Category: Volatility

The “3 by 5 Index Card” on What You Need to Know About the February VIX Spike

University of Chicago professor Harold Pollack in an interview a few years ago mentioned that the best money advice can fit on a three-by-five inch index card. He was then challenged to write the card. His financial advice went viral. We follow this tradition by focusing on a simple “three-by-five index card” on the VIX volatility spike earlier the month.

What Is Your Focus? Schwerpunkt – The Center Of Gravity For Your Investment Efforts

Schwerpundt is a German word meaning main focus, center of gravity, or focal point. The term came from Von Clausewitz’s “On War” and refers to the strategic objective or goal of any military campaign or battle. It is the place of greatest importance against an adversary.

Has SPY – VIX Sensitivity Changed in the Last Week?

The talk of the markets is the significant spike in the VIX index and the large decline in equities over the same period. An important question is whether the relationship between the stock and volatility has changed with this move. A quick answer is no.

Rincon Capital – A Rising Tide Lifts All Boats

John F. Kennedy’s aphorism “a rising tide lifts all boats” seems to be particularly appropriate when describing the results of both the domestic and international equity markets these past 30 days.

Volatility Shock – A Concern That Is Real, but Should Be Tempered By VIX Dynamics

We believe that a volatility shock will generate a feedback loop that will force equity prices lower. High leverage tied to volatility targeted risk management will mean that any increase in volatility will lead to portfolio rebalancing and position cutting. This negatively correlated leverage effect between equity returns and change in the VIX is real, as measured by researchers at the New York Fed, see “The Low Volatility Puzzle: Are Investors Complacent?”.

Being Short Volatility is Risky in a Crisis – Do You Know Your Volatility Premium Exposure?

Implied volatility is usually higher than realized volatility so there is a positive volatility risk premium, except when there is a crisis or volatility spike at which time the volatility premium turns negative. A recent CBOE seminar presented a chart on the volatility premium to illustrate the risk.

The Growing Danger from a Market that is Complacent of Risk – A Variation on Minksy

Investors should be concerned about the unintended behavior from low volatility. Low volatility will lead to higher volatility in the future when investors become complacent about risk, the “Volatility Paradox”. This paradox has been discussed by Richard Bookstaber as early as 2011 and recently referred to in a post on his blog, Our low risk (low volatility) world.

Natural Gas Market – Elasticities Are Changing and That Means More Volatility

Natural gas has always been a volatile market and subject to weather shocks; however, over the last few years the volatility and weather shocks have been dampened because of the high storage inventory levels. Monthly volatility has declined by at least 1/3 over the last three years as inventories remained high.

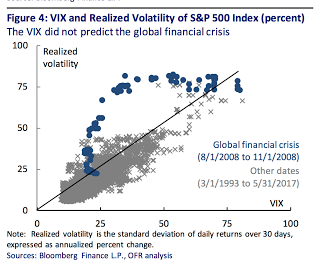

We Will Get Volatility Wrong at Transition Periods – Need to Prepare Before the Event

A provocative chart from the research piece The Volatility Paradox: Tranquil Markets May Harbor Hidden Risks by the Office of Financial Research Markets Monitor shows the poor forecasting of volatility when there is a regime change. Of course, tranquil markets harbor hidden risks. Low volatility is pricing in a lack of imagination of what the future may hold. The markets usually say that tomorrow’s change will be represented by the deviations of yesterday. We have learned from reading Minsky that low volatility will lead to risk-seeking behavior as investors reach for yield, employ leverage, and become complacent. Hence, a shift in regime will lead to more dramatic change in volatility.

Risk Parity and Volatility Targeting as a Danger – Let’s Get Real with Some Numbers

There is growing talk that volatility targeting and risk parity are the dangerous new “portfolio insurance” strategy of the decade. In the post-’87 crash period, the view was that portfolio insurance sowed the seeds of market destruction by creating a market decline feedback loop. As an option replication strategy, portfolio insurance automatically increases risk exposure […]

Is “Directional Volatility” Needed for Trend Followers?

What is needed is volatility coupled with price trends, which Ivarsson refers to as “directional volatility”. “What we at RPM look for is ‘directional volatility’, meaning volatility that drives markets in a certain direction”. – RPM’s executive Vice President Per Ivarsson

The concept of directional volatility is elusive. It combines two concepts, the path of prices with the price spread away from the average. The quote is focused on the critical need for a trend with volatility for trend-follower to profit. Volatility is necessary but not sufficient for strong trend-following profits. It is necessary to have prices move across a range in a discernible path, but a wide price range can still be without trends. Trends may occur if there is low volatility but the level of profits will be smaller and the trends will be harder to identify.

The depiction of trend following as a look-back straddle is based on volatility and the ability of the trend follow to capture the range. The look-back option is the potential max that a trend follower may achieve for a single trade within a time span. Nevertheless, if we think of a stochastic process for a price series, we want a mean change plus wide dispersion. It is not enough to just have volatility, the journey expressed in the volatility is critical.

Volatility and Managed Futures – Is There a Relationship with the VIX?

Many believe that managed futures is a long volatility strategy because the strategy is like being long a look-back straddle. We believe there is a more nuanced story associated with long gamma exposure, but let’s use the prevailing wisdom of long volatility as a starting point for a discussion.

VIX and What to Expect – The Odds Against the Big Jump

The VIX index, the most widely watched measure of market volatility, is at extended lows with a jump lower after the French presidential first round election results. The uncertainty and risk premium from this election has been taken out of the market. Economic uncertainty has also fallen since the US election although it is still elevated since the earlier last fall.