We addressed the looming energy crisis in Europe in several articles, including the “War on Low Energy Prices,” It appears the day of reckoning is quickly approaching. However, they are choosing paths that I did not anticipate. In reaction to Russia closing the pipeline, the Europeans proposed two solutions; capping the amount that Russia would get paid for their energy or government-provided subsidies for their citizen’s utility bills.

The first of these is a non-starter. Oil and natural gas are both commodities which, by definition, mean they are indistinguishable from country to country. Rumors abound that China is already selling Russian oil to Europe at a premium despite the current boycott. Expect more of the same with a price cap where China can simply pay them a higher price and then re-sell “Chinese” oil to Europe.

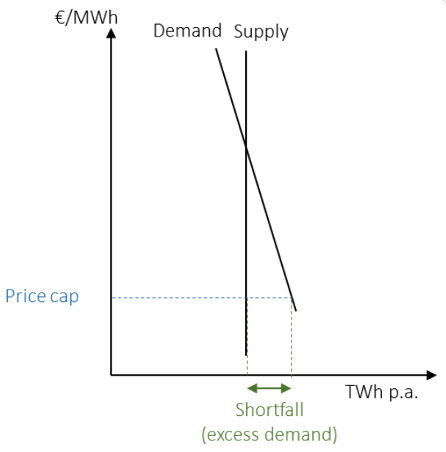

Subsidizing bills as a second choice hides the true cost of energy. This is clearly a horrible policy as it will support demand without increasing supply. This is illustrated nicely in the chart below, showing that this will create a gap where more people want power than is available. The likely result is rolling blackouts this winter.

A third choice is also being debated, which would make permits easier or cheaper to obtain. We discussed the Compliance Market setup at length previously. As a recap, emitters purchase a carbon allowance to balance their output with their measured pollution. Over time, the cost of these increase until carbon is eliminated or reduced to “safe levels.” Predictably, the current price for permits is surging as utilities scramble to produce energy in any way they can. This makes energy even more expensive than it would otherwise be, even with the government paying the bill.

With unsustainable energy costs, European governments left themselves little room to maneuver. The desire to focus on eliminating fossil fuels and nuclear energy appears to be ebbing. Perhaps this will save them. Headlines just this week reflect this change:

- UK to end fracking ban

- Germany to keep two nuclear plants open and burn coal

- France reactivating a closed pipeline to send gas to Germany

- Polish Prime Minster tells the Financial Times he would support scrapping ETS for a year or two.

We addressed the potential for a surge in bankruptcies due to the Covid “Bankruptcy Gap” just a couple of weeks ago in time for the August data to roll in. Sadly, it appears that the downward trend is shifting as all types of filing increased in August from this time last year.

This brings us to a driving force that will add additional stress. We predicted in May 2021 for our “Inflation Coming?” article that inflation might be inevitable, increasing the price of hard assets and commodities. This clearly occurred but seems to be moderating as the economy cools amid fears of a recession. As we described it, the Fed Pickle was that central banks could choose to keep on the rate path and risk economic contraction or back off for fear of a slowdown. They continue to push steadfastly to higher rates which are already affecting housing prices, reflected in the highest mortgage rates since 2008. While we may already be in a small one, the risk of a bigger “Recession Coming” is prevalent. Spiking energy prices in Europe and beyond, central banks raising rates while unwinding balance sheets, and geopolitical risks abound.

In an environment where choosing a theme for the economic story is difficult, I expect large positive and negative swings. Trading volumes should pick up as summer winds down as well. With policies changing by the day, we will continue to advise strategic allocations to alternative investments to keep portfolio risk in balance during the potential chaos still to come.

Photo by Pawel Czerwinski on Unsplash