Category: Alternative Investment Strategy

Risk-on- What happened to fears of 2018?

The equity reversal was tough on many trend-followers. This reversal spilled-over to US bonds during the month. Good buy trend signals now in both equities and bonds. Dollar strength reversed on Fed pause remarks. Metals and energy both moved higher during the month even with global growth threats. Commodities asset class is not a trend rich environment at this time.

Global stocks – All about avoiding global slowdowns and recessions

Is it that simple? Global equity investing is all about missing the big macro risks – recessions. There are headline risks every year, but it is always about economic growth when you step-back and look at annual performance. If global growth appreciably slows, global stocks are hurt. A simple long-only asset allocation strategy is to stick with long-term trends with the ability to walk-away when a recession or slowdown occurs.

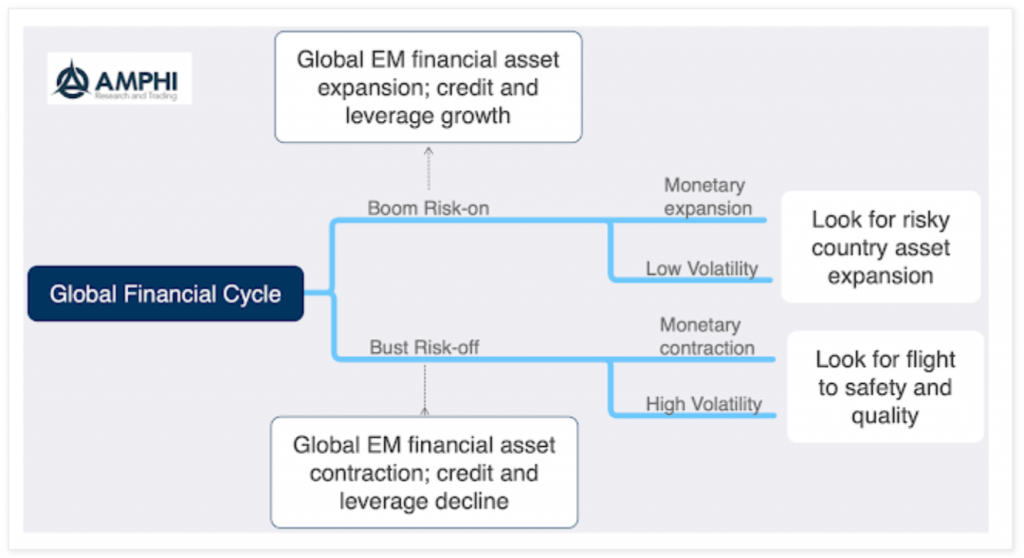

Global Financial Cycle – Look for the risk regimes

A recurring theme for our forecasting model is not predicting the future but just identifying the current regime. It is more important to first know where you are before you determine where you might be going. If you have ever been lost, the best solution is to first figure out your current location.

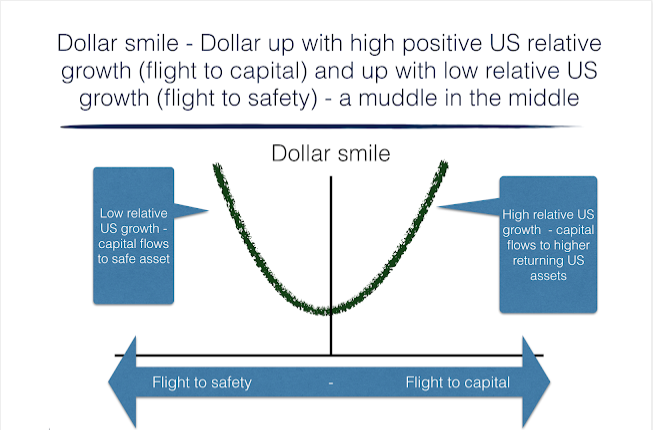

Dollar smile – We are moving to the smile bottom

A good simple approach for framing the longer-term movements in the dollar is through using the narrative of a dollar smile. We have written about this years ago, but think it is relevant today. The dollar smile, first popularized by Stephen Jen, says that currency behavior is driven by two competing regimes. Regime 1 is […]

Concentration, inequality and the status quo – Size matters but not always for the better

A capitalist system is not always competitive environment, but competitive environment is a capitalist system. One key macro issue that is not often discussed is the increasing concentration of businesses in the US and other capitalist countries. While not monopolies, an increasing amount of market share is in the hands of fewer companies and form oligopolies.

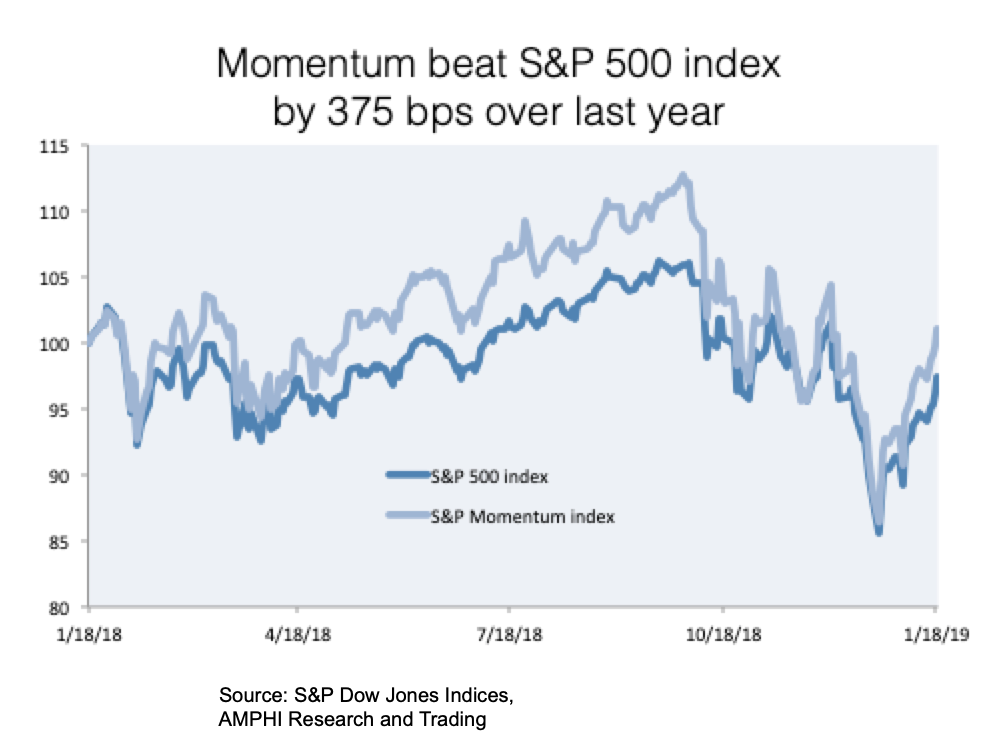

Momentum is still a viable strategy – Look at the numbers

There has been a lot of discussion on the lack of success with momentum and trend-following strategies. There is little doubt that there has been greater dispersion in returns across managers. There have been winners and losers with disappointment focused on some larger high profile firms.

Strategies for Assessing ’40 Act Alternative Investment Funds

With the increase in ’40 Act alternative investment fund offerings, there is greater interest in how to use these funds to help diversify portfolio risks effectively. There are a number of classification schemes that often overlap with some traditional mutual fund categories. Hence, there is an issue of how to best classify the set of […]

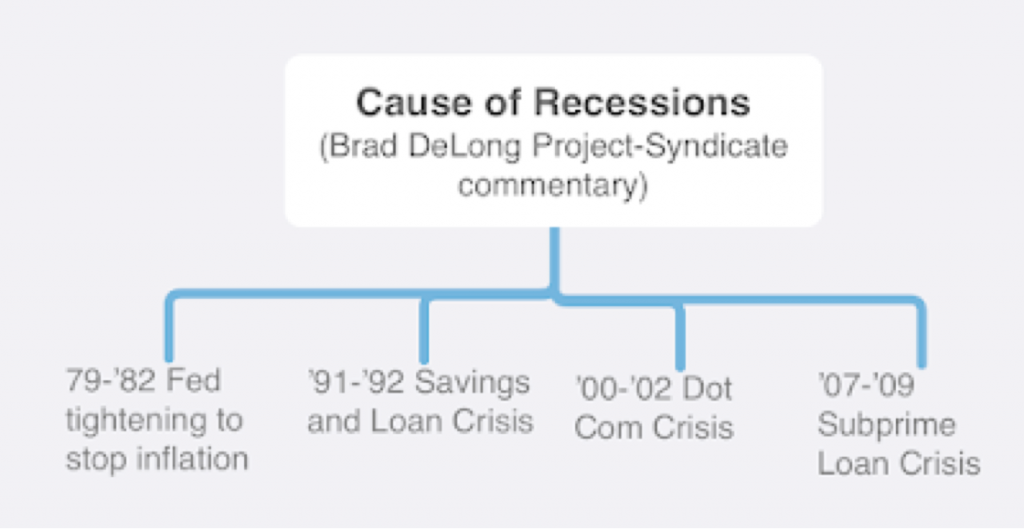

What will be the cause of the next recession?

There has been increased market talk about the next recession. Many are predicting it will occur this year albeit the dispersion of views is wide. To do a proper assessment for the cause of the next recession investors should go back to the causes of past recessions. This one will be different, but we should assume there will be common features with the past.

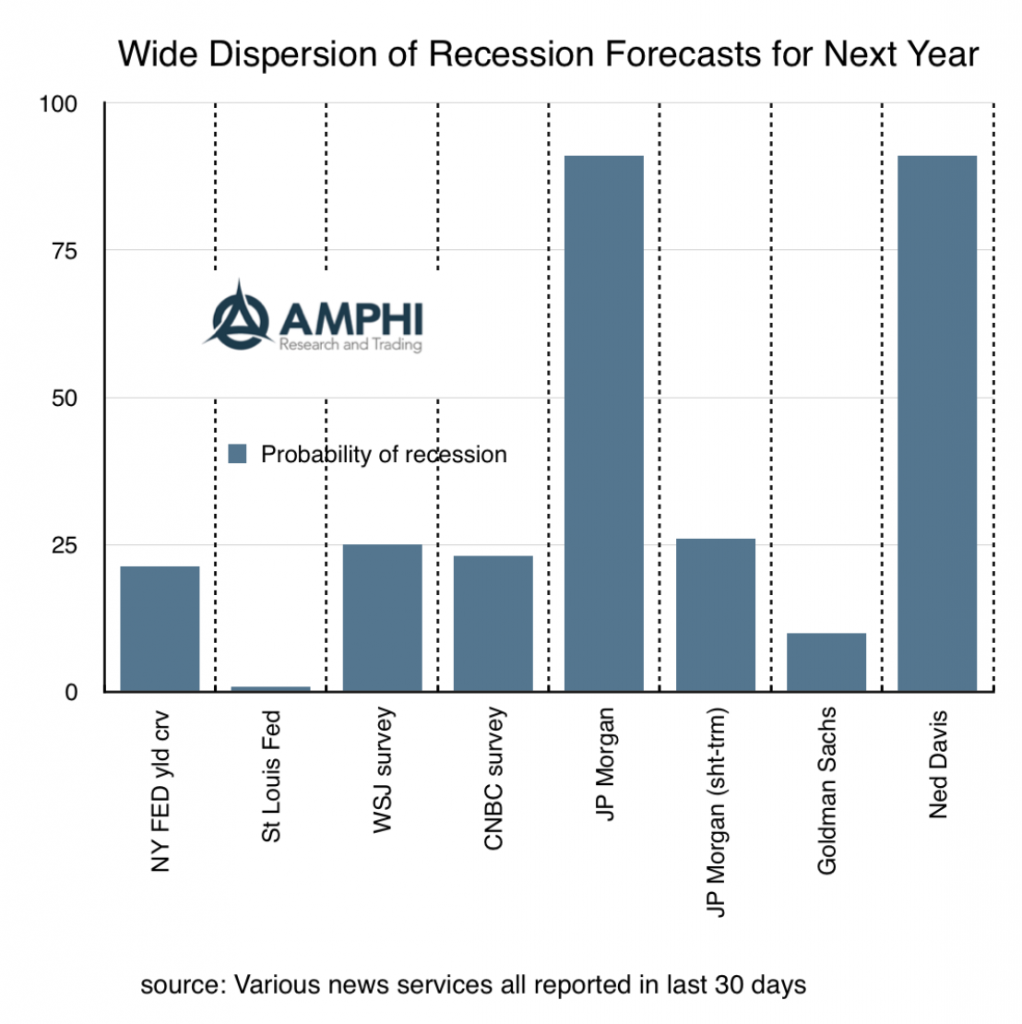

Recession probabilities – There is no consensus

What is the chance of a recession this year? Many have tried to build systematic models to give a probability number. This has been a good advancement in thinking about macro forecasting, but the variability of forecast is unusually wide. Different inputs will give different probabilities and there is no consensus on what should be the right inputs.

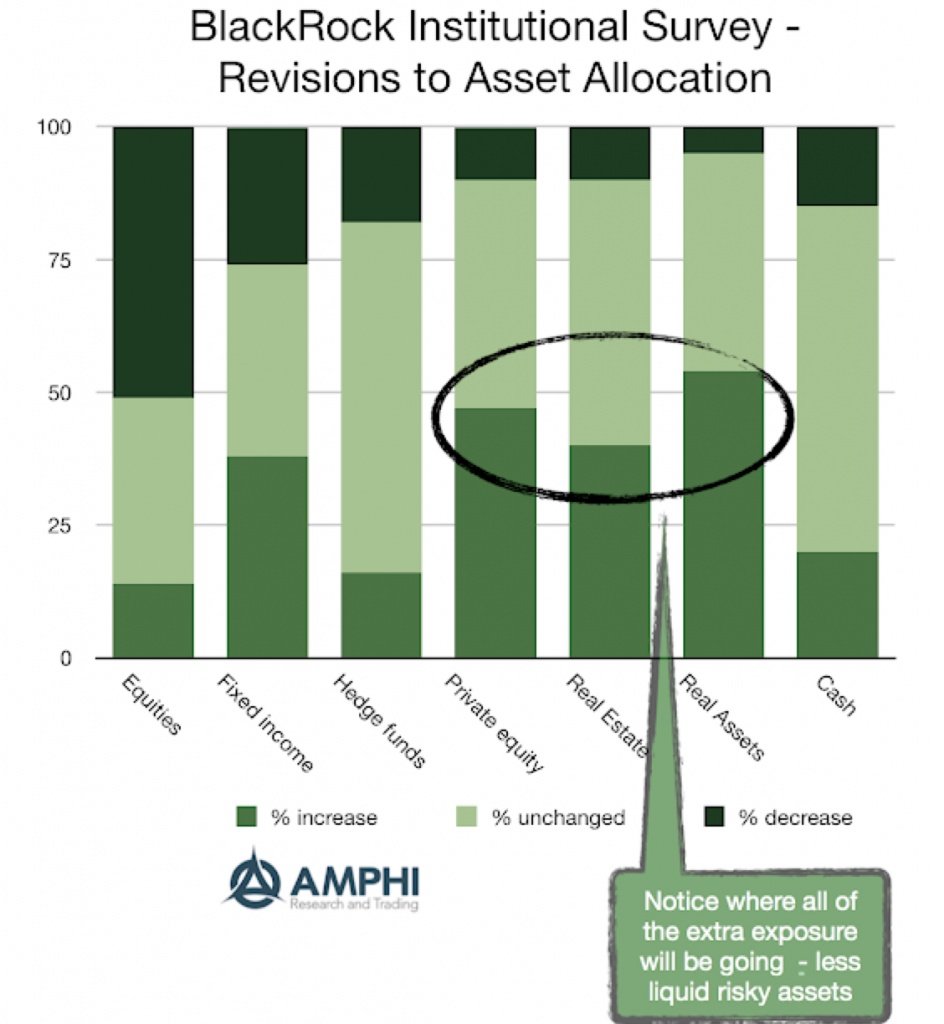

Where are institutional investors going to put their money? Not what you think

It was a tough year for money managers. All asset classes underperformed cash and most were negative for the year. Equities were a return disaster for December. Hedge funds did not do well for the year. So what will investors do?

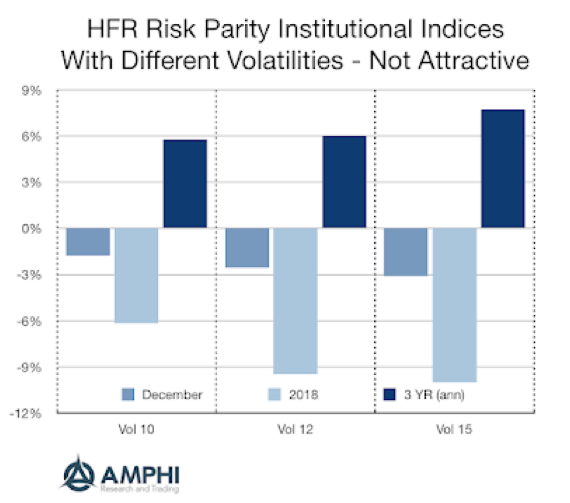

Risk Parity – A tough year for this diversification strategy

Risk parity was thought of as a portfolio strategy that would protect investors buffeted with uncertainty. Don’t think about dollar allocations, but risk allocations; it is a better way to manage a portfolio. Unfortunately, theory does not always work in practice. Using a simple benchmark of the average return for mutual funds with 50-70% equity allocation would have had slightly better returns than the 10% risk parity index and would have done much better than the higher vol indices in 2018.

What are shadow interest rates telling us?

We cannot forget that the zero bound on interest rates caused distortions in market price signals. Now in the US rates are above the zero bound so it seems like the concept of a shadow rate is not important; however, it is still relevant for many other central banks and it provides a good measure of where we have come over the last few years. Using the shadow rate as a historic measure of relative tightening, we can say that the Fed has actually been on a tightening policy since the end of quantitative easing.

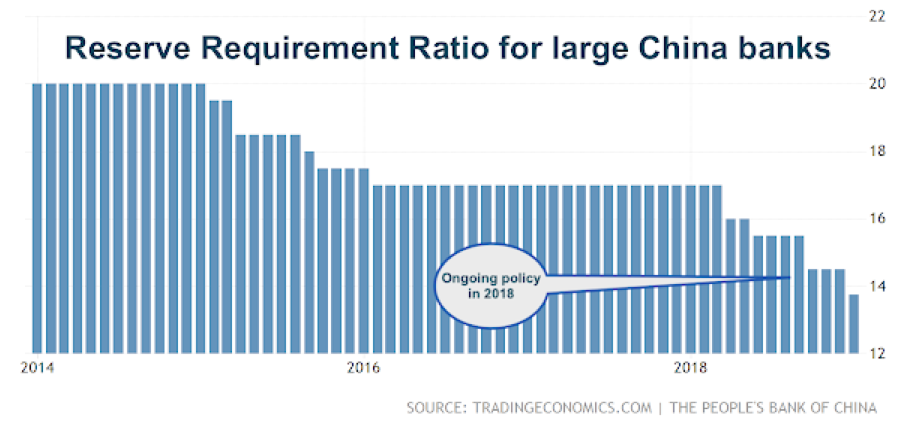

Just as important as Powell Put – China monetary action; PBOC on the move

One of our major themes for 2019 is that investors should more closely track monetary policy developments in China. The reasons are simple: the economy is big, its trade impact is global, and the PBOC at times has followed a monetary policy at odds with the Fed and ECB.