Market performance for October was sobering. Investors were complacent to volatility and the fact that markets correct. The speed of adjustment hurt the average managed futures manager who was not able to get out of markets, which repriced at the beginning of the month. Although the month ended with some improvement from return lows, there is little to celebrate.

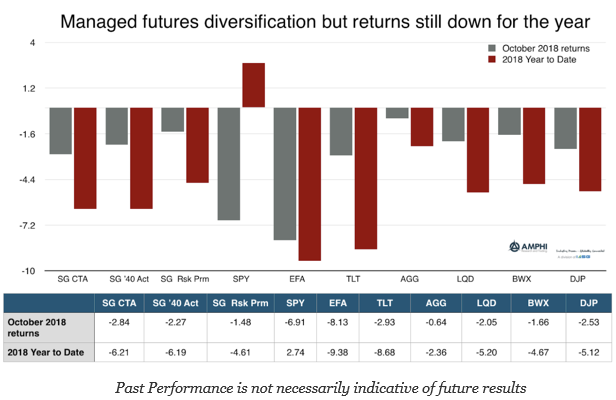

Managed futures, on average, performed better than equity markets but this is little consolation when returns were still negative. The combination of trading all major asset classes and being able to go both long and short provides a high degree of diversification, but crowded long equity trades dominated performance. Additionally, all major asset classes repriced risk, so there were no clear trends to exploit.

Investor expectations for managed futures were not realized, which is a problem. So what should be the right expectations for momentum/trend during equity reversal months? Generally, in the short-run it is unlikely that trend-following returns will be negatively correlated with equity returns. Negative correlation between equities and managed futures only comes over time with sustained declines. Managed futures are generally uncorrelated with equities. Investors will gain diversification, but the form is unclear.