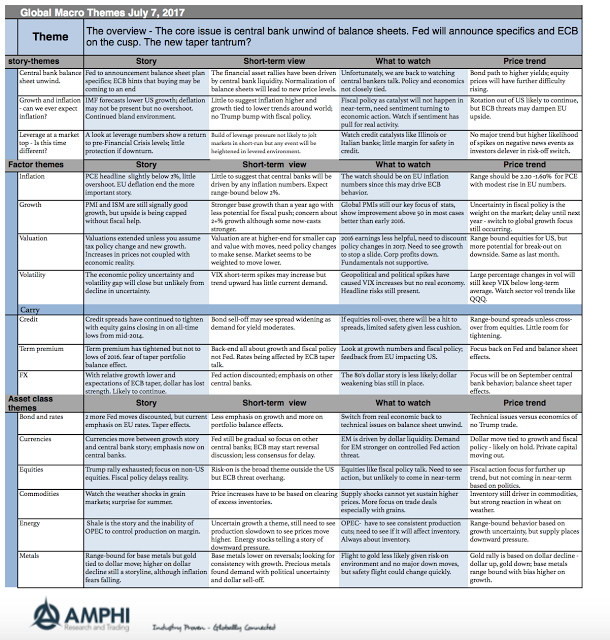

What will be the key driver for global macro portfolios in the year’s second half? I hate to say it, but it will again be central bank behavior. I thought there was a switch to focus on the real economy with the Fed starting to raise rates and react to the macro environment. Still, markets seem intensely focused on how normalization and central bank sheets will be adjusted.

We are getting a taste of the new world with solid bond market sensitivities to any suggestion of an ECB change. It may not be a taper tantrum, but there is a new caution with holding bonds. This bond caution will carry over to other risky assets. Simply put, the financial asset rallies worldwide were driven by liquidity and leverage, and now the liquidity environment is changing. The adage for markets has always been, “Don’t fight the Fed” when it is adding liquidity. The same philosophy should apply in the opposite direction, “don’t fight central banks if they are going to normalize.” Leverage is out, and risk-taking should be more prudent. This process of market switching to normalization may not be immediate or dramatic but should be in the minds of all investors.