Category: Economics

2025 in Review: Markets, Policy, and the Path Forward

History never repeats itself, but it often rhymes. This is even more so the case this year, as Trump began his second term with similar but different disruptions to the markets. Rising stocks, normalizing inflation, and the AI boom took center stage. We discuss some of the key events below and try to anticipate where […]

The Bankruptcy Cycle Returns: Delayed Failures and the Cost of Easy Money

Proper forest management requires clearing dead brush, protecting high-risk areas, and conducting controlled burns. As January 2026 approaches, marking the one-year anniversary of the devastating Southern California wildfires that destroyed over 16,000 structures, we examine the mistakes made and how those lessons apply to the financial markets. Much like forest fires, risk can be mitigated […]

How Irrational Is It? Valuation Ratios and Bubble Risk

For anyone who has ever ridden a roller coaster, the distinct sound of the chain nearing the top of the first drop echoes in our ears. Click, click, (slower) click…. Anticipation builds right before we experience the massive first drop, picking up speed on the way down. If only the equity markets provided the same […]

Auto Loans: The Overlooked Credit Canary

Identifying weakness in markets can be a difficult task. Metrics like gross domestic product (GDP), equity market gains, and unemployment paint in broad strokes. Lenders often try to identify risk at a granular level. This might include tracking payments arriving late, higher credit card balances, increases in line of credit usage, or non-payment of insurance […]

Is the Fed Late—Again?

After months of telling the public that “Inflation is transitory,” the Fed finally admitted that it kept policy loose for too long in 2021. Months of rate hikes followed in 2022, dragging the stock market down as assets repriced. Now, the rates in the United States outpace those of major economic zones across the world. […]

Paradigm or Paradox? When Tariffs Replace Free Trade

Politicians like to pick and choose their economic schools of thought to justify their policy and spending decisions. Elected liberals like to point to the Keynesian effects of government spending, whereby each dollar inserted into the economy drives multiples of that value in growth. Conservative officials often use the Austrian theories, which posit that free […]

A Bull in the China Shop

A common complaint about politicians is that they avoid critical decisions because they only care about keeping their job. Much like a middle manager at a bank, taking a daring chance and failing gets you fired, but doing the bare minimum keeps you employed. Donald Trump is not a normal politician. In a continuing trend, […]

Inflation Coming?

Want to play a “fun” game? Go to Google and type “currency crisis (insert any country name)” and see your results. Luckily for Americans, you will find that the United States is one of the few countries that have avoided this designation so far. As one of my Polish friends who immigrated asked me, “Why […]

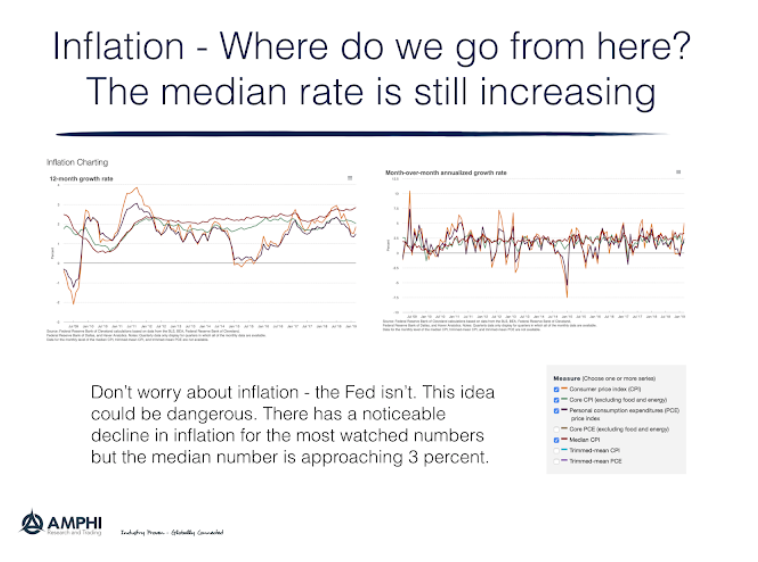

Inflation – Where do we go from here?

Don’t worry about inflation – the Fed isn’t. Or, the Fed believes there is no value is trying to get ahead of any inflation increase given the relatively tight range for inflation. The market penalized any fixed income investor that acted on inflation fears. Any Fed objective function has a higher weight on growth.

Behavioral economics – Is an atheoretical approach harmful?

Behavioral economics research has been path breaking and has truly impacted the thinking of most investors. Psychology is fundamental to human decision-making and our knowledge and understanding of economic agents has been enhanced through the large body of research in this area. Through finding exceptions and breaking down conventional utility maximization theory and wisdom, behavioral economic has advanced science, yet this work is not completely fulfilling. Our knowledge is filled with behavioral exceptions and leaves us with the impression that our decision-making skills are psychological damaged, but there is no unifying framework for how the range of biases fits within utility maximization, consumer behavior, market efficiency, and general decision-making.

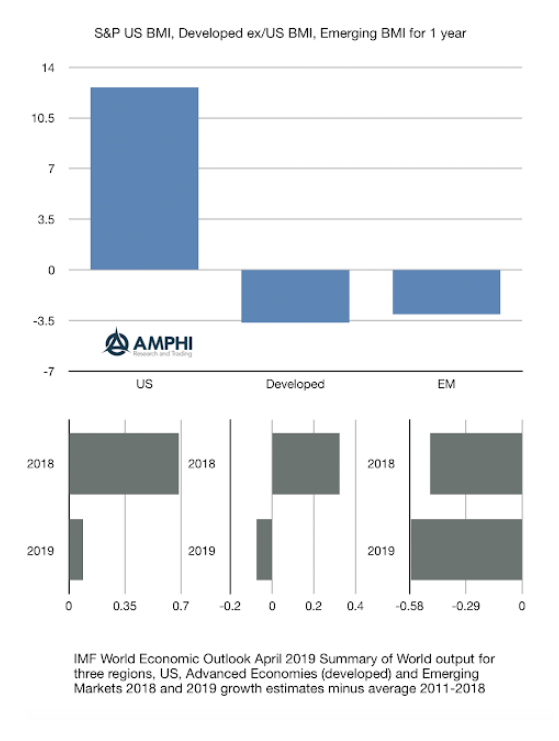

Global Macro Rationality and Equity Returns – Consistent With Growth Story

While some question the rationality of markets over the last few quarters, we believe equity markets are global macro consistent. This consistency can be seen in the return pattern for the US, developed markets, and emerging markets. As a simple surprise number, looked at the difference between the average growth rates for three macro categories from the IMF WEO from 2011-2018 against 2018 growth and expected 2019 growth.

Credit risk – Profitability more important than leverage

There should be concerns about the amount of corporate leverage in the economy, but if there is no catalyst credit event, current risk is limited. We are not downplaying potential credit risk, but there needs to be focus on the right issues that will drive corporate bonds spreads higher.

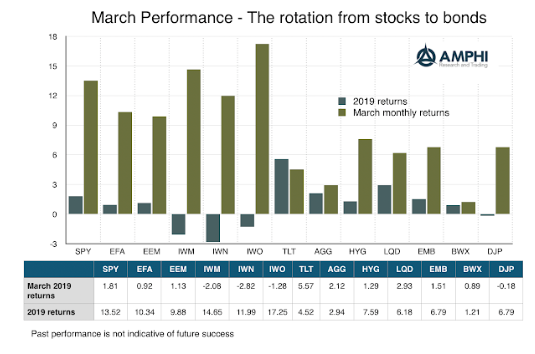

March – The big rotation from stocks to bonds

March was about asset class rotation from equity to bond demand with fixed income significantly out performing equities in March. Markets have moved from the January monetary euphoria to something more cautious and questioning. If the Fed potentially put all rate rises on hold for 2019 and the ECB is delaying a course on normalization, do they know something I don’t know?