Category: Managed Futures

Current Trends

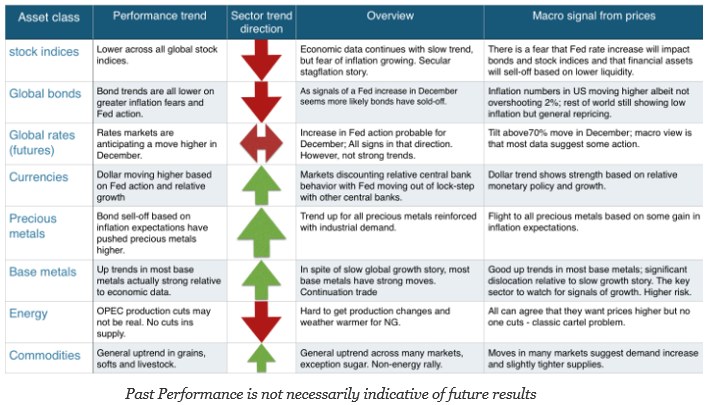

Each month we run a set of trend models against the major markets in each asset class sector. We then average the trend direction, either up or down, to generate a sector signal.

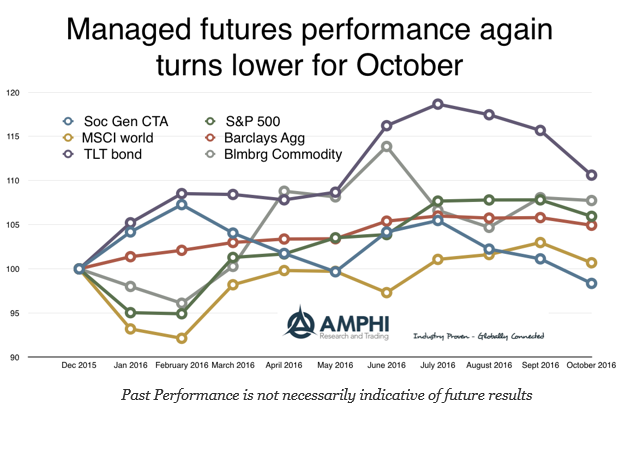

October 2016 Managed Futures Performance

Managed futures should not be synonymous with trend following but most of the major indices that track this hedge fund style have a high proportion of trend-followers.

Managed Futures Performance

Managed futures shows good long-term performance versus equities. Yes? No? If you start investing in the SocGen CTA index in 2000 and compare with any end year until 2015, you will shows positive returns as a stand-alone investment.

Limited Major Trends, but Some Selected Opportunities in Commodities

Each month we look at the major trends in market sectors to determine the current macro signals within prices and the effectiveness of trend following. Last month, our view was that monetary policy uncertainty left the markets with few clear trends. October looks like a potentially good market in the fixed income, rates, and commodities. The best market potential for October as of the start of the month is in base metals and the energy complex. Nevertheless, the trend signals in base metals are significantly at odds with bond signals and with the talking head stories that global growth will continue to be modest. Maximum opportunity and risk occur when trends are at odds with general market commentary or conventional wisdom. The energy complex is trending higher on OPEC news, but the ability for these trends to last will be subject to OPEC members holding to some production limits.

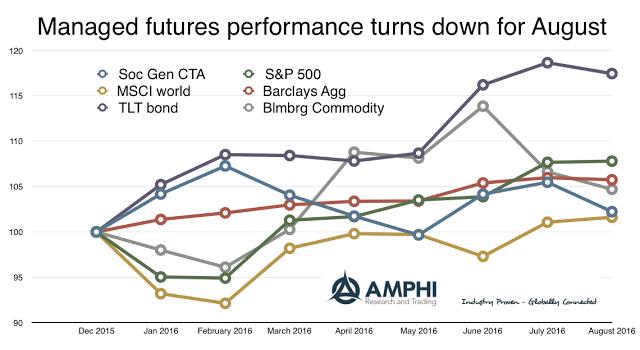

Managed Futures – A Month of Giveback

The performance of the SocGen Managed futures index fell short this month relative to major asset classes except for the long bond. Its year to date performance is now below all of the major asset classes. While many traditional long-only traders were able to take advantage of the risk-on environment, managed futures was not able to exploit opportunities surrounding the Fed announcement.

Quant and System Developers – There is a Distinction

Thinking about the analysis of systematic global macro and managed futures managers, I asked a simple question, is there a difference between a quant and system developer. A portfolio system is a complete integrated approach for making market predictions and investment decisions including sizing, entry, exit, and risk management. Is it possible for a manager to be less well-trained as many newly minted engineering quants, but still be talented at building portfolio systems?

Tactical Investing in Global Macro and Managed Futures

There are good times to invest in global macro and managed futures on a tactical level and there are other periods when the investment decision should be made on a strategic level. There are conditions when divergent strategies which are highly uncorrelated to core risky assets such as equities will do better. Unfortunately, there is not a lot of data for those periods of very strong managed futures performance. For example, crises like recessions are good periods. We also believe that periods of large deviations from fair value for an assets class will be global macro and managed futures friendly.

Managed Futures and Volatility – The Type of Vol Matters

Managed futures strategies can be described in a number of different ways. Many researchers and market practitioners have referred to it as a long volatility strategy. This language has captured many as a good shorthand description. In the same vein but much more clearly developed, it has been called being long a straddle. A straddle is volatility sensitivity with its gains occurring only after prices move outside the strikes plus premium. Empirical research has shown that the long straddle is a good representation.

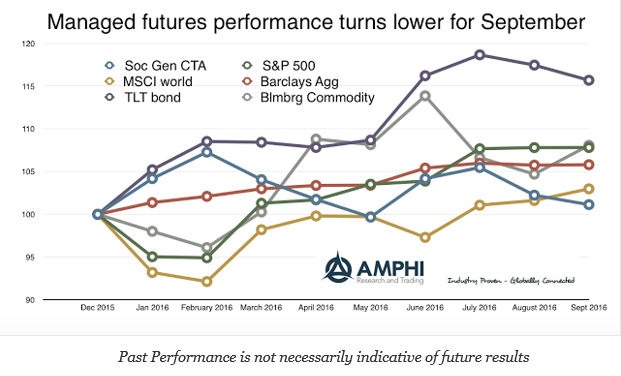

The Summer Ups and Downs of Managed Futures

The summer was a positive performance period for managed futures, yet it was still filled with return up and downs. We have identified periods of more than 2% gains and losses on the AMPHI Liquid Alt Index, an equal weighted index of the largest liquid alternative programs available. This return pattern is representative of many periods in managed futures performance with equal gains and loses punctuated by larger gains when there is a market divergence or dislocation. In this case, the main driver was the post-BREXIT market reaction that lasted for approximately two weeks.

Managed Futures August Performance – Negative Chop

A rule of thumb for managed futures performance is that if there is little movement in the underlying asset classes, there will be negative performance for the average managed futures manager. While it does not apply to all managers, certainly trend-followers need trends, and a measure of trend is the longer-term volatility or spread in prices.

Investing in a Continuum of Change: Trading Futures Markets Amidst Rapid Transformations

Market Commentary from Kottke Commodities – Commodity Capital CTA – Kenneth Stein Most of our expectations are just knee-jerk reactions to day-to-day details, but today’s headlines rarely reflect tomorrow’s reality meaningfully. For example, how many tectonic changes in different areas of our lives have and continue to occur, only dimly perceived even by those attentive to […]

Alternatives to Long Only Passive Strategies

As we discussed in “Why an Absolute Return Strategy”, most investors, knowingly or not, rely on long-only passive strategies. These investors may shift between stocks, bonds and cash at various intervals, but generally their portfolio returns mimic those of well-known stock and bond indices. Alternatively, active or absolute return investors rely on many different strategies that are not dependent upon a positive market direction to generate positive returns. To continually build wealth through good and bad markets, absolute return investors require a diverse, alternative set of strategic tools. This article describes a number of strategies used by absolute return investors to help them achieve their goals.

July Results showing good month for Managed Futures

The IASG CTA Index has approximately 75% of managers updated through July performance with almost all sectors posting positive returns for the month. The one exception is the agricultural index where many managers struggled with grain pricing continuing downward pricing and many with expectations that there would be a bounce back in grains.