The channels of monetary policy are more important for any investigation of the macro economy. This is one of the key lessons from the Financial Crisis. Now that short-term rates are finally moving higher, the behavior of banks with respect to their lending activities becomes more critical. It is expected that as rates move higher, the demand for loans will be lower. Additionally, there may be a tightening of lending when rates move higher.

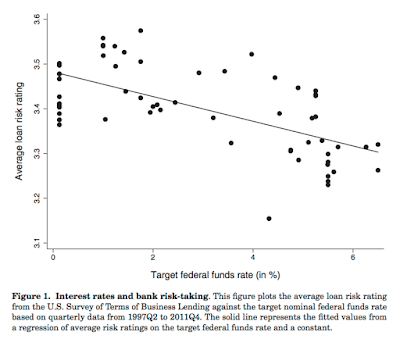

How tight will lending become as rates rise? There is limited analysis on this question, but a Journal of Finance paper, “Bank Leverage and Monetary Policy’s Risk-Taking Channel: Evidence from the United States” suggests the higher rates will take a bite out of riskier lending.

This is important because there is so much debt that will have to be refinanced at higher rates. There will be a day when debtors will need more money or have to rollover existing debt. They may know that the price paid for that debt will be higher, but the real question is whether the quantity will be available. Past research says there will be a day of reckoning; however, that day has not yet come.

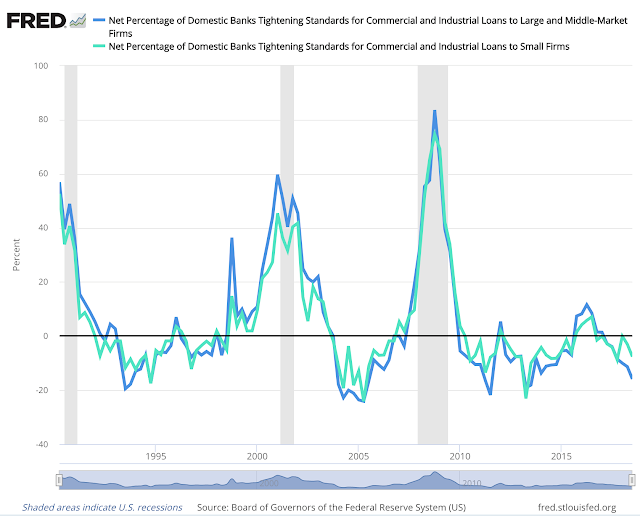

A review of domestic loan tightening standards suggests that at this point there is nothing wrong with the supply of credit. There is no tightening. You can warn about credit, but any action on this warning may be early. Investors may avoid fixed income based on the direction of rates, but right now, the risk of banks not providing credit as a reason to avoid seems to be limited.