An investor may want to increase his commodity beta exposure to meet his strategic allocation target for this asset class. Unfortunately, all betas are not created equal in the commodity space. There is a wide difference in the choices that are available and this chasm is much greater than anything found in other asset classes.

Investor may not be able to get to smart beta because there is little agreement on just plain beta. If you ask someone what is the beta benchmark for equities, the answer is easy, the SP 500 index. For bonds, the answer is the Barclays Aggregate Index. An investor may choose a different benchmark, but there is almost universal agreement on a base index. This is not the case for commodities. Given investor luck, whatever benchmark is chosen, it is likely that another will do better.

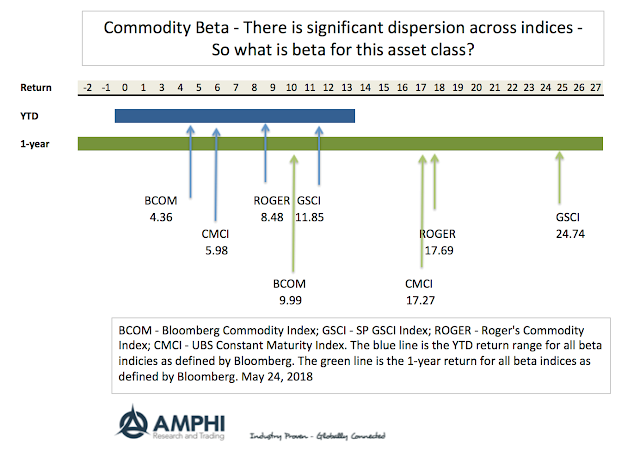

The chart above shows the range of returns for commodity beta based on the broad definition used by Bloomberg. This range includes a fair number of what may be called smart beta approaches to commodity investing; nevertheless, we highlighted four basic passive long-only commodity indices that have been actively used by investors. The BCOM and GSCI would be the most popular. The GSCI will have a higher energy allocation than the BCOM.

For 2018, the differential between the two leading indices is over 700 bps while the difference for the last year is over 14%! Picking the wrong benchmark will have a significant performance difference for that asset class bucket. There is no simple solution to this problem. Averaging more than one index is possible but does seem to be a satisfying alternative. Hence, making the simple decision to have some commodity exposure is actually much more difficult than would be the case in other asset classes.