Category: Alternative Investment Strategy

Central Bankers as a Tribe of Technocrats – Outside the Mainstream?

Are you a technocrats or a politician? If you listen to central banks, they will say they are just technocrats or experts who do not engage in politics. To discuss political implications of policy or have politicians involved in the discussion is an infringement on a central banker’s cherished independence. Only through independence and limited oversight can central banks do their sacred technical work.

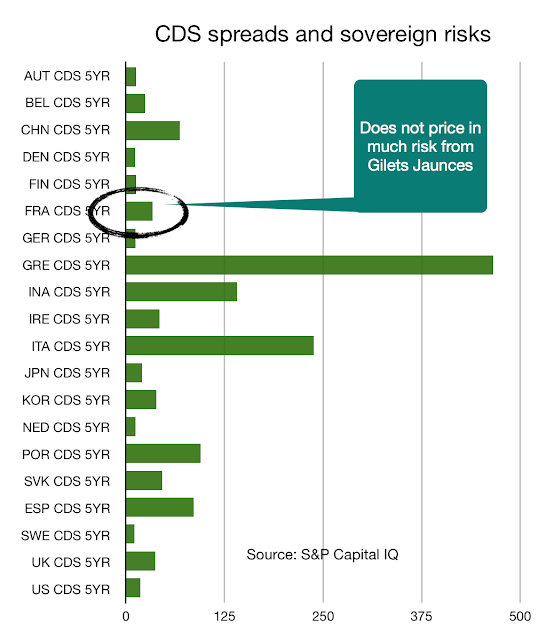

French Political Uncertainty Not Priced Effectively

The cost of being wrong with political uncertainty is significant and the impact will be felt across many markets. The yellow jacket “uprising” has already shifted French economic policy and will also affect the direction of government. We may not be extremists but the fundamental pact between the governed and government is broken which is not good for any investments.

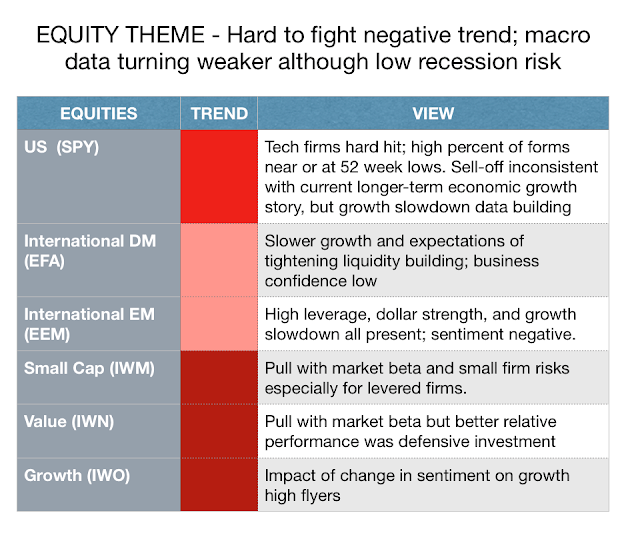

Equity Risk Allocation – No Change in Exposure Reduction View

It not a matter of like or dislike the fundamentals of equities in the current environment. When sentiment changes and volatility increases, reassessment of current exposures is warranted. However, concern about the macro environment should be increasing. Maintaining lower market risk exposure by more than half of core allocation from 60% to 30% or half equity beta exposure is appropriate. (The darker red signifies a stronger trend.)

Categorization and Classification – Fundamental to Finance and Investing

“Categorization is not a matter to be taken lightly. There is nothing more basic than categorization to our thought, perception, action, and speech. Every time we see something as a kind of thing… we are categorizing.”

– Linguist George Lakoff

From The Geometry of Wealth by Brian Portnoy

Most investment work is about forming categories. We divide securities into asset classes. We make subcategories within an asset classes. We make industry classifications. We divide risks into different types of premia. There are value classifications. There are categories and classifications based on macro factors like inflation. Investors like to group. All scientists like to make groups and form clusters of similar things to find commonality.

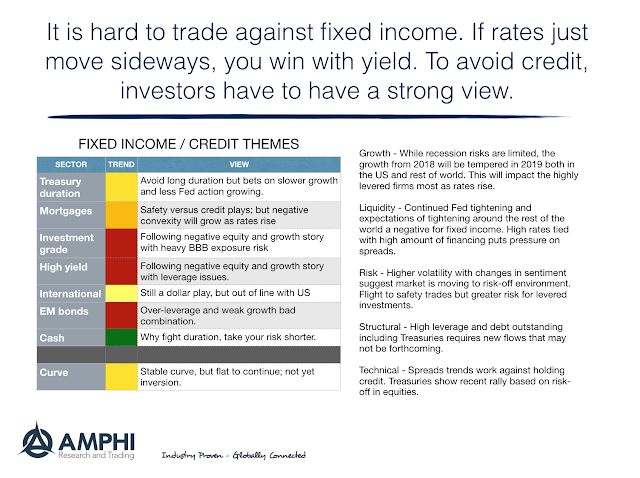

Fixed Income Choices – Move To Further Underweight

Current views on asset allocation in fixed income and credit are generally negative. The focus should be on holding shorter duration and cash investments.

Spread Widening Can Be Costly – All Is Not Well In Credit Land

It does not take much for an investor to have a losing credit trade on long duration bonds. The average duration on a long-term 10-year corporate is around 8 and current OAS spreads for triple-B corporates are 160 over Treasuries up from 120 earlier in the year. Half this move will take investors back to levels seen in 2016 and wipeout all of the spread compensation for a year. This is not an extreme bet if we have any further erosion of equity prices or change in credit risk expectations, (See Corporate debt growth has exploded – The added macro shock sensitivity creates real risks.) Shorter duration corporates will be at less risk given their lower duration but the stocking up of credit for yield reaching can be painful if credit risks increase.

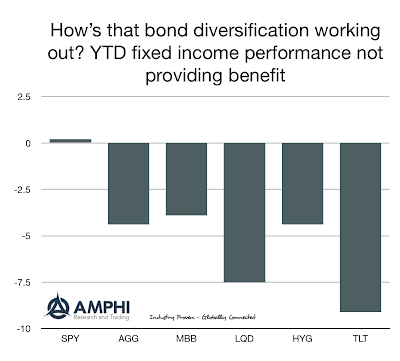

No Diversification in Mudville – Time To Try Different Risk Premia Styles

Diversification is usually thought of as a longer-term concept. Don’t worry if it seems like you are not receiving diversification in a given month or quarter. Think about diversification across a longer horizon. Diversification also does not guarantee better returns for a portfolio. Negative diversification does mean that your losers will be offset with winners.

25 Years after Jegadeesh and Titman – The Momentum Revolution

Trend-following and momentum has always been an important part of hedge funds and alternative investing but it would be hard to say that trend-following was mainstream thinking prior to the early 90’s. This was the high water period of the market efficiency, but that thinking started to take a major change with the “Returns to Buying Winners and Selling Losers: Implications for Stock Market Efficiency”, published in the leading Journal of Finance. There were other papers that discussed similar topics and the behavioral finance paradigm shift had already begun, but this was the one paper that many academics started to quote with increasing frequency about momentum effects.

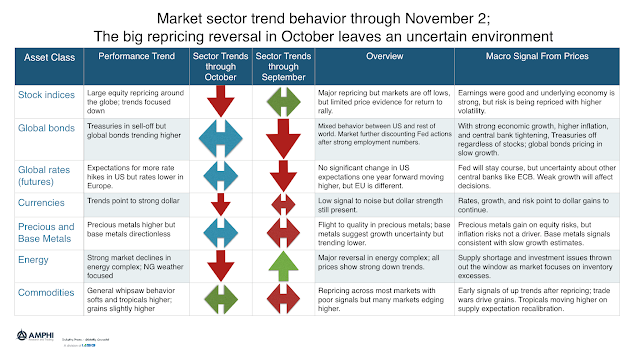

The October Repricing Causes Low Signal to Noise, Limited Trends

When markets reprice risk, it is not fun being a trend-follower. Long equity indices were a crowded trade and few made money when the early October reversal hit the markets. Fast traders were able to exploit the move, but a bounce off the lows hurt intermediate traders. Bonds were hit with the cross-currents of flight to safety against the continued threat of growth and Fed action. Currencies were hit with this repricing and not a place of profit able trends.

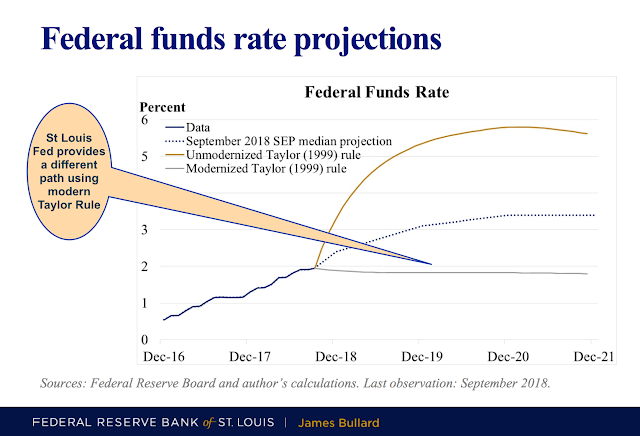

Mixed Signal from a Fed Official – A Modernized Taylor Rule Says Stop

Simple assumptions to some classic monetary models will produce very different policy views for the direction of Fed action. These significant policy divergences are the reason for the recent pick-up in bond trading. A dispersion of opinions on Fed action will lead to more volatility, trading, and potential rewards in these markets.

Managed Futures: Portfolio Diversification Opportunities

WHAT ARE MANAGED FUTURES? The term managed futures describes a diverse subset of active hedge fund strategies that trade liquid, transparent, centrally-cleared exchange-traded products, and deep interbank foreign exchange markets. Managers in this sector are called commodity trading advisors (CTAs) and their strategies are largely focused on financial futures markets with additional allocations to energy, […]

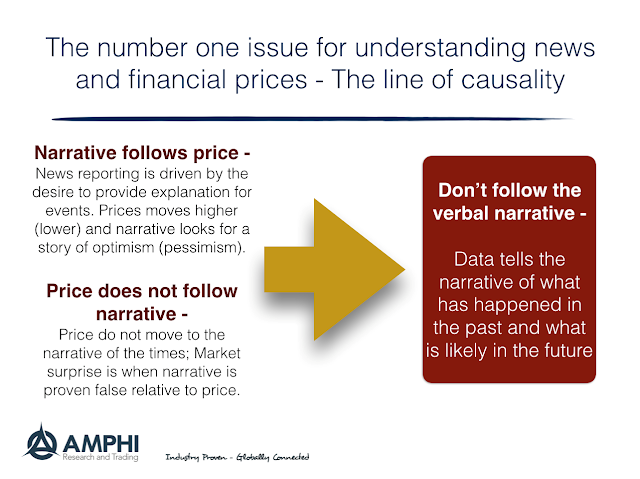

Narrative and Price – Know the Line of Causality

With all of the discussion on news, “fake news”, misinformation, and opinion, it is important to focus on some first principles for investing and narrative as news. The narrative is not the facts from an announcement, but the story surrounding the price move coupled with facts. For any investor, it is important to realize that narrative generally follows prices, and prices do not follow narrative.

What Money Managers Can Learn from Waffle House

If you have been on the road looking for cheap food 24 hours a day in the South, you have likely been to Waffle House. It is not the best breakfast, but it is a good place for a quick meal. You usually will not see a money manager or a Wall Street banker at […]