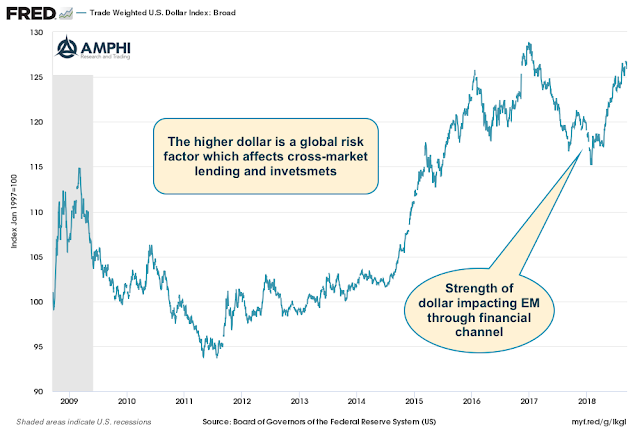

Global markets has been focused on trade, trade wars, and tariffs. News has been dominated by discussions on trade and less often about dollar currency changes and capital flows, yet capital flows often dominate trade. An increasing dollar is supposed to be emerging market positive through the trade channel, but in reality, a dollar appreciation will increase financial risks and impact EM investments.

Extensive research work by the Bank of International Settlements (BIS Working Papers No 695 “The dollar exchange rate as a global risk factor: evidence from investment” by Stefan Avdjiev, Valentina Bruno, Catherine Koch and Hyun Song Shin) shows the impact of a dollar shock on cross-market lending and investment. Forget the trade rhetoric and focus on the capital flows. Moves in the dollar have risk spillover to the rest of the world.

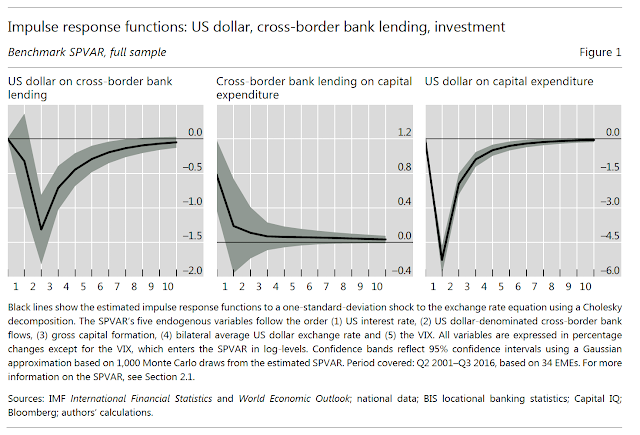

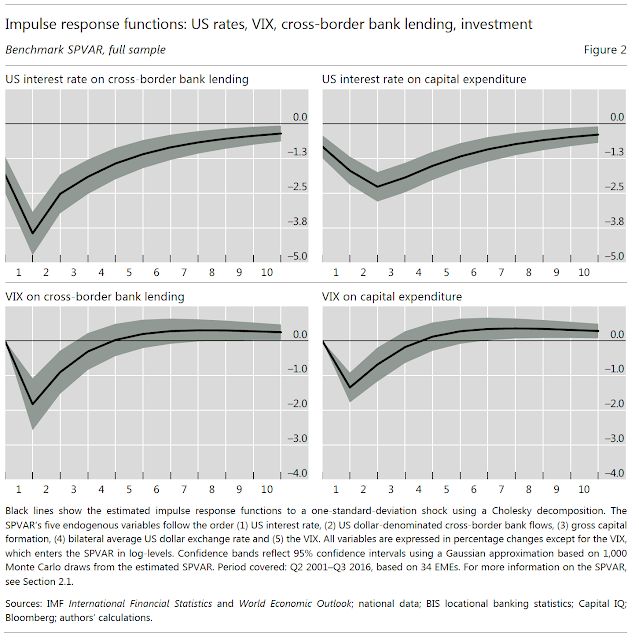

The BIS research work shows the impact of shocks from a dollar increase or a US rate increase. The spill-over to emerging markets is real as lending is decreased, credit risk is increased and real investment is reduced. The impact is illustrated through their empirical model which measures shocks to the cross-market system. A dollar shock will reduce cross border lending and affect capital expenditures. Similarly, a rate shock which will affect the dollar will also carry-over to cross-border lending.

The actions of the Fed do not just affect US financial markets but will spillover to emerging markets through this lending channel. A tightening Fed, even in the name of QE normalization, relative to other central banks will have a dollar impact which will lead to an EM lending impact.

In the last four years, the trade-weighted dollar has appreciated 20%. The dollar index is close to all time highs given the 2018 gains. This dollar shock negatively impacts the value of unhedged dollar-denominated liabilities. Borrowers are facing risks that they may not have expected with a less hawkish Fed. A reduction dollar lending growth to EM coupled with the higher cost of liabilities will translate to real investment effects.

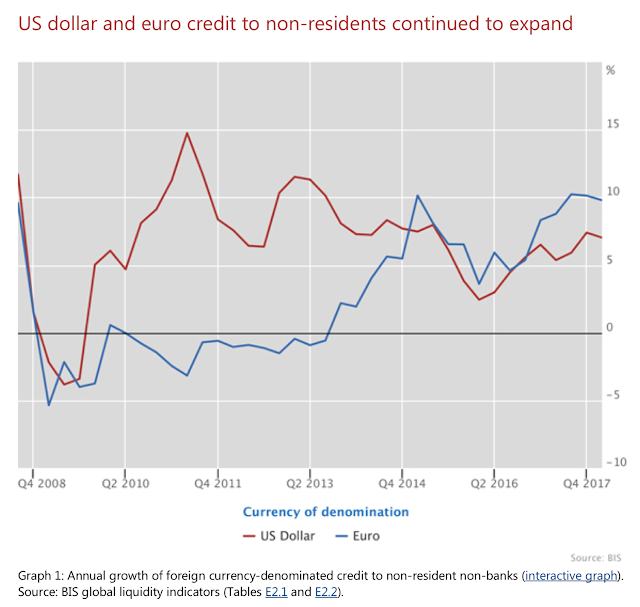

We may not yet be seeing the full effects in the BIS data since debt growth is still high. 2017 was a period of dollar decline which reduced any dollar shock pressure. We can see that the dollar credit growth rate has slowed since the end of Fed QE and the rise in US rates. There has also been a switch to euro financing. Perhaps not yet binding for all countries and companies, but the dollar shock is an important driver in the global credit cycle that will spillover to real EM investment and growth.