Category: Commodities

Narrow Ranges Reflect Ample World Supply

The amplitude of grains and oilseed prices last month was extraordinarily narrow. Soybeans were the most-contained, with a high-to-low closing price range of just 28c in the March contract, narrowest for January since 1998. It’s even more remarkable considering that on the 12th, USDA surprised the trade by reducing the 2015-16 U.S. crop by 50 million bushels. The reason that such stable matching of supply and demand rarely persists for a month is the constant fresh assessments of risks to production of crops in the field and the next to be planted. Today, such is the adequacy of supply and geographic diversification of growing areas that the market judges risk to be lowest in decades.

Commodity Prices and the U.S. Dollar

The chart above plots the performance of the Commodity Research Bureau (CRB) index, a benchmark measuring the prices of 19 diverse commodities. The legend is purposefully omitted so that we may pose the following question: If the lines represent one indicator, why are there 3 lines? The answer lies not in the commodity prices underlying the index, but in the currency used to express the prices. The blue line represents the CRB index as it is commonly expressed, in U.S. dollars (USD). The green line is denominated in euros and the black line in Brazilian reals. This graph highlights that the currency in which a commodity is denominated can have a meaningful effect on prices.

WEO: Adjusting to Lower Commodity Prices

Global growth for 2015 is projected at 3.1 percent, 0.3 percentage point lower than in 2014, and 0.2 percentage point below the forecasts in the July 2015 World Economic Outlook (WEO) Update. Prospects across the main countries and regions remain uneven. Relative to last year, the recovery in advanced economies is expected to pick up slightly, while activity in emerging market and developing economies is projected to slow for the fifth year in a row, primarily reflecting weaker prospects for some large emerging market economies and oil-exporting countries.

12 Questions to Ask Before Selecting a Commodity Trading Advisor

Here is a list that I’ve developed for Individual investors to know the answers to or ask before investing their risk capital with a Commodity Trading Advisor or Professional Money Manager. This checklist is ever evolving as new information comes to light or the dynamics change in the market place. Our hope in providing this […]

Bulls Being Lured in With Dropping Rig Counts

CNBC is running out of credible, bullish analysts on the oil complex. The calls for $65+ WTI seem relatively sparse. Is anybody in their right mind still thinking crude oil is going higher? Of course. We all know Keynes’ saying, “The market can stay irrational longer than you can stay solvent.” But seriously, how much […]

Don’t Be Fooled by Oil Bull Talk

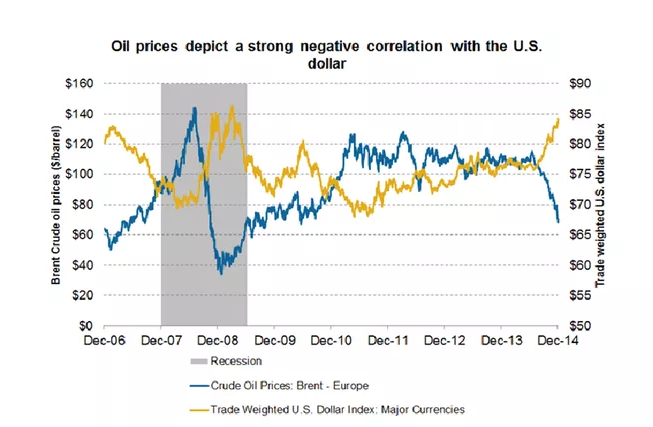

Written by: Bryen Deutsch The 200-day moving average is a widely held long-term trend indicator. Markets trading above the 200-day moving average have a tendency to be in longer term uptrends. Markets trading below the 200-day moving average tend to be in longer term downtrends. Last July, the US Dollar Index crossed above the 200 […]

Overcoming Mental Biases in Trading and Investing

Average CTA’s, investors, and people generally have an overwhelming desire to be “right.” Who likes to be wrong? You read and hear daily from friends, and fellow traders (spouses – J), how important it is to be correct, especially when they make a market prediction or, even worse when they put real money into a […]

Crude Bulls Running Out of Steam?

Crude bulls posted a new yearly high on Friday as WTI rocketed higher in the previous two sessions after Wednesday’s more bullish-than-expected DOE inventory release. More bullish?? Or less bearish might be more like it. Since making multi-year lows on March 18, WTI crude has seen a healthy 42% rebound. Likewise, Brent crude has rallied […]

Oh, Wheat…

Wheat futures continued their downslide today with May15 sinking 15 ¼ cents in Chicago and settling at 4.70 ¼ and hitting a new life of contract low, this all despite Funds holding a record 100,000 contract short position. U.S. moisture has been beneficial with weather forecasts into next week for additional rains which is starting […]

Energies: Outlook for the Upcoming Week

Friday’s choppy action was unsurprising as the refined products exhausted themselves on Wednesday and Thursday. After a quiet start to the week, RBOB gasoline shot up 13 cents and up HO 10 cents while Brent Crude popped $4. Interestingly, June WTI closed DOWN for the week as we saw the June Brent/WTI spreads widen to over $8. Last […]

Avoiding Costly Mistakes in CTA Trading: Key to Consistent Profits

Success in trading is measured in terms of the growth of the account balance. A CTA is not expected to play God and call every twist and turn in the market correctly. Some professional and proven CTA systems are only correct 25-30% of the time and still consistently pull huge profits out of the markets. […]

Are cocoa traders making money on the Ebola scare ?

David Martin of Martin Fund Management recently posted this article on PBS Newshour:

David Martin Finds Soft Commodities a ‘Last Century’ Challenge

David Stephen Martin deals in commodities that people have a hard time doing without. Take that cup of fine Colombian coffee you just drank. Or that chocolate bar. Or that soothing glass of orange juice. Martin trades the soft commodities — coffee, cocoa, sugar, orange juice and cotton. And he has fun doing it, even though these commodities are some of the most volatile products: vulnerable to frost, drought, disease, insects, animals, guerrilla wars and occasionally unstable governments. They are grown and traded all over the world.