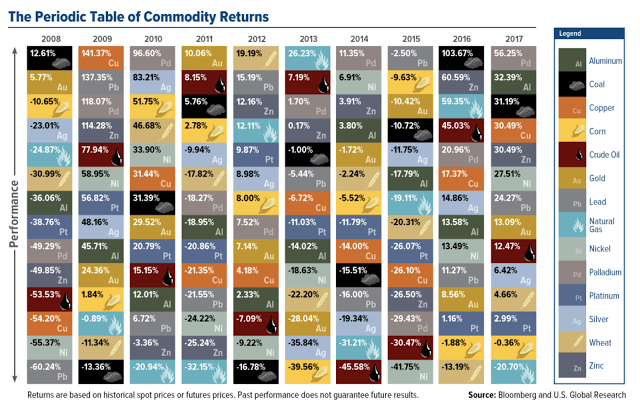

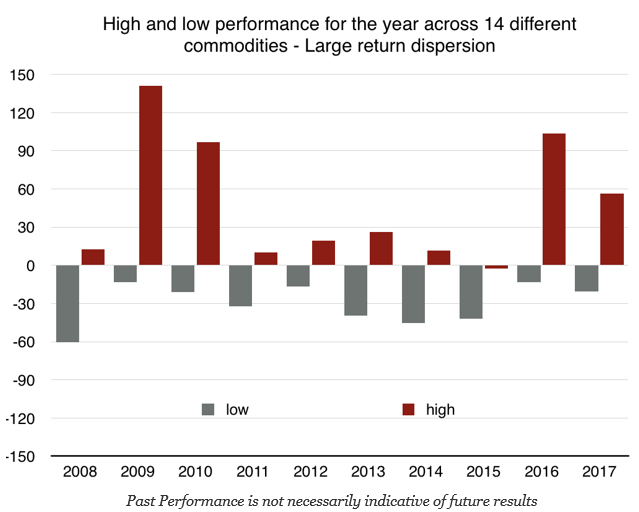

Volatility in commodities as measured by their dispersion in returns is high, so it is hard to characterize the behavior of the commodity sector. The periodic table of annual returns highlights the varied behavior of these markets. This list does not even include softs, tropicals, or livestock commodities and is tilted to the base metals; however, the story would still be the same.

It is not unusual for the annual return dispersion to be over 100% between the lows and high commodities. It is also unsurprising to see the top gainer in one year to fall to the largest loser the next year.

Given these large differences in behavior across commodities, there is a fair amount of specialization with commodity hedge fund managers. There ill be focused funds that only trade oil and do not trade any other sub-sectors. Hence, commodity trading by hedge funds is fragmented and the size of managers is often smaller than what would be found in other asset classes. Investors are more likely to need specialized skill in assessing commodity trading talent, or at least there is more knowledge required to understand market dynamics. Portfolio building is more likely to involve bundling a set of managers than picking one overall commodity specialist.