Category: Global Macro

Global Macro in One Page – Rotation to Non-Dollar Assets Continuing

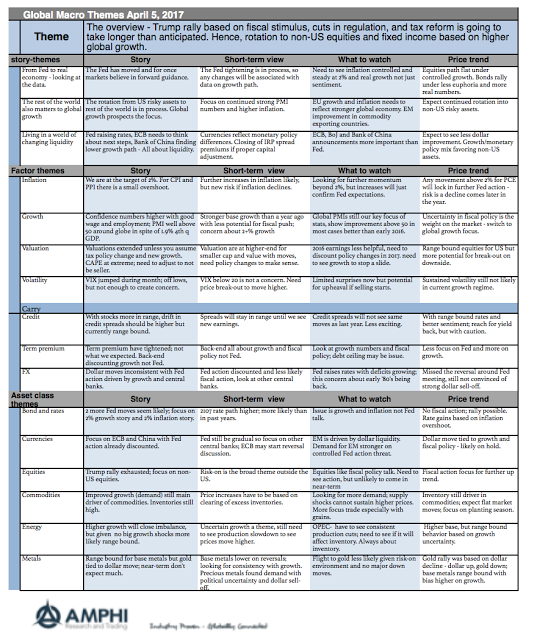

March was a tough month for making any economic judgments. The Trump rally in equities was expected to continue, but reality has been a switch to non-US risky assets. A bond sell-off was expected given Fed action combined with more fiscal policy revelations. It did not happen. The dollar was expected to continue its rally based on further confirmation of the Fed being out of step with other central banks. It did not happen.

Global Macro on One Page – More of the Same

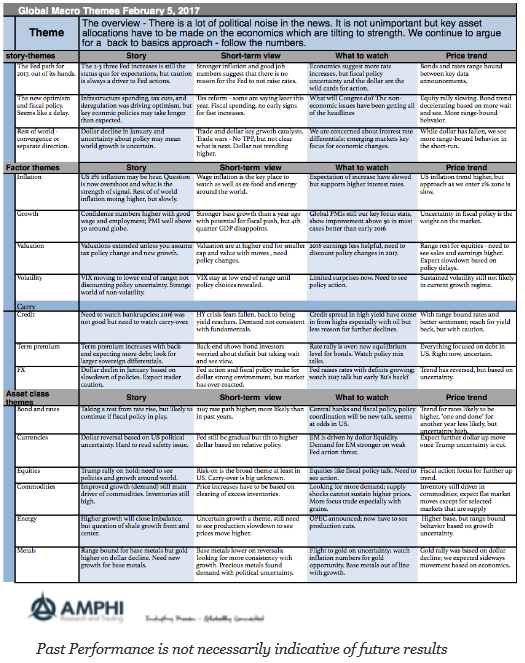

Just because there is the passage of time does not mean that market themes will change. The big issues could be unresolved with no information that will change expectations. We are at one of those times.

Global Macro on One-Page – Follow the Data and Trump Policy

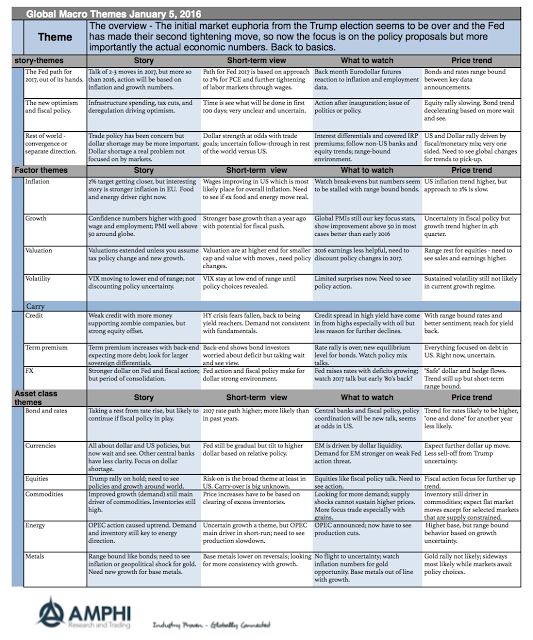

The market euphoria since November is all based on expectations of future US policy. Rational expectations of future policy and not the current economy are driving markets. Albeit the US economy has positive sentiment and has shown economic growth improvement, there are still headwinds that may only be mitigated through a change in policies. 2017 will be defined by the implementation of those policies and their effectiveness at reducing the ongoing credit recession.

Trends for December – Dispersion Across Sectors

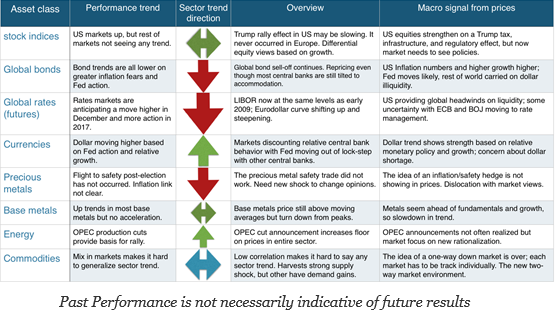

Key financial market trends show continuation as we enter December. Down trends in bonds and rates may show some weakening after the strong moves in November, but there are few signs of reversals. Dollar strengthening is linked to the bond moves based on expectation of increased US growth and Fed action. Energy markets show a strong uptrend on announced OPEC production cuts. The US equity rally post-election is slowing. This stock rally never occurred in global markets. There are limited trend opportunities in precious metals and slowing trends in base metals. Commodity markets are mixed based on large dispersion in supply and demand conditions.

History Lessons

What experience and history teaches us is that people and governments have never learned anything from history, or acted on principles deduced from it.- Georg Hegel 1832

This is a quote heard before; however, many have not given it specific operational meaning. This is especially true for financial analysts. What is learned in history can be varied, but what is critical is accepting that what people and governments will do is often mistaken. Current motivations for action will differ from should be done if there is a close reading of history. There is a strong distinction between what people and government “should” do if they internalize history and “will” do.

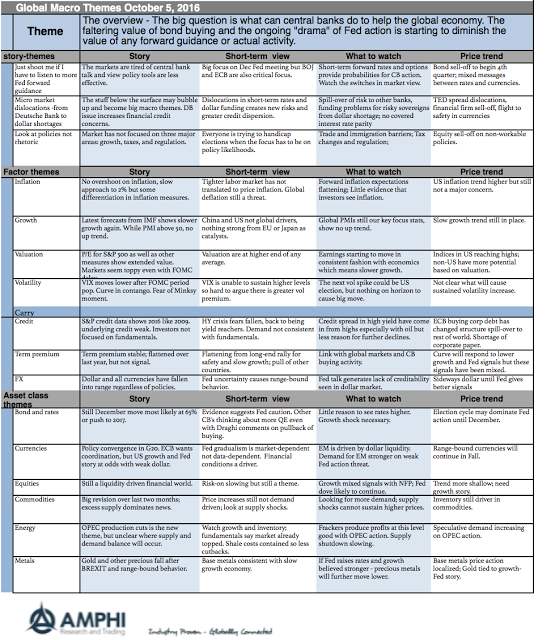

Global Themes on One Page – More of the Same from Last Month

Who is looking at the economic data when the US is closing in on one of the most important presidential elections in the last few decades? Of course, what presidential election has not been important? Personality polarization has driven party behavior to extremes with little focus on policy proposals. Constant change to meet the current electoral audience has created uncertainty; however, the written proposals of the candidates provide clear policy differences.

Tactical Investing in Global Macro and Managed Futures

There are good times to invest in global macro and managed futures on a tactical level and there are other periods when the investment decision should be made on a strategic level. There are conditions when divergent strategies which are highly uncorrelated to core risky assets such as equities will do better. Unfortunately, there is not a lot of data for those periods of very strong managed futures performance. For example, crises like recessions are good periods. We also believe that periods of large deviations from fair value for an assets class will be global macro and managed futures friendly.

Less Noise, More Insight: How Smart Investors Stay Ahead

As an analyst, reading all the news that is fit to print is not a good value proposition. It just takes up too much time and leads to the confusion of work with effort. Problem with News Consumption Too often news articles just try and fit the facts with current market behavior. If employment figures […]

Policy Coordination – The New New Thing for Central Banks?

Reading some of the recent comments by central banks there seem to be three emerging themes over the last few months.

International Monetary System Not Working on Four Dimensions

Eichengreen is one of the leading international monetary economists and historians. He has always been especially effective at describing and analyzing the global monetary framework across time. When I look at the international monetary system on these four dimensions, I find that we lacking coherence or policies that will affectively raising global growth. Consequently, the longer-term story of secular stagnation or just a lower global growth path will continue to hold. Changes in these dimensions will be necessary to change the slow growth story. Our current views are not positive:

Global Macro Investing – A Simple Framework

What separates global macro investing from other hedge fund styles? This style is significantly different from others because it has a broad focus on a wide range of asset classes. It is not just equity or fixed income focused. Its search for opportunities goes beyond any single country.

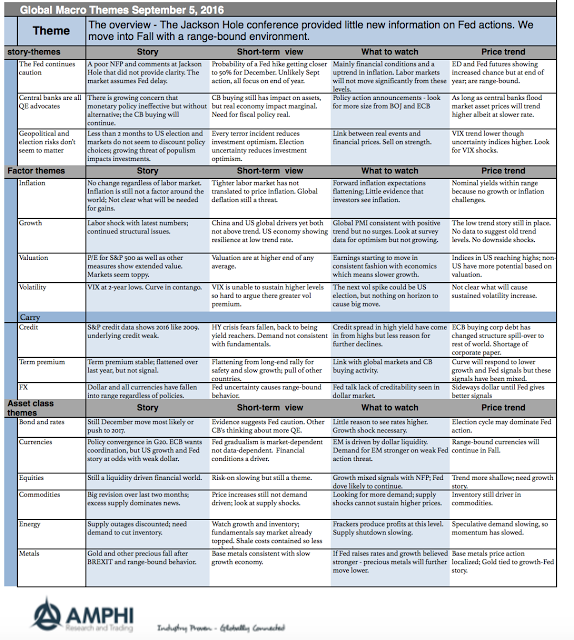

Global Macro on One Page for September

The major themes for September have not changed significantly from last month. The reason is simple. The markets have not moved much and the economic information that we have received in the last month has not changed expectations. The two big events were the Jackson Hole conference which provided little new light on Fed behavior and the confirm payroll last week which rolled back some of the real economic enthusiasm.

CTA Spotlight – Sandpiper Asset Management

Today we are profiling a CTA that is new to the IASG database: Sandpiper Asset Management. The Sandpiper Global Macro Program is a multi-strategy program employing systematic trend following and discretionary trading methods across 50 liquid futures markets. The Program produces returns across a wide range of economic cycles and exhibits a negligible correlation to other investable assets. Risk is managed […]