Mark Rzepczynski, Author at IASG

Prior to co-founding AMPHI, Mark was the CEO of the fund group at FourWinds Capital Mgmt. Mark was also President and CIO at John W. Henry & Co., an iconic Commodity Trading Advisor. Mark has headed fixed income research at Fidelity Management and Research, served as senior economist for the CME, and as a finance professor at the Univ. of Houston Baer School of Business.

Bill Gross’ Alpha: How He Generated High Returns in Fixed Income Through Sector Risk Premium Allocation

Bill Gross has retired and there already has been research to see if he was the Warren Buffet of bonds. His fixed income track record over the long-run cannot be easily be matched, but a careful study of his portfolio suggests that his gains were generated differently than the classic stock-picker. He may have generated alpha but he did it the old fashioned way in fixed income, he took on more sector risk. See “Bill Gross’ Alpha: The King Versus the Oracle” by Richard Dewey and Aaron Brown.

Unveiling the BAIT Strategy: The Art of Trading with Advantage

You are so intelligent. You have a great trade idea and know it will be a winner, but there is only one small problem. For any trade you make, there must be someone else on the other side. For every buyer, there has to be a seller. So, for what you are doing right, someone […]

The fallacy of extrapolation – A deficiency of forecast imagination

One of the great problems with forecasting is the fallacy of extrapolation. Forecasters love to believe that tomorrow will be like to today and head in the same direction. Whatever is the trend today will continue tomorrow to the exclusion of other alternatives. There is over-extrapolation.

Alan Krueger and the Tough Problem of Happiness

Everyone who has taken a course in economics is aware of utility theory and the desire to have more “utils”. Those with a historical focus will recall the deep discussions of early 19th century economist, “utilitarians” and the dismal science. The concept of measuring and auditing happiness has resurged in economic research, but it has been a perplexing problem. The basic idea with both economics and finance is that money can buy you happiness, but the reality is more complex.

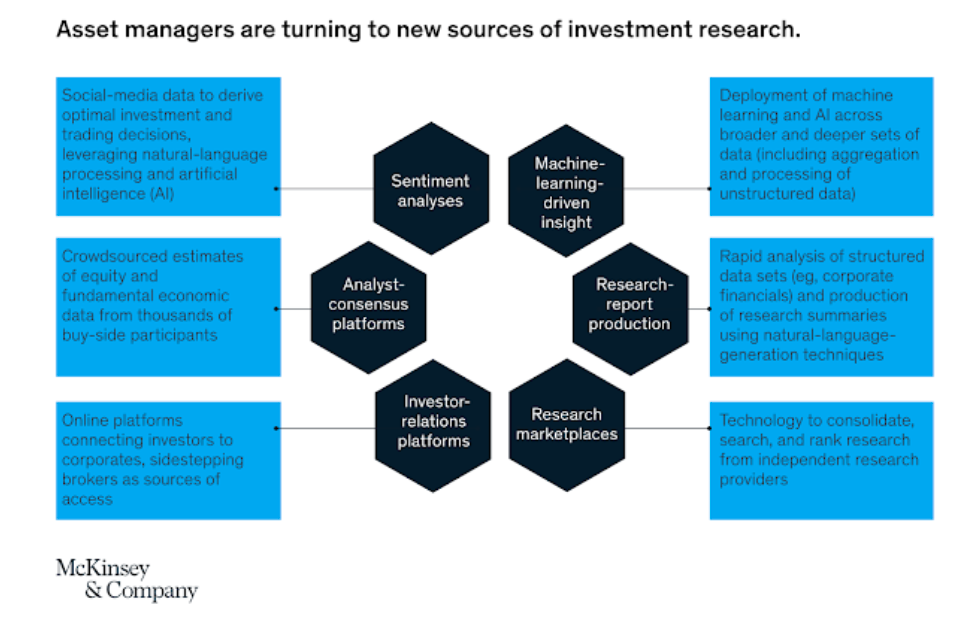

McKinsey & Co on investment management – Embracing advanced analytics only the beginning

A new research piece from McKinsey and Co focuses on the investment management industry, “Advanced Analytics in Asset Management: Beyond the Buzz”. This work is not cutting edge. It is straight forward advice that more analytics are being used in the distribution, back office, and the investment process, and investors are going to have to step-up their analytic game.

The dispersion in hedge fund returns – Differences in style matter

All hedge funds are not created equal as the return box chart shows for the post Financial Crisis period. There is a significant amount of dispersion across hedge fund styles. Over the period 2009-2018, the difference between the best and worst hedge fund category is almost 7 percent after we account for global equities and bonds.

The Desire For Private Equity – Return And Yield; But Time May Be Running Out

The attraction to private equity and other less liquid alternatives is clear from the Guide to Alternatives by JP Morgan Asset Management. The return profile is much higher for private equity and debt funds than more liquid alternatives and global bonds; however, the dispersion in returns is multiples higher than what can be expected from other public categories.

Where are you getting diversification within alternatives?

All alternative investments and hedge funds are not created the same. There is significant dispersion in their correlations with global bonds and equities. Some are better at diversification and others are good for adding returns. A recent Guide to Alternatives from JP Morgan Asset Management provides long-term correlations for alternatives and hedge funds for the post Financial Crisis period.

Risk premia versus hedge funds – Worth a look

As we better understand the return generation process, we are able to dissect any set of money manager or hedge fund returns into its component parts. At a high level, any money manager can be divided into a set of risk factors or premia and alpha or skill. As a general conclusion, researchers have found that as investors get better at identifying risk factors, the size of alpha declines. We are able to attribute more returns to specific risks so the amount that is leftover as skill declines.

Why Probability Matters More than Direction: Insights for Traders and Investors

One of the critical problems with decision-making is that it is often simplified into either/or choices. “Yes/no,” and “Go/No-Go” is how we often focus our attention and make decisions. Life is easy when problems are framed as either black or white. For example, the Fed will either tighten or not tighten. Employment will either increase […]

Naturalistic decision-making permeates investment world

Gary Klein is one of the great researchers in practical decision-making; however, he has been overshadowed by the behavioral bias revolution and the more popular work of Nobel prize winner Dan Kahneman. That is unfortunate and should be rectified. Klein focuses on naturalistic decision-making; the fact that decision-making in real life is significantly different than anything in a controlled environment.

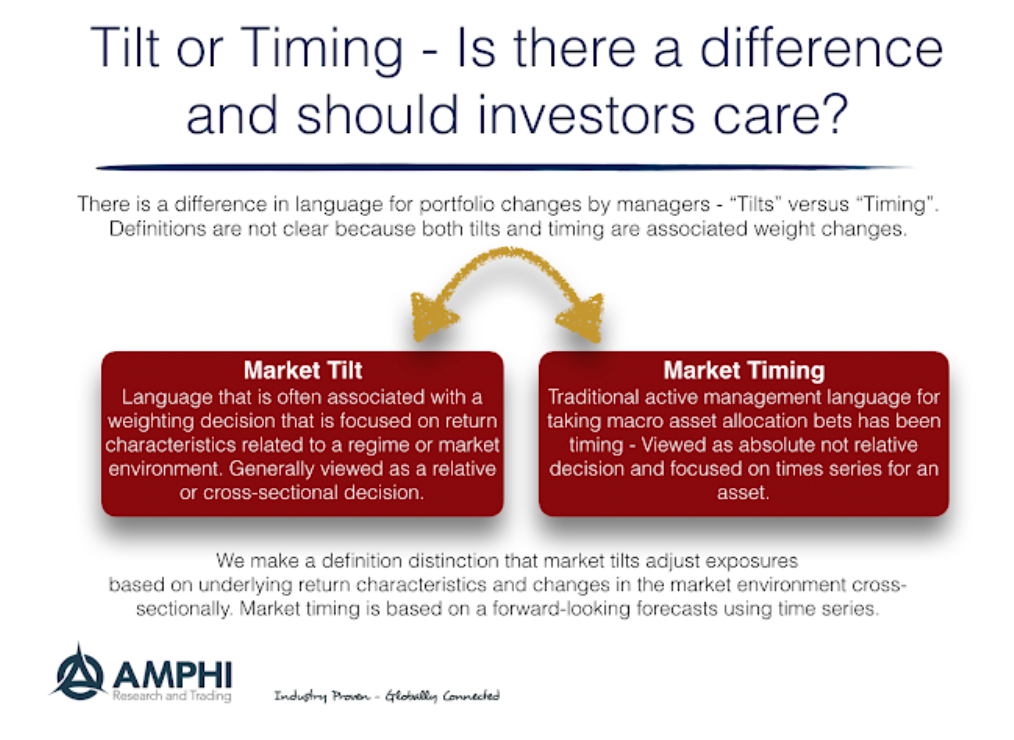

Market Tilt or Timing – Is there a difference in forecasting?

At a recent conference, I heard a large money manager say the following, “We do not market time, but we do take market tilts.” Unfortunately, no one was able to ask the manager to clarify the difference between tilts and timing. Aren’t they both forecasts?

Premortem for decision-making – Better than waiting for the decision postmortem

All investors and traders want to get better as decision-makers. They are open to learning and improvement, and a natural way to gain this improvement is through reviewing their actions after the fact. The old adage is that we will learn from our mistakes. If you have a thorough review process, you can form an effective feedback loop to ensure future decisions will not be driven by the mistakes of the past.