the same strong gains but there is the opportunity for smoother returns the will be less correlated with any given commodity sector.