Mark Rzepczynski, Author at IASG

Prior to co-founding AMPHI, Mark was the CEO of the fund group at FourWinds Capital Mgmt. Mark was also President and CIO at John W. Henry & Co., an iconic Commodity Trading Advisor. Mark has headed fixed income research at Fidelity Management and Research, served as senior economist for the CME, and as a finance professor at the Univ. of Houston Baer School of Business.

Managed Futures and Volatility – The Type of Vol Matters

Managed futures strategies can be described in a number of different ways. Many researchers and market practitioners have referred to it as a long volatility strategy. This language has captured many as a good shorthand description. In the same vein but much more clearly developed, it has been called being long a straddle. A straddle is volatility sensitivity with its gains occurring only after prices move outside the strikes plus premium. Empirical research has shown that the long straddle is a good representation.

The Summer Ups and Downs of Managed Futures

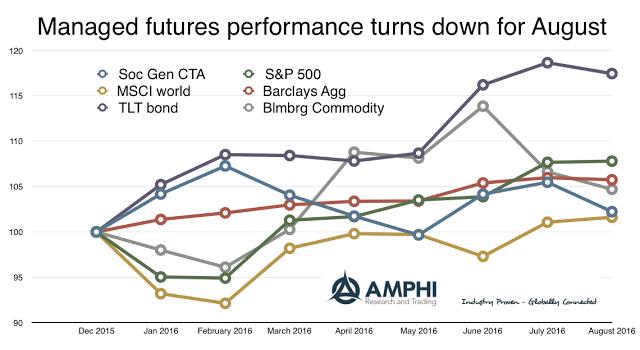

The summer was a positive performance period for managed futures, yet it was still filled with return up and downs. We have identified periods of more than 2% gains and losses on the AMPHI Liquid Alt Index, an equal weighted index of the largest liquid alternative programs available. This return pattern is representative of many periods in managed futures performance with equal gains and loses punctuated by larger gains when there is a market divergence or dislocation. In this case, the main driver was the post-BREXIT market reaction that lasted for approximately two weeks.

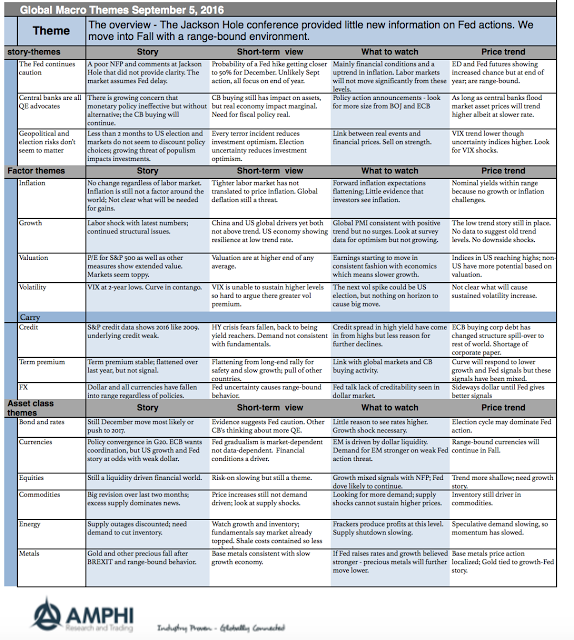

Global Macro on One Page for September

The major themes for September have not changed significantly from last month. The reason is simple. The markets have not moved much and the economic information that we have received in the last month has not changed expectations. The two big events were the Jackson Hole conference which provided little new light on Fed behavior and the confirm payroll last week which rolled back some of the real economic enthusiasm.

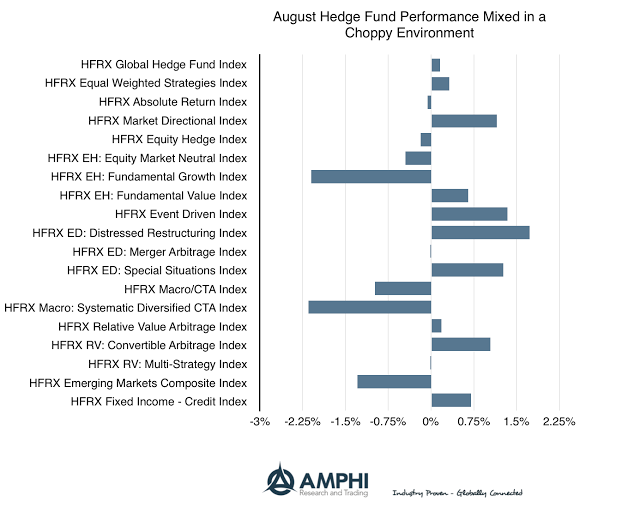

Hedge Funds Performance Shows Dispersion in August and for the Year

2016 is a year is turning out to be special for relative value hedge funds focused on distressed and event driven strategies. These two along with special situations, equity market direction, and convertible arbitrage moved to be the August winner. The losers for the month were fundamental growth and systematic CTA’s. Both these strategies need movement in economic or firm-specific fundamentals which just did not occur for the month. Relative to the flat equity and fixed income markets, August performance for hedge funds was at best fair.

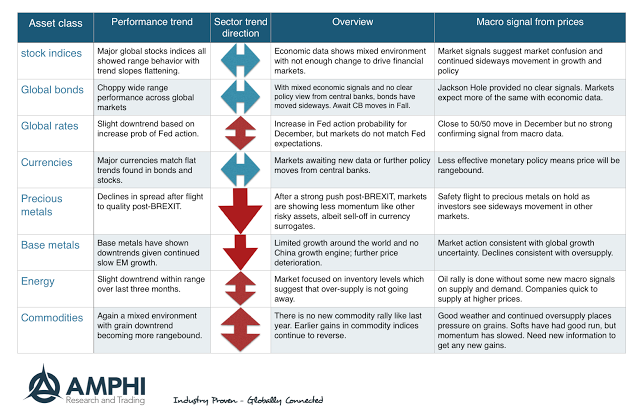

Lack of Trends Across Major Asset Sectors

The reason for the lackluster performance of managed futures is clear from a review of trends for the major sectors. For stock indices, global bonds, and currencies, the big three asset classes, there were no clear trends for the month. Global rates, energy, and commodities also showed sideways movement albeit with a slight downward tilt. The only sectors that showed any real direction were precious and base metals that moved lower.

Managed Futures August Performance – Negative Chop

A rule of thumb for managed futures performance is that if there is little movement in the underlying asset classes, there will be negative performance for the average managed futures manager. While it does not apply to all managers, certainly trend-followers need trends, and a measure of trend is the longer-term volatility or spread in prices.

Wider Dispersion in Sectors, Styles and Countries in August

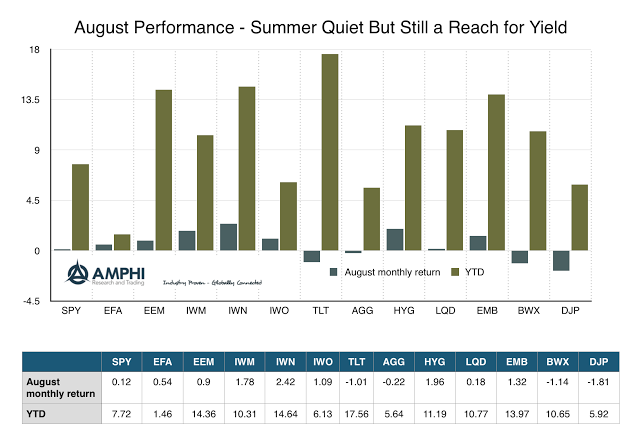

We have described August as the dog days of summer given the limited movement in major asset classes; nevertheless, we were seeing more dispersion within equity and bond sectors, styles, and country indices. Moving averages are flattening and there are less clear signals within our sector groupings. It is unclear how long range-bound behavior will last given that the Fall season for financial markets, when trading activity picks-up, starts next week.

Review of Asset Classes

For many it was a hot August. Time to slowdown, go on holiday, and not worry about financial markets. Of course, there is a lot to worry about, but August performance across most asset classes showed general range-bound behavior with a continued reach for yield within the equity and fixed income asset classes. The tight range was linked to no substantive news to change expectations. After weeks of hype, the comments of Fed Chairman Yellen at the Jackson Hole conference did not serve up anything new. The data driven Fed may raise rates or not based on further confirmation of data that seems stuck in a range.

Beware, Sharpe Ratios are Time-Varying

“What is your Sharpe?” This is one of the first questions that is always asked of managers. The mangers will firmly reply, “My Sharpe ratio is X.” The conversation then moves onto the next question as if this one number serves to address the performance issue, yet the Sharpe ratio is dynamic. In a drawdown, no one wants to even see that number. When things are going well, the Sharpe ratio is king. Investors have to accept that this is a variable number because the underlying assets bought by funds have variable Sharpe ratios.

The Elegance of Simplicity in Investment Management

Some people believe that if you want to show how smart you are, you should tell people how complex your investment process is relative to others. Wow investors with your skill and mental agility, this will win you new money. Be and act like the most intelligent person in the room. The Power of Simplicity […]

Getting Ready for a Liquidity Event Through Using Index Futures

Liquidity is never present when you need it. This truism is especially the case when there is a financial crisis. A crisis become a liquidity event if sellers cannot find buyers at a fair price or at extreme any price. If the security is more specialized or complex, it will be even harder for the seller to find buyers. There will have to be a greater price decline from fair value before a buyer is found.

Scenario Analysis – Because There is More Than One Path to the Future

Investors do not know the impact of different alternatives in history. In fact, history is subject to discovery and this process of historical discovery is subject to biases as we try to sift through facts.