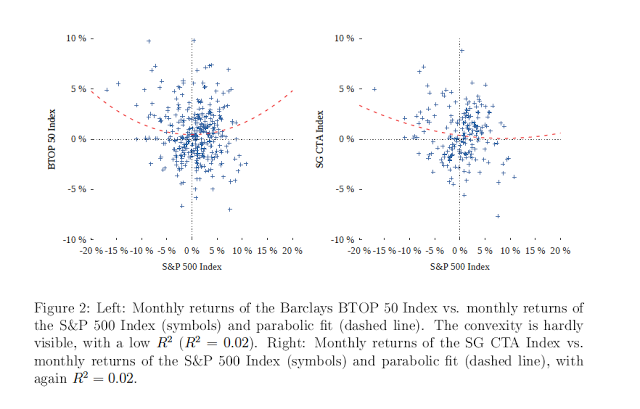

Managed futures strategies can be described in a number of different ways. Many researchers and market practitioners have referred to it as a long volatility strategy. This language has captured many as a good shorthand description. In the same vein but much more clearly developed, it has been called being long a straddle. A straddle is volatility sensitivity with its gains occurring only after prices move outside the strikes plus premium. Empirical research has shown that the long straddle is a good representation.

Others have noted that the straddle-long-volatility story is not an effective description. Rather, the focus has to be on a long gamma story not just vega. Volatility as measured by the spread in prices is necessary but not sufficient for profits in managed futures. Choppy market behavior that could be associated with higher volatility may not allow for managed futures profits. Simple stories just do not seem be adequate explanations for describing managed futures.

I have been partial to the divergence story as a description of managed futures as a twist on the long volatility story. Managed futures programs make money when there are divergences from some price equilibrium. There has to be trend movement with some minimum size move. Managed futures managers are long convexity. Volatility can help with that description as a measure of price dispersion but there has to be directional price movement. This descriptive story still needs more formal testable hypotheses although the long gamma option story is consistent with divergence.

A subtler theme on the volatility story is that managers are long longer-term volatility or the dispersion in prices and short short-term volatility. Shocks to short-term volatility will stop-out positions for managed futures programs given that a price shock will hit the stop and cause positions to be eliminated. This makes managed futures positions similar to a knock-out option. Higher short-term volatility that does not covert or impact long volatility will not be helpful for most managed futures managers who are looking at longer term trends.

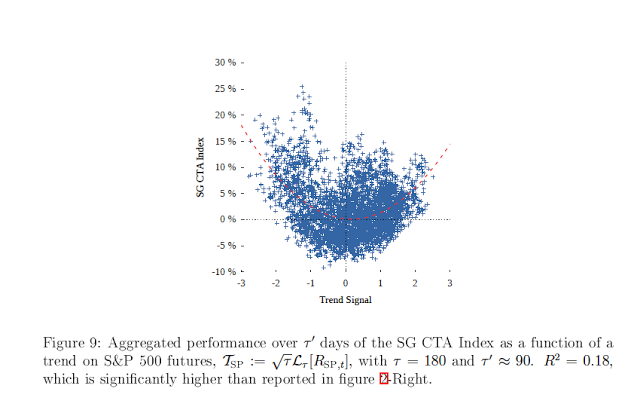

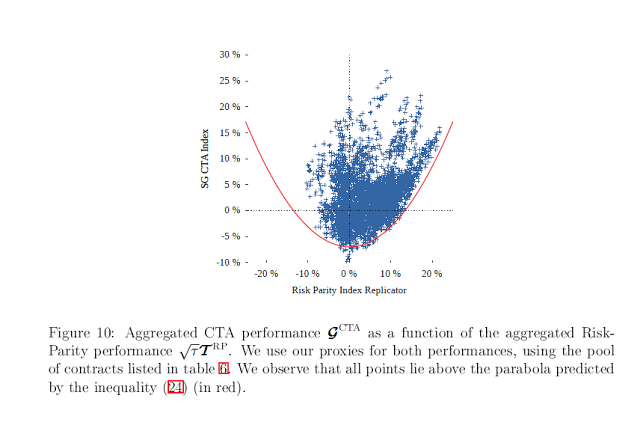

Entering this story is some new research that is very insightful on the behavior of managed futures managers, Tail Protection for Long Investors: Trend Convexity Work, by the folks at Capital Fund Management in Paris. Managed futures managers do provide positive convexity and it is related to long volatility. The difference between long and short volatility is related to positive serial correlation in prices. Volatility for a longer timeframe will be higher than short volatility because the serial correlation will widen the price dispersion.

The researchers exploit this effect in their analysis and find that the positive convexity gains for managed futures are related to the time horizon analyzed. There will not be positive convexity over short horizons when the manager is a long-term trend follower. Convexity will appear when the analyzed time horizon is consistent with the time frame of the manager. This is consistent with the divergence, gamma, and long long-vol and short short-vol story. Additionally, it adds to the straddle story in that the expiration of the options on the straddle is important for describing the manager. This is an important advancement in our understanding of managed futures.