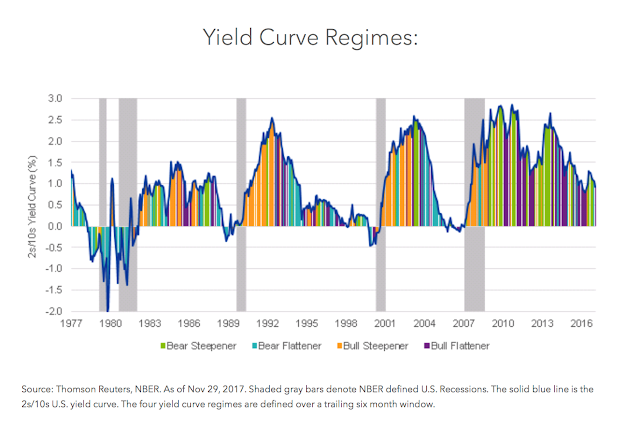

There has been a litany of stories on yield curve flatness as if this is the signal that will provide the investment secret to success for 2018. Investors should watch the yield curve closely, but it is important to focus on what it is and is not signaling. There is a cost with trying to be preemptive to what is being signaled in the yield curve.

Flat or inverted yield curves tell us something about:

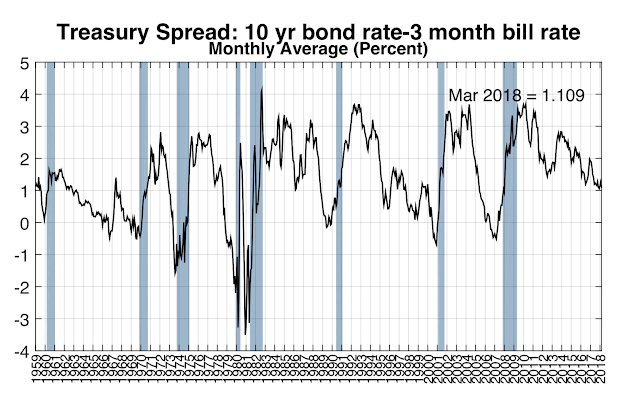

- Recessions – Inverted yield curves precede recessions although flat curves can last for a long time before becoming inverted or showing a recession signal. All recessions are preceded by inversions but not all inversions lead to recessions.

- Fed behavior – Flattening and inverted yield curve are associated with tightening of Fed policy, but tightening does not mean that a market sell-off or recession is around the corner. The link between the beginning of the tightening cycle and the impact on financial markets is loose.

- Term premium risk – Flat yield curves tell investors there is no compensation for taking duration risk. There is limited reason to take marginal duration risk. We find that flat curves signal future increases in yield. It is a negative signal for bonds.

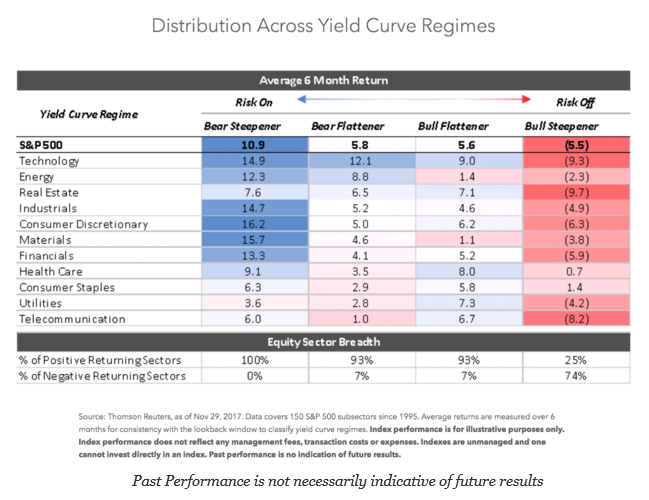

Equity markets – Flatter yield curve do not mean lower stock returns. Flattening curves are not associated with market sell-offs.

Now, there is a truism that you have to get flat to go inverted; however, there can be a long lag between showing flatness of inside 100 bps and moving to an inverted curve. Watch the slope of the curve, but be careful about trying to be early with the portfolio changes. Adjusting intra asset class allocations is different from allocation changes across asset classes. Reducing duration risk or equity sector exposures does not mean switching from risk-on to risk-off allocations at a macro portfolio level.