Category: Managed Futures Education

Markets Have to Adjust as Fed Alters Course

The Fed’s normalisation process has been a tortuous on/off affair primarily because their focus has been almost entirely on not upsetting the financial markets rather than doing the right thing for the long term health of the US economy. This week, the Federal Reserve machine cranked into action to persuade markets that they want to raise rates before the Summer and again before year end. So far, the reaction has been quite muted, but it is far from certain that this calm veneer will continue. Let’s dive in and think about what the Fed are doing and what this means for markets.

大宗商品交易顾问基金研讨会

拓展海外资产投资,深入了解大宗商品基金策略与投资 时间: 2016年8月20号-至29号 地点:芝加哥 主办单位: Institutional Advisory Services Group, USA

Investors in Search of Instant Gratification But Patience Needed

As most of us know, trying to predict financial markets is frustrating nearly all of the time, and downright impossible too much of the time. Part of the problem is that everyone wants instant gratification. As money managers, we are delighted when our trades become immediately profitable and frustrated when they don’t. The same goes for all market participants regardless of individual timeframes.

Bracketology – An Investing Lesson from the NCAA

“Bracketology”, a term coined by ESPN, is the study of the annual NCAA college basketball tournament. Interestingly the art or science of filling out an NCAA tournament bracket also provides insight into how investors select investment assets. Before explaining, we present you with a question: When filling out an NCAA bracket do you A) start by picking the expected national champion and work backward or B) analyze each matchup, and pick winners starting at the earliest rounds, working toward the championship game?

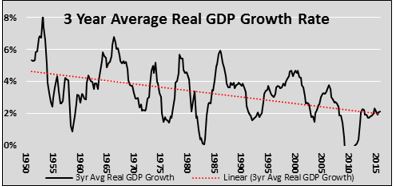

Paradigm Shift

The Absolute Return (AR) series of articles provides a primer on alternative investment styles to which few investors have access. Global markets and economies appear to be at the precipice of a paradigm shift making the timing of the AR series of unique value. In the 7 years since the financial crisis, most asset prices have experienced significant appreciation allowing for even the most inexperienced investor to increase his or her wealth. As the saying goes, “a rising tide lifts all boats”. For investors, understanding the tide of financial momentum is extremely important. Accordingly, we summarize 4 primary drivers of past returns to help gauge whether the tide can continue to rise or if retreat is more likely.

The Importance of Limiting Losses in Absolute Return Strategies

Absolute return strategies aim to generate positive returns irrespective of market direction. A more accurate and appropriate definition is that absolute return, or active investment management, always seeks to minimize losses. We mentioned this as a core attribute of an absolute return strategy in “Why an Absolute Return Strategy,” but this simple concept is worth […]

Building Wealth: The Power of Absolute Return Strategies

The first goal of investing is to increase wealth or, to put it differently, to increase purchasing power. Warren Buffet says, “Rule 1 of investing is never losing money. Rule number 2 is never forget rule number 1.” The hidden message in these seemingly obvious statements is that building wealth depends much more on preventing […]

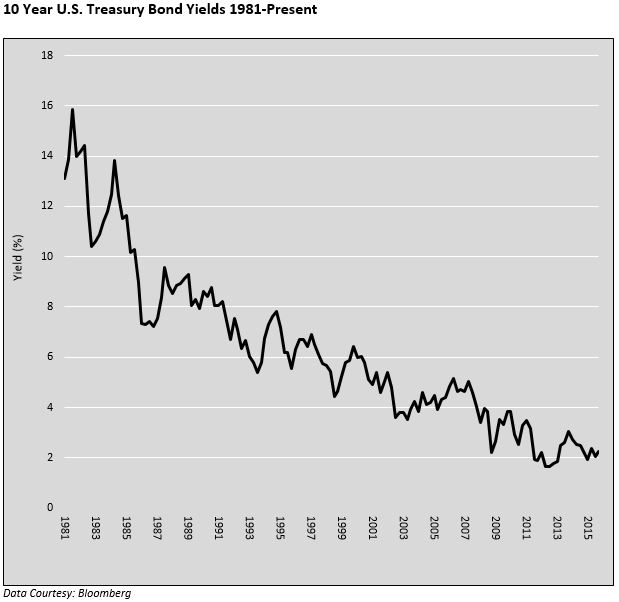

Bonds – What Drives Investors

Part 2 of our series on bonds “Bonds – Is Credit Growth Hitting its Limits?” discussed the likelihood that the demand to borrow could stay weak, keeping the demand curve from shifting right and therefore playing an important role in keeping a lid on higher interest rates. In this final article of the series we focus on factors that investors should consider to help gauge demand for bonds.

Bonds – Is Credit Growth Hitting its Limits?

In “Bonds – More Than Meets the Eye”, we proposed that despite historically low interest rates there may be opportunities in Treasury Bonds to earn total returns well in excess of their current low yields. In this article, the second installment of a three part series, we analyze some important factors which help determine where interest rates might be headed in the near term. This article focuses on the demand side of the supply/demand curve to understand pricing pressures. Part 3 of this series will emphasize the supply side of the curve and key determinants of interest rates including economic growth and inflation.

Bonds – More Than Meets the Eye

When buying equities, some investors plan for a short holding period, seeking to capitalize on short-term price fluctuations – “a trade”. Others plan on a longer holding period based on economic or fundamental analysis – “a long-term strategic investment”. Regardless of which tactic is employed, few schedule a specific day, month or even year for divestiture. Contrast this with the bond investor’s strategy, whereby many bondholders seek to hold their investment to its maturity date. Those bond investors possessing this predilection are likely unaware of potential opportunities that trading bonds offers. In this era of historically low yields the opportunity for outsized returns may be significantly larger than current yields advertise if one considers selling a bond prior to its maturity.

Commodity Prices and the U.S. Dollar

The chart above plots the performance of the Commodity Research Bureau (CRB) index, a benchmark measuring the prices of 19 diverse commodities. The legend is purposefully omitted so that we may pose the following question: If the lines represent one indicator, why are there 3 lines? The answer lies not in the commodity prices underlying the index, but in the currency used to express the prices. The blue line represents the CRB index as it is commonly expressed, in U.S. dollars (USD). The green line is denominated in euros and the black line in Brazilian reals. This graph highlights that the currency in which a commodity is denominated can have a meaningful effect on prices.

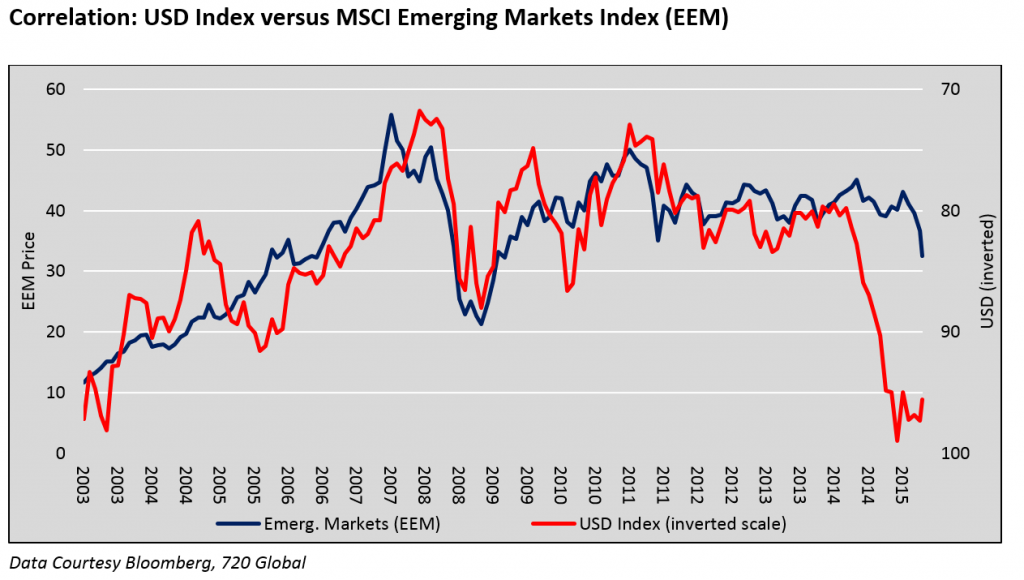

The U.S. Dollar and the Emerging Markets

Historically, periods of USD appreciation have led to outflows of investment dollars resulting in economic hardship, crisis and even regime change in emerging market nations. The 1997-1998 Asian crisis, the related default of Russia and the collapse of the hedge fund Long Term Capital Management, for instance, were precipitated by a strong USD and a rapid reversal of capital flows from Asia back to the U.S. It is estimated the crisis resulted in the repatriation of $250-$500 billion.

The USD Role as a Funding Currency

Over the past year, the real trade-weighted U.S. dollar (USD) index increased over 10%, fostering a slowing of global economic growth, increased volatility in financial markets and plummeting commodity prices. This serves as a reminder of the influence the USD has on global trade and asset markets. Periods of dollar appreciation, as highlighted in the graph below, are not well understood by the investing public as there have been only two major appreciation periods since the removal of the gold standard in 1971. The potential consequences from a third major USD appreciation can have a significant effect on expected asset class returns.