“We need to embrace the fact that we don’t know what the next bad outcome is. We need to think outside the box.”

“The world is continuing to change, and we need to constantly reinvent ourselves in this revolving world.”

-John Williams, President NYFRB

Look outside the box! Everyone should look outside the box. Everyone wants to me the person looking outside the box. There is a desire for innovation, but are we sure that this is the best solution to any problem?

I want to be known as creative, but is attempting to be creative always the best use of our time. Perhaps it is better to look at the past and search for similarities or the obvious before moving outside the box. Let the data speak first before looking for odd alternatives. Exhaust the obvious first.

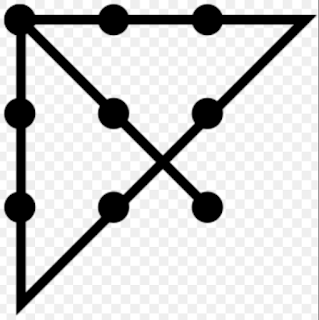

Thinking out of the box originated as a solution to the “nine dot problem” – using only four lines, pass through each dot without lifting the pencil off the paper. It is a great game for showing creativity.

Yes, thinking out of the box provides the solution to the puzzle. The solution literally requires being outside the box. Still, the first order of business is learning to look inside the box and see whether we are missing what may be considered obvious. Someone who is trying to solve the nine-dot problem should follow a process. The first may be to try simple solutions.

With respect to NYFRB president Williams, we agree that we don’t know what will be the next bad outcome, but the first thing is to focus on the bad outcome that may be potentially staring us in the face. Bad outcomes usually seem obvious after the fact, so a fist pass is to look at problems that are most likely before venturing into the less likely.

We don’t have to think out of the box to realize there is a debt leverage problem. We don’t know the catalyst for the problem but we do know that a change in cash flow expectations will lead to a financial failure. The yield curve inversion is another obvious place to look. A flattening curve affects financial markets, so you don’t have to look outside the box. What is more important is thinking through the timing of inversion on market prices.

You may not want to be the one who is looking inside the box, yet looking inward for better understanding has a higher likelihood of success. Conventional thinking or rather looking for the obvious from what is known is not a bad starting point. After all that is obvious is eliminated, then other solutions can be entertained. This is a simple conservation process for solution management.