Risk management is more than applying quantitative tools to measure things like volatility or skew. It is an operational management problem of gathering and reporting data. The quality of risk management is related to the ability of a manager to properly aggregate data for analysis. Hence, strategies that have greater operational problems at gathering information on risk will have higher risk.

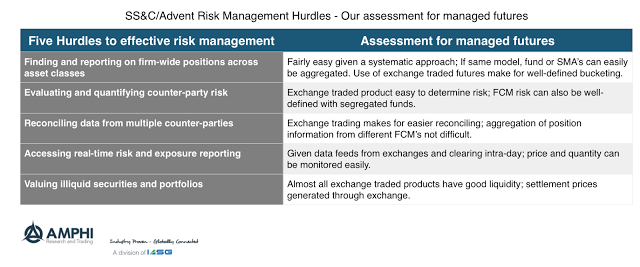

A white paper called “Managing Risk in a New World: Navigating the five major hurdles for hedge funds” from SS&C/Advent describes the biggest risk management reporting problems for hedge funds. We have taken their five hurdles and assessed whether managed futures managers will have a hard time overcoming these impediments. This is does not say that managed futures managers actually better control risks. It does say that it should be easier to gather the right information to make risk management decisions for this hedge fund style.

In very broad terms, managed futures risk management is easier given reporting is easier. First, there is not a problem with illiquid securities. All futures have a price and likely trade everyday. Second, exchange trading makes for easier reporting. A trade can be executed and the matched trade is reported to the exchange. Margin can be assessed and exposures can be measured. Third, given the exchange structure with a clearinghouse, there is limited counter-party risk. Fourth, if trades are done through multiple brokers and clearing firms, the process of reconciling or aggregating positions is easy. Finally, given the defined characteristics of the futures contracts, it is easy to report firm-wide positions. There is little ambiguity of what is bought.

Overall, the ability of managed futures managers to provide aggregate position information is relatively easy and the underlying instruments have been developed to maximize liquidity and serve as generic contracts. Hence the operational risk of managed futures will be lower than many other strategies. Given operational risk is minimized, quantitative can be properly applied.