Category: Managed Futures

Keeping it Simple with Explanations – An Investment Narrative needs to Answer Key Questions

There are two communication problems with global macro investing. First, the stories used to explain the global macro economy are confusing, contradictory, and haven’t proved to be true. This is an outgrowth of the poor forecasting of macroeconomics in general. Second, the stories used to explain the investment process especially for quants goes over the head of most investors. A discussion of techniques is not an explanation for how returns can be generated. Managers need to work on their narratives to ensure that investors understand what they do and why they make money.

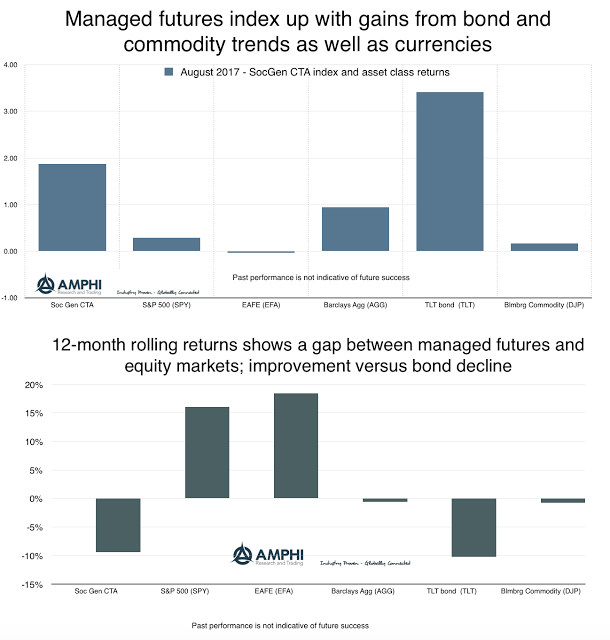

Managed Futures Post Gains on Bond and Currency Trends

Many CTA managers posted gains for August based on strong bond moves in the US and up trends in European fixe income. Currencies continued to add to profitability albeit the decline in the dollar has a flatter slope than previous months. Gold trading was profitable for those who traded it in tandem with currencies. Equity index trading was a more difficult sector given mid-month spikes in volatility and a reversal in direction during the second half of the month. Commodity trading was mixed for many managers with profitability associated with market allocation and style of trading employed. Oil trended lower while refined products and natural gas were slightly up for the month. Hurricane Harvey volatility affected position-taking at the end of the month. Industrial metals have continued their summer upward trends which has caused renewed interest in this sector.

Global Macro – Managed Futures as an Alternative to Corporate Bonds

Corporate bond risk is rising. Of course, with improvement in the overall economy and continued bond flows many will not believe it, but the statistical data suggest that spread moves are no longer symmetrical. There is more potential for spread widening versus continued tightening.

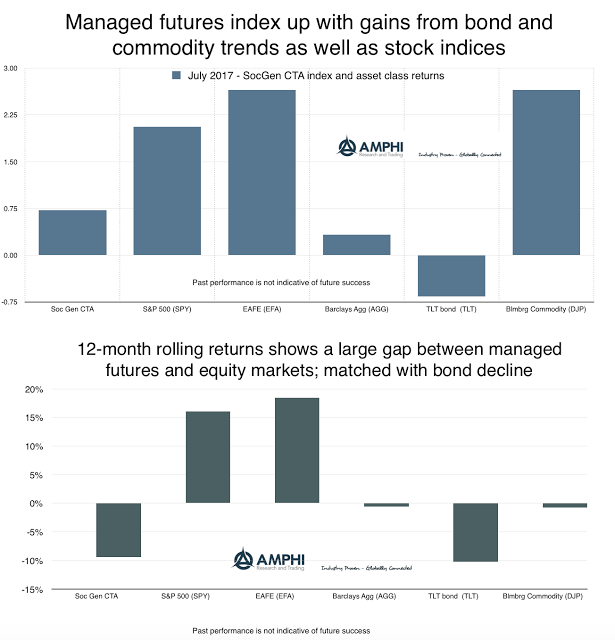

CTA’s Find Trends to Reverse Some of Last Month’s Poor Performance

The month began with some very promising trending opportunities, but with some choppy moves in both bonds and commodities, returns were generated by those who were nimble at position-sizing and getting out of losing trends before profits were completely given back to the market. This was a month where trend timing length mattered. Long-term trends ride through short-term choppiness. Short-term trend following is often able to profit and exit on reversals. A difficult problem is matching model to trend length and is often the reason for a diversity of timing models.

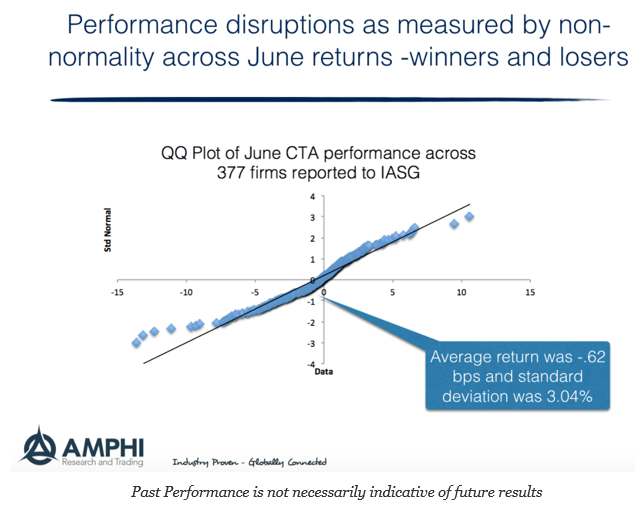

When Markets Disrupt, So Does Performance – June Managed Futures and Outliers

What kind of month was June for CTA’s? Well, you can look at the distribution plot of returns for the month to get an idea of the extremes. We created the QQ plot for the 377 firms that reported to the IASG database for June as of last week. This can be done for smaller more specialized samples, but we took the maximum set of data reported to IASG.

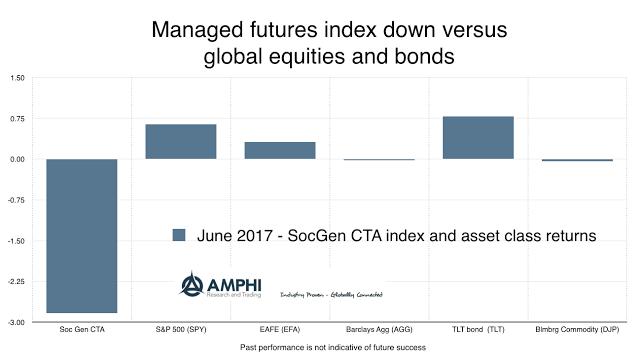

Managed Futures Hit with Trend Reversals, but Opportunity Potential in July

The managed futures index from SocGen was down over 2% for the month with price declines in many major financial markets over the last week. Similar performance has been found with other indices; however, those managers with more commodity diversification have fared better.

Mixing Collateral with a Managed Futures Portfolio – Need to Know Marginal Contributions

In an earlier post we discussed the issue of using capital more efficiently in a managed futures investment. The premise is simple. If only limited funds are used for margin, the majority of cash associated with a managed futures investment are held in low interest investments. This portion of the managed futures capital can be better deployed to increase returns. Similarly, managed futures can be used as an overlay to an existing portfolio to better use cash. See “Use your collateral wisely and enhance managed futures efficiency”.

Managed Futures – All dressed up but not Going Anywhere

Money has flowed into managed futures under anticipation that there will be a crisis event that will need the diversification benefits of trend-following strategies. These investors adjusted portfolios away from perceived overvalued assets to the value from long-short diversified trend-following. What is the sense of increasing allocations after the divergent event of a equity sell-off?

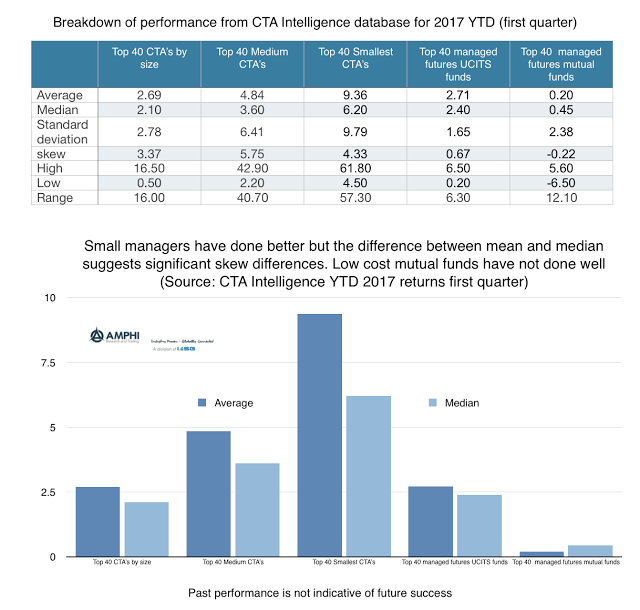

Size Matters with Managed Futures but Not Just with Performance

There has been a preference for large managers within the managed futures space as measured by money flows, but it comes at a cost. Looking at year to date performance from the CTA Intelligence performance database shows the differences in performance based on size. What is clear is that the average performance of a set of 40 small managers is significantly higher than the performance of the largest 40 managers. Going down in size will allow clear increases in average return and with median returns; however, a closer look shows that the price of obtaining higher returns can be high in terms of regret.

The Effectiveness of Managed Futures: Exploring Trend-Following Strategies

Why is managed futures or, more precisely, trend-following an effective investment strategy? Many managed futures programs have been successful by keeping it simple and using heuristics like following the price trend and not always using all the available information about a market. Disciplined and systematic decision-making seems to be a robust means of dealing with […]

Volatility and Managed Futures – Is There a Relationship with the VIX?

Many believe that managed futures is a long volatility strategy because the strategy is like being long a look-back straddle. We believe there is a more nuanced story associated with long gamma exposure, but let’s use the prevailing wisdom of long volatility as a starting point for a discussion.

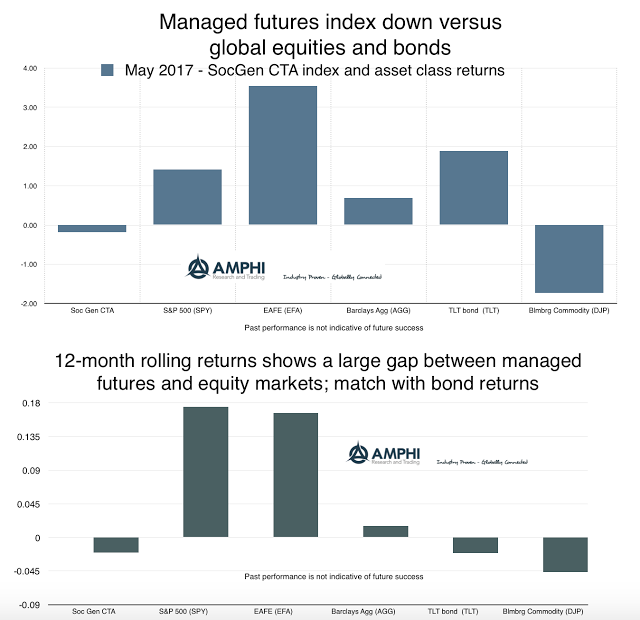

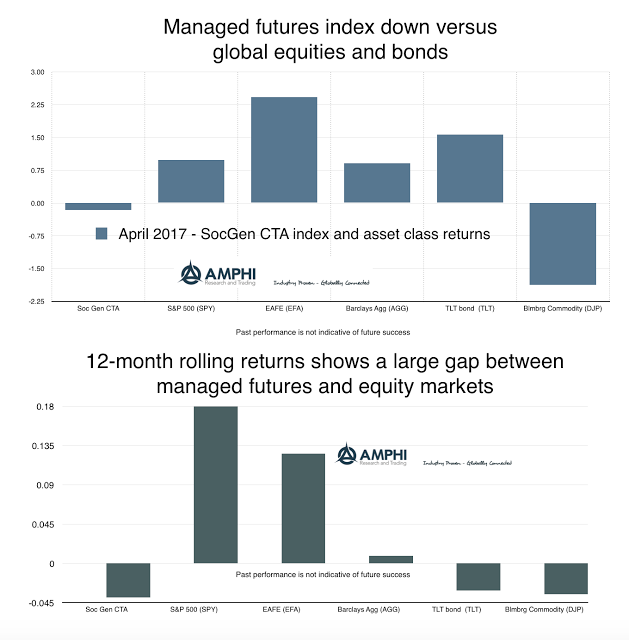

Managed Futures Flat for Month of April

The SocGen CTA index was essentially flat for the month which is not surprising given three major factors. One, we are in a global risk-on environment which generally is not attractive for trend-followers. It is not that there are no trends, but there were limited gains from diversification across asset classes relative to a risk-on portfolio. Two, there were few strong trends going into the beginning of the month. Given the usual time-frame for effective trend-following which is weeks not days, there has to be continuity of trends to have a good performance month. The strong gains in foreign markets may not have been given enough exposure to generate good portfolio returns. Three, the focus on financials especially fixed income and currencies by large managers was a drag on performance relative to equities and short commodities trends. Four, volatility is at extreme lows. We have looked at market volatility through the VIX index and current levels are above the 98th percentile for the lowest since 1990. Divergent strategies based on taking advantage of the spread in prices through time will be limited in their return potential in this type of environment.

Using Economic Growth as a Predictor for Managed Futures Returns

Another simple test to determine whether managed futures returns will do better than average is by looking at economic growth. We know that bonds and other defensive assets like managed futures will do better in “bad times,” such as a recession, but there are not many recessions. The cost of being defensive can be very […]