Mark Rzepczynski, Author at IASG

Prior to co-founding AMPHI, Mark was the CEO of the fund group at FourWinds Capital Mgmt. Mark was also President and CIO at John W. Henry & Co., an iconic Commodity Trading Advisor. Mark has headed fixed income research at Fidelity Management and Research, served as senior economist for the CME, and as a finance professor at the Univ. of Houston Baer School of Business.

Risk Parity

Risk parity has been one of the most important advancements in portfolio construction over the last decade. It places the focus on equalization of risk and not on comparing expected returns which are notorious for being difficult to forecast. However, there is a problem with risk parity. It will allocate more to low risk asset classes that may be subject to a downturn. There is no opinion on market direction or valuation. It assumes the investor has no information on individual assets or view of factor risks. Outperformance relative to cap weighted portfolio is related to whether low risk assets have returns than higher risk assets.

International Finance

International finance has been increasingly confusing for academics, policy-makers, and traders. Just when you think currency markets will be well-behaved and follow theory, they will move in ways that are totally unexpected. We have always known that currencies are hard to predict given they are expectational markets. Even with perfect foresight about underlying fundamentals, our ability to explain currency is suspect. The research continues to show that currencies are hard to predict and fundamental models can only explain a small percentage of the price variation. There needs to be a deeper framework for understanding foreign exchange behavior.

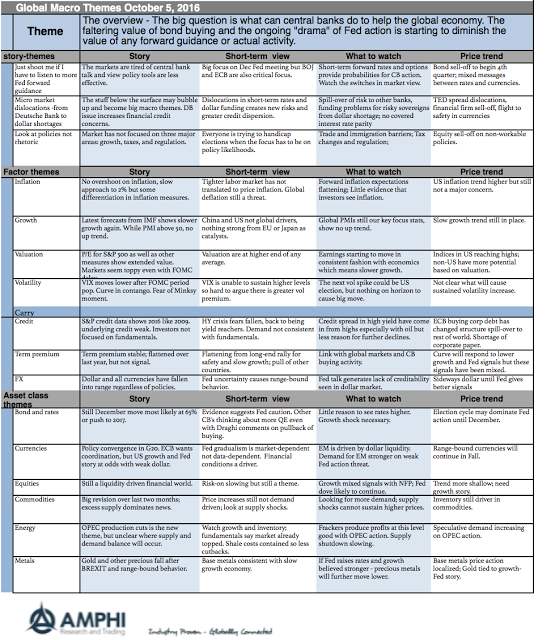

Global Themes on One Page – More of the Same from Last Month

Who is looking at the economic data when the US is closing in on one of the most important presidential elections in the last few decades? Of course, what presidential election has not been important? Personality polarization has driven party behavior to extremes with little focus on policy proposals. Constant change to meet the current electoral audience has created uncertainty; however, the written proposals of the candidates provide clear policy differences.

Equity Hedge Funds Generate Strong Gains in September

DISCLAIMER: While an investment in managed futures can help enhance returns and reduce risk, it can also do the opposite and result in further losses in a portfolio. In addition, studies conducted on managed futures as a whole may not be indicative of the performance of any individual CTA. The results of studies conducted in the […]

Limited Major Trends, but Some Selected Opportunities in Commodities

Each month we look at the major trends in market sectors to determine the current macro signals within prices and the effectiveness of trend following. Last month, our view was that monetary policy uncertainty left the markets with few clear trends. October looks like a potentially good market in the fixed income, rates, and commodities. The best market potential for October as of the start of the month is in base metals and the energy complex. Nevertheless, the trend signals in base metals are significantly at odds with bond signals and with the talking head stories that global growth will continue to be modest. Maximum opportunity and risk occur when trends are at odds with general market commentary or conventional wisdom. The energy complex is trending higher on OPEC news, but the ability for these trends to last will be subject to OPEC members holding to some production limits.

Skew Risk, Volatility Risk, and Managed Futures

Some new research on risk parity makes provocative comments on the risk and potential value of managed futures in a portfolio. In one of our previous posts, we cited this recent work suggesting that accounting for skew can be helpful relative to a risk parity approach focused on volatility. See Messy markets, mixed distributions, and skew – […]

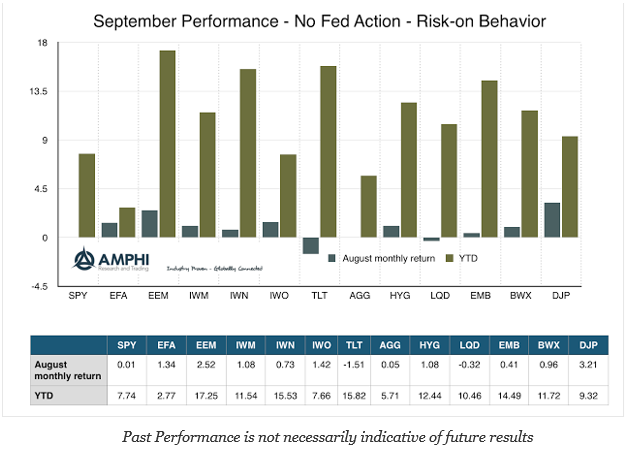

September Performance – Risk-On with Fed on Hold

Was investing for the month so simple? The Fed did not take any action, albeit the threat that they are getting close, and the markets rallied for the month. Fade the Fed regardless of their speeches about wanting to move rates higher. We think this strategy may be ending in December, but right now investors were again rewarded for not believing any threats of Fed action.

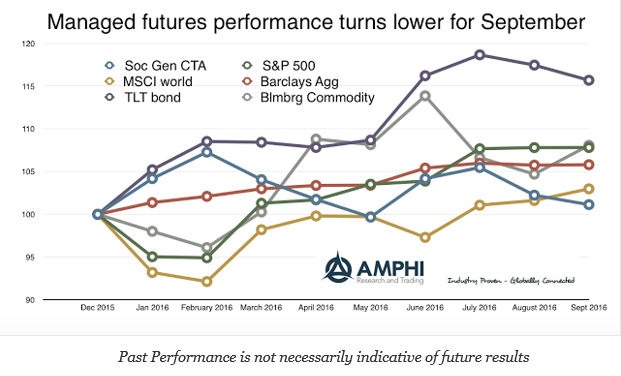

Managed Futures – A Month of Giveback

The performance of the SocGen Managed futures index fell short this month relative to major asset classes except for the long bond. Its year to date performance is now below all of the major asset classes. While many traditional long-only traders were able to take advantage of the risk-on environment, managed futures was not able to exploit opportunities surrounding the Fed announcement.

Minksy, Volatility, and Skew

The Financial Crisis resurrected the thinking of Hyman Minsky and his “financial instability hypothesis”. With the crisis, there was coined the term Minsky Moment, the time when financial markets collapse after a period of prosperity from the excessive speculation on financial assets. Unfortunately, his insightful views on financial instability never received the attention it deserved before the crisis. It was not structured in the current economic orthodoxy of formal mathematical modeling.

Messy Markets, Mixed Distributions, and Skew – Thinking About Downside Risk

We often only think about markets in terms of risk and return where risk is measured by the standard deviation of returns. It is easy to calculate and update. Unfortunately, the changing nature of markets makes for messy calculations and analysis. Assuming a normal distribution is just too simple for measuring risk. Investors have to be aware of skew in return distributions. More specifically, investors have to account for negative skew because the unexpected extra downside risk is what really hurts portfolio returns.

TED Spread Warning – Not What You Think

The TED spread has been used as financial market warning signal for decades although it has moved in and out of favor over time. Market participants have turned to other measure of financial risk, but when this old measure jumps, it is worth taking a closer peek.

Momentum in Futures Not Spot – Hidden in the Basis?

Momentum strategies work with commodity futures, but a closer examination shows that the same momentum strategies are ineffective with commodity spot prices. This result, that the cash price action is not mirrored in the futures prices, seems odd. Of course, the futures are expectational markets, but the cross-sectional behavior in the spot should be represented […]

The Clearinghouse, FCM’s, and the New DFP’s

The clearinghouse is the truly special feature of any futures exchange because it allows buyers and sellers to comfortably come together to trade with only limited credit risk. Traders know that they do not have to worry about the specific risk of their trade counter-party because their risk is with the clearinghouse. We know that the actual structures in place are more complex than this simple story. The mechanics make all the difference so changes should be looked at closely.