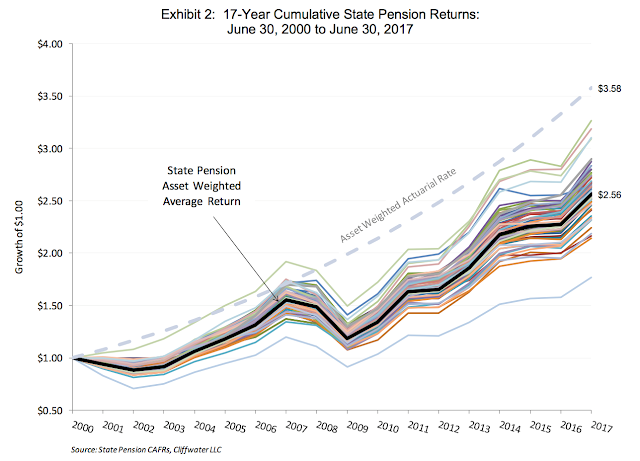

There are still significant funding challenges for state pension funds even with the bull market over the last decade. The consulting firm, Cliffwater, analyzed state pension performance over the last decade in the recent review. State pensions have not been able to meet their actuarial return assumptions. This under performance places them further below their funding requirements. These funding shortfalls exist even though most funds beat a 70/30 stock bond benchmark. There is also strong return dispersion across states with the best states generating returns 25 percent over the median state return and the worst states over 30 percent lower than the median.

The reasons for the under performance and the dispersion in returns is clear once we look at return dispersion around asset class benchmarks. States beat the 70/30 stock/bond benchmark, but that has not been good enough to generate an acceptable return versus actuarial assumptions. Actuarial assumptions, which averaged 7.79%, are going to have to come down although this is not a desired decision.

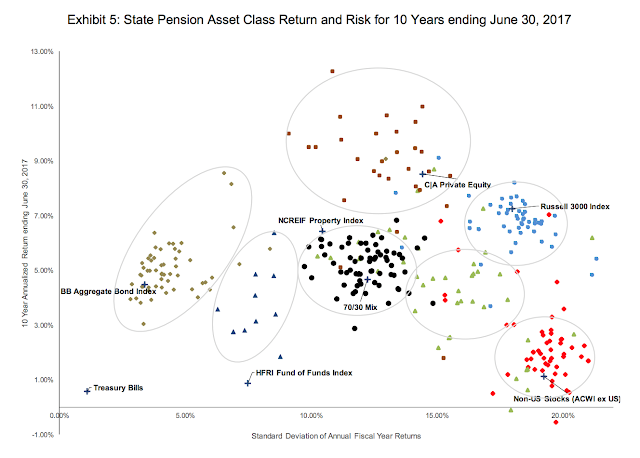

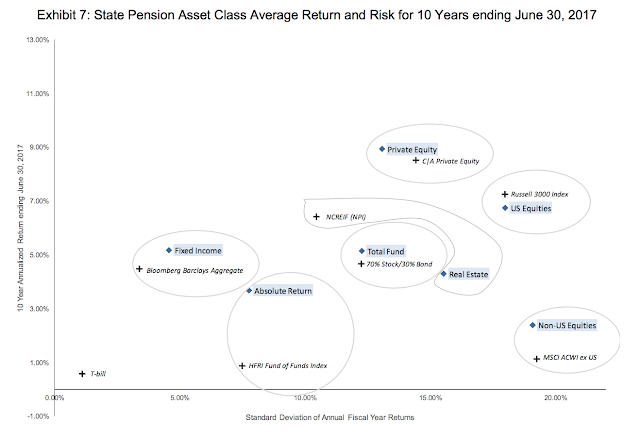

Portfolios saw significant absolute return drag from fixed income and absolute return strategies even if with benchmarks being exceeded. Only private equity median returns exceeded actuarial assumptions for the states. Non-US stocks were also a drag on performance.

So where are states going to get returns over the next few years to close the funding gap and hit actuarial assumptions? There may not be much room for extra return. Skill as measured by extra return versus a benchmark is possible, but the difference between median and benchmark is usually inside 100 basis points, so it is unlikely that pensions will be able to pick better managers to get more returns.

There will be swings in asset class returns based on the economic and credit cycle, which is a key area for advantage, but in a low growth and rates environment it may be hard to find an asset allocation mix to beat actuarial benchmarks. This will require tactical skill at changing the asset allocation. Given the size of these pensions, swings in allocation will not be easy to implement.

Pensions handily beat absolute return benchmarks, but this could be related to the poor quality of the benchmark over management skill. Nevertheless, absolute return strategies may still be the best way to boost returns for pensions. Independent of the vagaries of the market cycle, these strategies generated median returns of just under 3.5 percent, a far cry from what is needed by pension, but this is an investment area that can allow for return consistency.