Archives

Financial Analysis and “Truthiness” – Follow Data, Not the Talk

If I were being polite, I would not argue that we are in an age of lies by politicians, businessmen, or leaders, but what The Economist has called a “post-truth world”. Stephen Colbert described the current environment as one of different levels of “truthiness”. At best, clarity by leaders and spokespeople is in short supply. Most commentary is done for spin.

The Paradox of Skill – Why Competitive Markets are Left to Luck

The paradox of skill is an important concept to understand for any investor or trader. Managers will often talk about wanting to prove their skills in a competitive environment against the best in the world. Forget that nonsense. You want to be the best in an uncompetitive or less competitive environment. You want to have a strategy that others do not follow. Being in a competitive space may seem like a good thing, but it will be harder to beat others. If there is a fixed amount of alpha, everyone will be fighting for that same alpha and it will be harder to win your share when the market is more competitive.

Tactical Investing in Global Macro and Managed Futures

There are good times to invest in global macro and managed futures on a tactical level and there are other periods when the investment decision should be made on a strategic level. There are conditions when divergent strategies which are highly uncorrelated to core risky assets such as equities will do better. Unfortunately, there is not a lot of data for those periods of very strong managed futures performance. For example, crises like recessions are good periods. We also believe that periods of large deviations from fair value for an assets class will be global macro and managed futures friendly.

Probability of Recession Rising – A Warning

The US recession probability model based on the Treasury spread is a simple straightforward forecasting tool that can be followed in real time. If the spread term negative, watch out, economic winter is coming. Nevertheless, there are only a limited number of recessions and a limited number of signals. What is as useful is watching how the probability of a recession changes during non-recession periods. Periods of growing economic stress will see an increase in recession probability. For example, periods when the probability is more than 10% or even more than 5% will be times when equity markets will be under stress. These periods may pass without a recession, but there will be an impact on financial markets. This signal may have to be confirmed with other data since it provides early warnings, but it is valuable as a simple indicator.

Less Noise, More Insight: How Smart Investors Stay Ahead

As an analyst, reading all the news that is fit to print is not a good value proposition. It just takes up too much time and leads to the confusion of work with effort. Problem with News Consumption Too often news articles just try and fit the facts with current market behavior. If employment figures […]

Policy Coordination – The New New Thing for Central Banks?

Reading some of the recent comments by central banks there seem to be three emerging themes over the last few months.

International Monetary System Not Working on Four Dimensions

Eichengreen is one of the leading international monetary economists and historians. He has always been especially effective at describing and analyzing the global monetary framework across time. When I look at the international monetary system on these four dimensions, I find that we lacking coherence or policies that will affectively raising global growth. Consequently, the longer-term story of secular stagnation or just a lower global growth path will continue to hold. Changes in these dimensions will be necessary to change the slow growth story. Our current views are not positive:

Gemini Alt & IASG Alternatives Announce Technology Integration

CHICAGO, Sept. 13, 2016 /PRNewswire/ — The Gemini Companies announces that its affiliate, Gemini Alternative Funds, LLC (http://www.geminialt.com), has completed a software integration with IASG Alternatives LLC. As part of a strategic relationship, prospective Gemini Alt investors will have access to the IASG Alternatives managed futures database without leaving Gemini Alt’s Galaxy Plus managed account […]

Global Macro Investing – A Simple Framework

What separates global macro investing from other hedge fund styles? This style is significantly different from others because it has a broad focus on a wide range of asset classes. It is not just equity or fixed income focused. Its search for opportunities goes beyond any single country.

Managed Futures and Volatility – The Type of Vol Matters

Managed futures strategies can be described in a number of different ways. Many researchers and market practitioners have referred to it as a long volatility strategy. This language has captured many as a good shorthand description. In the same vein but much more clearly developed, it has been called being long a straddle. A straddle is volatility sensitivity with its gains occurring only after prices move outside the strikes plus premium. Empirical research has shown that the long straddle is a good representation.

Was August the Calm Before the Storm?

Historically the summer markets coincide with tight ranges and low volume. Trends seem to dry up, markets trade in tight ranges, and short-term opportunities can be rare. For instance, the past 30-day range in the SP 500 has been the tightest range since 1995. That particular market led to a 180% rally in the stock market over the […]

The Summer Ups and Downs of Managed Futures

The summer was a positive performance period for managed futures, yet it was still filled with return up and downs. We have identified periods of more than 2% gains and losses on the AMPHI Liquid Alt Index, an equal weighted index of the largest liquid alternative programs available. This return pattern is representative of many periods in managed futures performance with equal gains and loses punctuated by larger gains when there is a market divergence or dislocation. In this case, the main driver was the post-BREXIT market reaction that lasted for approximately two weeks.

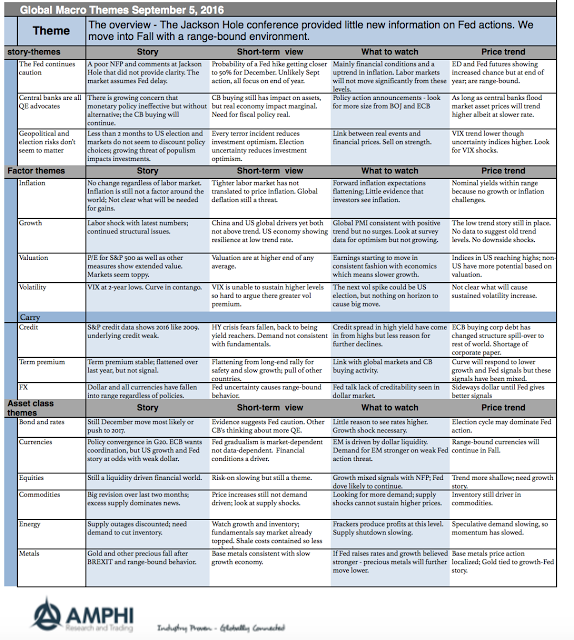

Global Macro on One Page for September

The major themes for September have not changed significantly from last month. The reason is simple. The markets have not moved much and the economic information that we have received in the last month has not changed expectations. The two big events were the Jackson Hole conference which provided little new light on Fed behavior and the confirm payroll last week which rolled back some of the real economic enthusiasm.