Category: Agriculture

Q1 Agricultural Market Commentary

Guest post by Malinda Goldsmith of Four Seasons Commodities Agricultural markets have completed monstrous seven-year bear moves for good reason. Consider that we’ve had four years in a row of record or near-record crops, generally benign growing seasons in North America, ever-larger crops in South America, a strong dollar and a trade war which focused […]

JTM Capital Management – Major Factors Affecting Agriculture

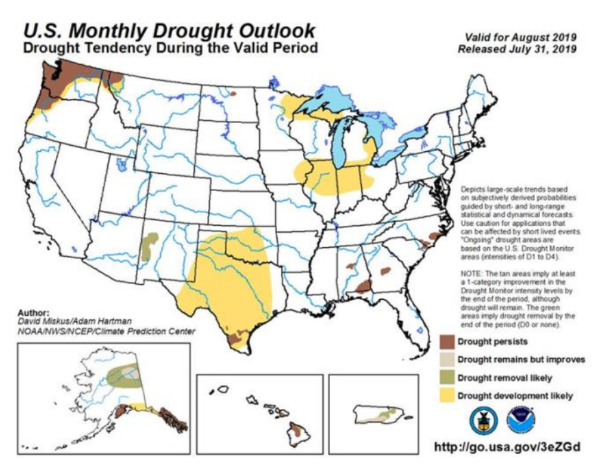

Following up on last month’s commentary, July featured lower than average rainfall and higher than average temperatures across most of the US’s primary growing regions. Interestingly enough these results were quite different than the NOAA long-range forecasts issued for the month. Specifically, most of the Corn Belt experienced maximum temperatures that averaged 2-4 degrees (F) above normal. As you can see on the left even with this year’s extremely wet spring, drought conditions are expected to develop in key growing regions of IA, IL, and IN. This is definitely something to keep an eye on as near perfect conditions will be needed to substantially increase row crop yields at this point.

Call Option on Weather Shocks Through Agricultural Managed Futures Managers

There is the potential for a major agricultural price dislocation if a strong La Nina effect lasts through the summer. It is unclear whether the current La Nina effects will continue, and current expectations are that it will dissipate in the spring, but history suggests that ENSO effects can disrupt many major commodity prices including corn, soybeans, wheat, coffee, and sugar. So how can investors take advantage of this uncertain opportunity?

Kottke Commodities – Little U.S. Business in Wake of Flood Rally

Between late June and end-July, U.S. agricultural prices traced an extraordinarily wide and rapid boom-and-bust, wild even for futures markets. The managers felt well-positioned in corn bullspreads, which did little despite the sharp changes in expectations for supply tightness; apparently it all occurred so fast that the commercial grain business was too frozen to assess and re-position. As December corn rose 90c per bushel in reaction to widespread flooding east of the Mississippi River, and then, après deluge, abruptly fell back 75c, the December-March spread narrowed only a scant 2c and then reversed by as much. The result was a crummy month for us.

Walmart Becomes Farm Friendly

Click the Link Below to watch the Full Story… Click Here

Oh, Wheat…

Wheat futures continued their downslide today with May15 sinking 15 ¼ cents in Chicago and settling at 4.70 ¼ and hitting a new life of contract low, this all despite Funds holding a record 100,000 contract short position. U.S. moisture has been beneficial with weather forecasts into next week for additional rains which is starting […]

Cattle: Futures Commentary

Bulls had something to cheer about to finish off last week’s trading in the Cattle markets after Thursday’s limit higher move followed by a $2-3 rally on Friday. However, the Friday afternoon USDA news was somewhat of a letdown, with the choice beef cutout coming in off $3.02 and the monthly COF (Cattle on Feed) […]

Still Neutral Sugar

Sugar #11- May15 Futures – In yesterday’s trading session Sugar future values were strongly influenced by the exchange rate movement in Brazil. This is the first time since March of 2004 that the dollar quote fell below $3, closing at R$2.967 (-1.3%).

Is Selling Corn the Way to Go? Update: April 21st 2015

Corn values sagging in early trade, with the May 15 contract currently trading at 3.72 ¼ lower by 5 ¾ cents with the new crop contract at 3.96 ¼ down 5 cents, pegging the May 15 vs. Dec15 (Old crop / New crop) spread at 24 cents. The Funds continue to add to their short […]

Kottke Commodities – Market is Pricing Political Risk on the Horizon

Surprisingly strong grain and oilseed prices in recent months bring to mind a joke: One man inquires of another, who’s on hands and knees beneath a streetlight, “Have you lost something?” to which is answered, “My contact lens.” “Where did you lose it?” asks the one. “Over there,” responds the prone, while pointing afar. “Then why are you looking here?” “Because the light’s better.”

Kottke Associates – As Grain Prices Fall, Shipping Costs Alter Outlook

Grain and oilseeds prices continue an abrupt transition from high-priced relative famine of the last five years to a low-price feast of plentiful supply. Farmers who did not prudently hedge before the big decline would say “overly plentiful,” but government subsidies will restore much of that. Recent years of demand growth undeterred by high prices had encouraged every farmer to plant and fertilize more, followed by Northern Hemisphere weather rivaling perfect greenhouse conditions. The result is the spectacular yields that high-tech seed companies advertised.

CTA Badges and Rankings

CTAs are always looking for opportunities to provide their firms additional exposure. Since IASG compiles data within our database, we thought it was relevant to provide CTAs with more marketing power when trying to reach their investing audience. Starting later this month, IASG will provide CTAs with access to a badge for ranking in the categories that meet their trading program. These categories include: discretionary, systematic, agriculture, Trend Following, Stock Index. The rankings badges will be provide monthly to the CTA for using on their email signature, embedding in their website, or within their marketing literature. Users of the IASG database will also get access to these badges on the CTA pages located in the right sidebar of the program page.

Kottke Associates – It’s The Weather, Stupid

August trading results improved markedly as one of the metrics with which we track ourselves, the ratio of winning trades to losers, rose dramatically. Summer crop development was uncharacteristically dull, with unchanging, uncannily positive growing conditions. Since we refrain from exposing investor capital to weather forecasts anyway, we trained our attention on the wheat crops already harvested and the old-crop soybean market still working out its supply tightness.