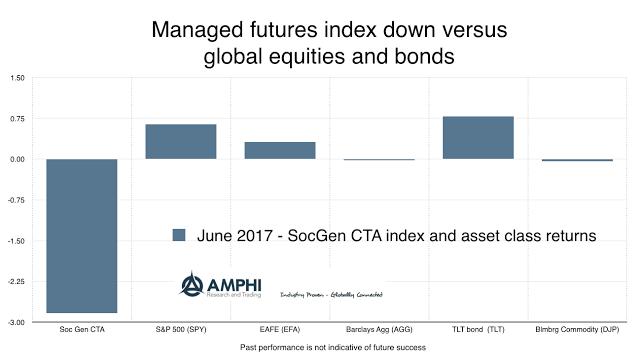

The managed futures index from SocGen was down over 2% for the month with price declines in many major financial markets over the last week. Similar performance has been found with other indices; however, those managers with more commodity diversification have fared better.

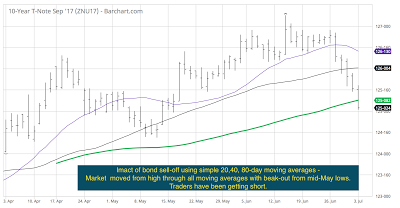

Total returns for stocks were still slightly positive for the month. Bond returns were cushioned by interest income. The extent of the market impact can be seen in our simple chart for 10-year Treasury notes. Prices have moved below the 20, 40, and 80-day moving averages which suggests that large trade adjustments from long to short may have occurred. Given the sharp decline, there were limited accrued profits from earlier trades. Given the higher volatility, many traders have lowered new position sizes.

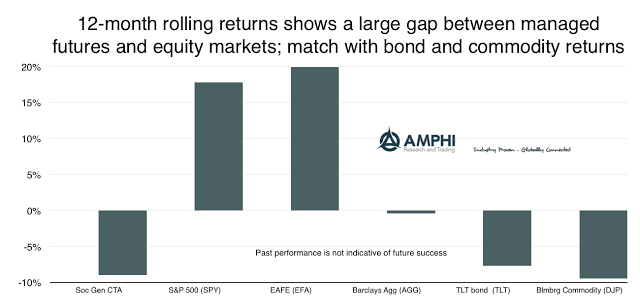

Managed futures for the last 12 months have matched the performance of bonds and commodities. This has made some investors cautious about adding managed futures exposure, but a turn in trends and sentiment may reverse performance gaps. We have found that strong price reversals across multiple asset class may first pull performance lower but may then lead to higher returns over longer periods if these new trends show persistence. Market divergences start with a reversal of the status quo.