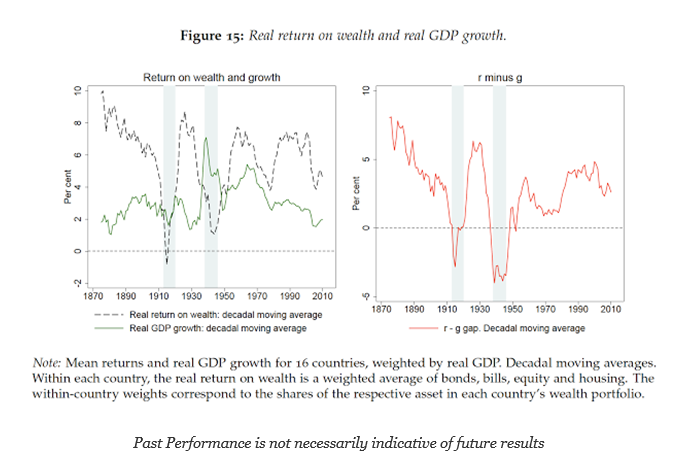

The new paper, The Rate of Return on Everything, 1870-2015, a tremendously informative research piece on long-term rates of return also happens to address one of the key issues concerning the cause of inequality discussed by Thomas Piketty in his book Capital in the Twenty-First Century. Piketty draws the provocative conclusion that inequality grows over time because the rate of return on wealth is higher than the growth of GDP. Wealth accumulates to those that have it and not to those that try and ride the wave of GDP growth. Given the positive discrepancy between “r”, the return on wealth, and “g” the growth in GDP, the gap of inequality will only grow over time.

“The rate of return on everything” shows that “r” is greater than “g” by a fair margin, but there are extended periods of negative returns and the return on wealth is highly variable. If you want to join the wealthy class, you have to save to have money to invest. As important, you have to control your wealth return to ensure you don’t lose your wealth. Inequality is a problem but wealth-holders take on risk and the certainty of gains are not guaranteed.