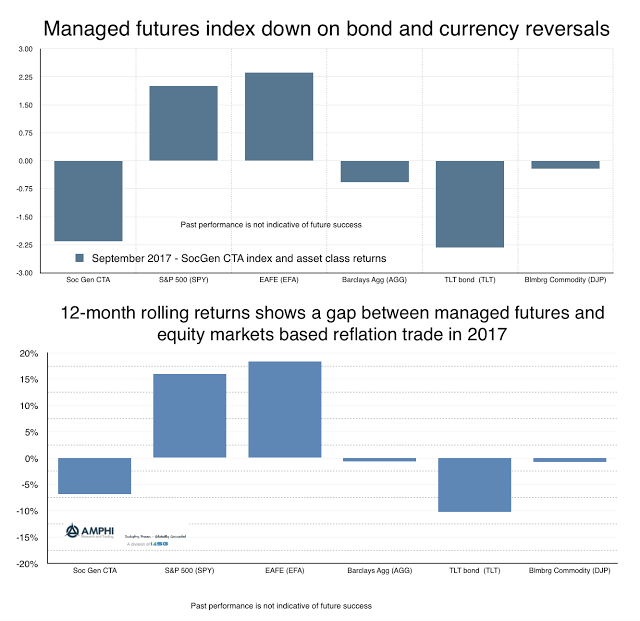

Managed futures returns across CTA’s were down on average for September based on reversals in currency and bond trends. The weakening dollar and the strong bond returns during the summer made for good performance in July and August, but the combination of renewed interest in the Trump reflation trade and uncertainty concerning the direction of interest rates changed the trend opportunities.

Unfortunately, for a trend-based manager, there will be a giveback of some previously accrued profits. Signal identification for exits and new positions is based on price reversals, so changes in directional slope will see negative portfolio returns. Some firms will be better at signal extraction based on the time frame for trades and the any conditional factors, but all will usually see a profit cut. This decline is more pronounced when there are sector changes and not just market adjustments. Given bonds and currency are large sector exposures for many CTA’s, the negative returns should not be surprising.

Managed futures and bonds are strong diversifying assets through their low correlation to equities. A strong equity (risk-on) environment will not be good for “bad times” portfolio diversifiers. There is a cost with diversification.