“I always believe that prices move first and fundamentals come second.” — Paul Tudor Jones

“And narratives move before prices.” – Ben Hunt

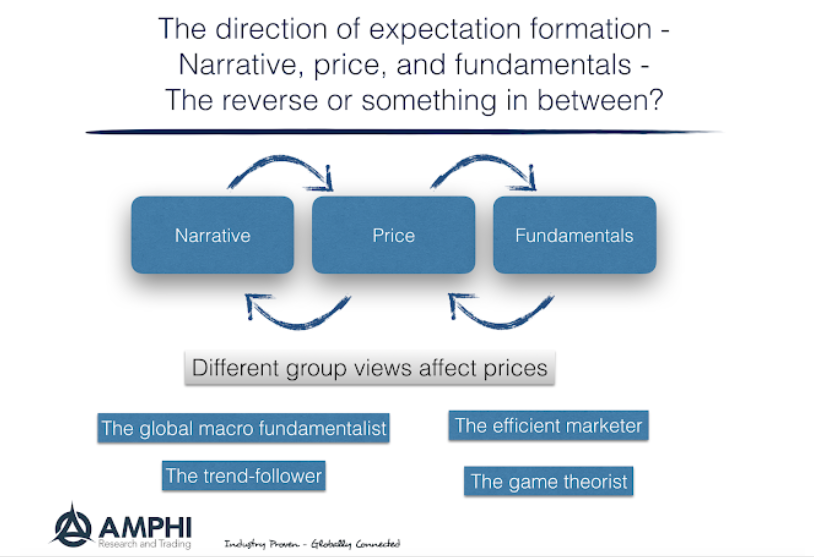

These alternative views are fundamental to how markets operate and represent an investor’s philosophy of markets. It drives how you filter information and derive profits.

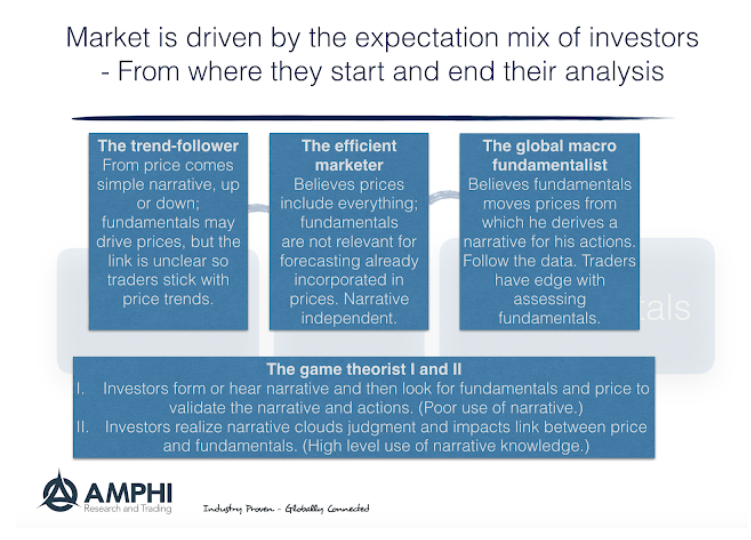

A trend-follower will state that price move first or at least the link between fundamentals and price is weak that there is no value with trying to determine fundamental relationships.

The global macro fundamentalist will state that economic events move markets and manipulating this data will create private information that can be used to forecast prices. Complexity in markets means that prices, which embody expectations, move first.

The efficient market person believes that markets move on surprise that all current information is incorporated in price. There may be value with research, but the return is just compensation to the effort required to gain an edge. Following trends will not give you an edge.

The narrative-driven investor thinks of the market as a game of expectations. Prices are a weight of different expectations which may be driven by stories, fundamentals, and the herd. Finding the narrative story that will push prices creates value. It is a “beauty pageant” of what investors think is the driving story for returns. From this story, investors look for confirming evident to support their narrative.

Any investor needs to know two things: what is the philosophy that drives his decisions; what is the philosophy that is driving the market as a whole. Are you price, fundamental, efficiency, or narrative driven? Is the market currently price, fundamental, or narrative driven? Know your expectation mechanics.