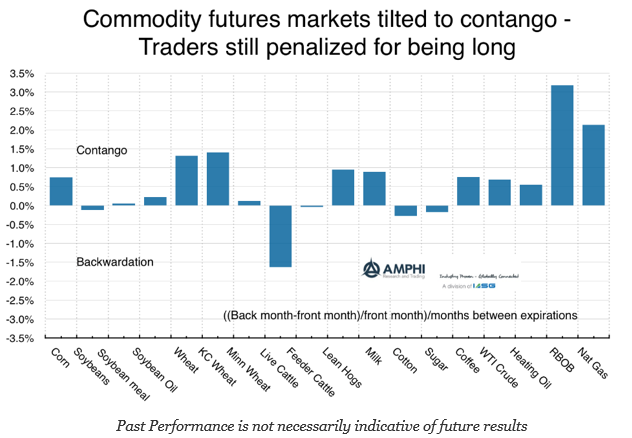

There has been increased interest in commodities and real assets with the increase in inflation. Commodity price as measured by the Bloomberg commodity are off the lows since February of last year, but he markets are still digesting the adjustments in demand and supply since the Great Financial Crisis. Most markets are still in contango because of high inventory levels. These contango levels have fallen over the last year, but are not like the long periods of backwardation during the 90’s and commodity super cycle. This places a significant roll drag on performance for pension funds that may choose to buy an index.

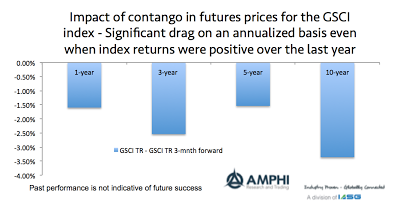

The drag on index performance can be significant. A review of total returns for the GSCI index relative to the GSCI 3-months forward shows the impact of contango. The return drag even in the last year when the index was up close to 20% was just over 1.5%. Over the last year, the drag has been well over 3%. Obviously, if there is a strong index move, the price appreciation may more than offset the drag, but it is a clear cost with trading commodities at this time.