Why should I hold managed futures? This was a much harder question to answer when bonds had such a negative correlation with stocks. Bond provided safety, yield, and return. Allocations to bonds provided diversification and return during the post-Great Financial Crisis period. It protected portfolios when volatility spiked, generated returns during the falling inflation, and did this through the simple allocation scheme of just holding two assets.

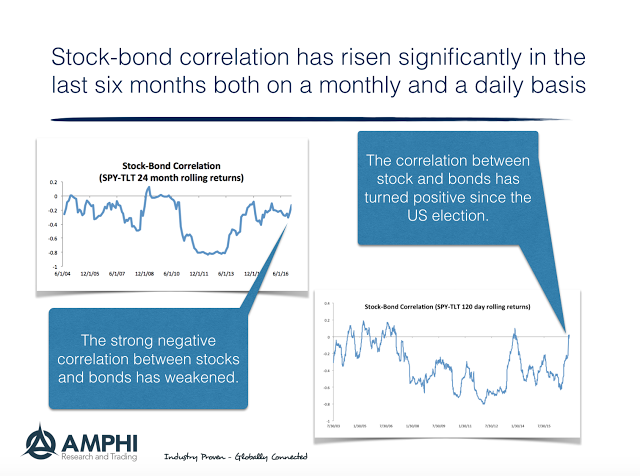

If the stock-bond correlation rises and moves closer to 0, managed futures will have similar diversification attributes. If bonds are underperforming because of low or negative yields and rising interest rates, managed futures programs are more likely to outperform on a total return basis. This makes holding managed futures more valuable.

The stock-bond correlation is increasing for several reasons, but the rise is primarily because of increasing inflation expectations. With inflation rising closer to 2% and the economy as measured by unemployment below 5%, inflation expectations have increased across most maturities. The negative correlation was associated with a “flight to quality” effect based on uncertainty, but with no current crisis, inflation expectations are the dominant driver. In addition, the low current volatility in equities, as measured by the VIX index, reduces risk-off safety flows.

If you believe that inflation should rise, a consistent allocation approach would be to increase managed futures exposure.