There are many works on managed futures that explain the basics of this hedge fund strategy, but the characteristics need to be reinforced especially at current times when the strategy is underperforming other hedge fund strategies. The core reason for holding managed futures is that it provides useful diversification. This diversification is not available from other strategies and this diversification will be especially present during ‘bad times” of a equity decline. Don’t forget that those strategies that have more systematic risk will need to generate higher returns. Investors will be paid to hold them. On the flip-side, there will be a “payment” for managed futures which does well in “bad times”.

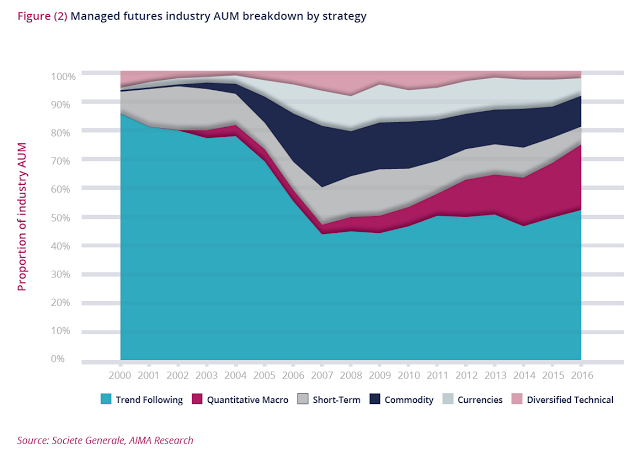

The new primer “Managed futures – Riding the Wave” published by AIMA goes through the basics for managed futures. Without going through all of the details, some of the highlights still show there is a strong case for managed futures. First, managed futures (CTA’s) are more than just trend-following strategies. Over the years, managed futures have moved from 85% to just over 50% of AUM. There is diversification within managed futures.

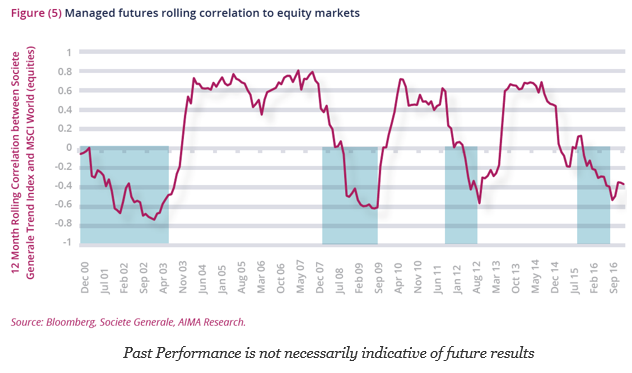

Second, managed futures will have large swings in correlation with equity markets, however, during those periods when equities do poorly, the correlations between managed futures and equities are either at zero or negative. This is the key diversification benefit from this strategy.

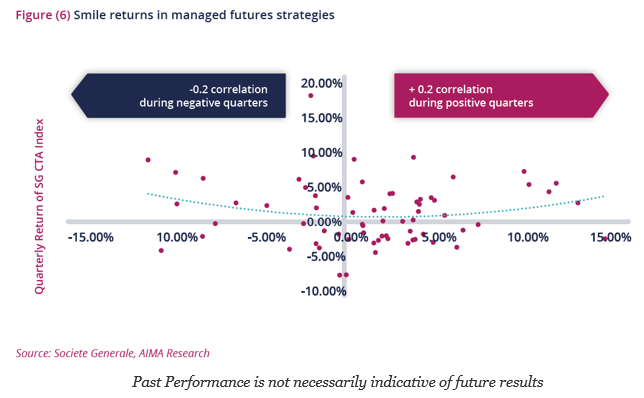

Third, the performance profile provides positive convexity or gamma against equities for investors. The correlation will be positive during positive equity quarters, but negative during negative quarters. We believe that this gamma feature is the real benefit for both macro and managed futures. You can control beta and hope for alpha but gamma is critical to offset risks from bad market moves.

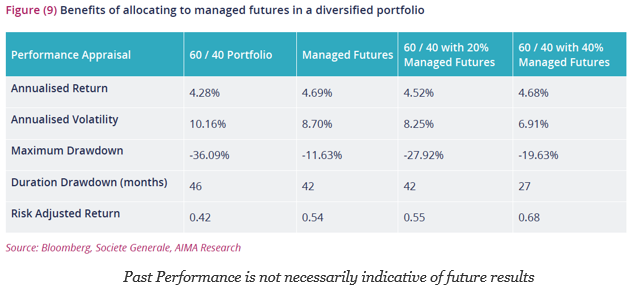

Fourth, the benefit of managed futures is present even for diversified portfolios which has both stocks and bonds. Even for the 60/40 stock/bond benchmark which is used by many investors, there is benefit from even adding just 20% to a portfolio. Bonds may be thought of as a critical diversifier but managed futures will add value even to the diversified stock/bond mix.

If investors know the future, diversification would not be needed. Diversification is based on the premise that there is uncertainty on the returns for stocks and bonds. Hence, positive performance for stocks or bonds is not a good enough reason to sell managed futures holdings. The benefits of managed futures gamma or low correlation come at some cost. Paying some of this cost is part of the investment profile. Investors will be rewarded when equities have an extended downturn.