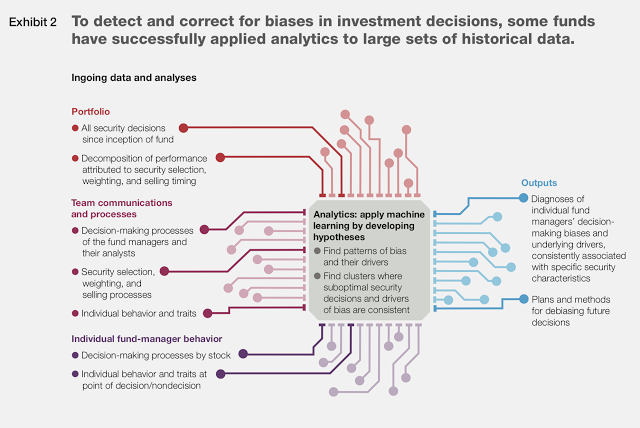

McKinsey and Company published an interesting paper on the use of AI in asset management called, “An analytics approach to debiasing asset management decisions”. (Hat tip to Tom Brakke for mentioning the article in his newsletter.) This paper shows the powerful use of analytical tools to extract hidden biases in investment management decision-making. Employing large data sets of manager decisions, companies are finding a wide set of behavioral biases identified in economics present with their decision-making.

Regardless of how smart the talent, biases can be deeply embedded in decision-making. These biases are often hidden from direct views because there was no systematic analysis of the data. Nevertheless, if they are found, there is a chance that decision-making can be nudged in the right direction. For example, if there is a confirmation or anchoring bias, the data can find the “bad” behavior, and procedures can be adopted to eliminate them.

This is a great use of artificial intelligence and data mining, but it begs the question of why rely on individual or committee decision-making in the first place with investment management. Systematic investing featured in quant programs, by their very nature, debiases decision-making. If there is confirmation bias, rules can be used to reduce it. If there is a bias to hold losers and sell winners, rules can be developed to reverse this tendency.

This does not mean that systematic programs are devoid of bias. It just means that the biases through a rules-based system are transparent. If they are present, it is because someone put them in the program. Any known behavior biases can be addressed directly. Perhaps the greatest value of systematic investing is not the development of any one special strategy but a holistic disciplined approach to ensure repeatable success.