Mark Rzepczynski, Author at IASG

Prior to co-founding AMPHI, Mark was the CEO of the fund group at FourWinds Capital Mgmt. Mark was also President and CIO at John W. Henry & Co., an iconic Commodity Trading Advisor. Mark has headed fixed income research at Fidelity Management and Research, served as senior economist for the CME, and as a finance professor at the Univ. of Houston Baer School of Business.

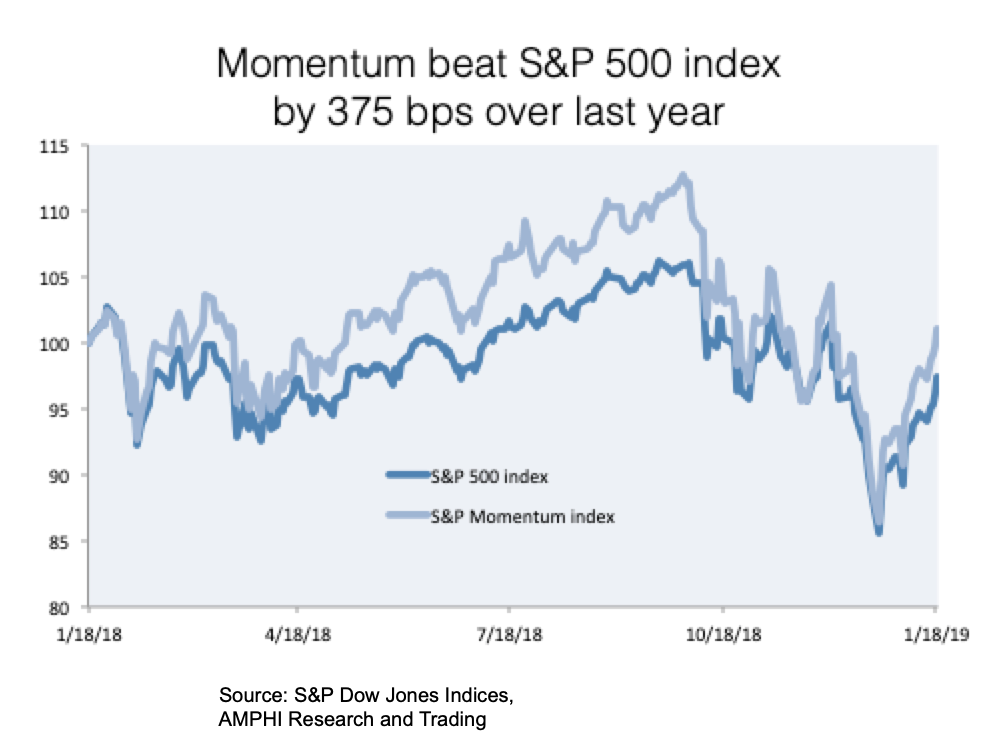

Momentum is still a viable strategy – Look at the numbers

There has been a lot of discussion on the lack of success with momentum and trend-following strategies. There is little doubt that there has been greater dispersion in returns across managers. There have been winners and losers with disappointment focused on some larger high profile firms.

Strategies for Assessing ’40 Act Alternative Investment Funds

With the increase in ’40 Act alternative investment fund offerings, there is greater interest in how to use these funds to help diversify portfolio risks effectively. There are a number of classification schemes that often overlap with some traditional mutual fund categories. Hence, there is an issue of how to best classify the set of […]

The Balancing of Global Risks – What Do You Need To Do?

The World Economic Forum has produced their Global Risks Report 2019 (14th edition) this week. The report provides an exhaustive listing of the greatest potential threats to the global economy and discusses the potential linkages between these risks. The WEF describes five categories of risk: economic, environmental, geopolitical, societal, and technological. It is worth spending time getting their assessment although be warned that risks are everywhere and not going away. There is no good news with these potential threats.

In credit do you trust? – This trust may be misplaced

The origin of the word credit, credere, is Latin for believe or trust. So there is a simple question for any credit investor, do you believe that current outstanding credits can be trusted to payback all interest and principal over the next few years? It is a simple question and many who trusted payments a year ago do not have the same trust today.

Stupidity – Not acting on what is right in front of you

I defined stupidity as overlooking or dismissing conspicuously crucial information. – Adam Robinson

That definition seems obvious, but there has been deeper research studying how to define stupidity. Of course, this research was published in an academic journal called, Intelligence.

Nonetheless, it seems that one of the key ways to generate success in investment management is to just not do stupid things. Cut the stupidity and you will be more likely be a success. Unfortunately that is easier said than done. Stupidity is all around us. We are not just talking about behavior biases but rather the issue associated with a lack of good sense or judgment. Of course, behavioral biases and stupidity do intersect. The attempt to employ mental shortcuts will lead to stupidity.

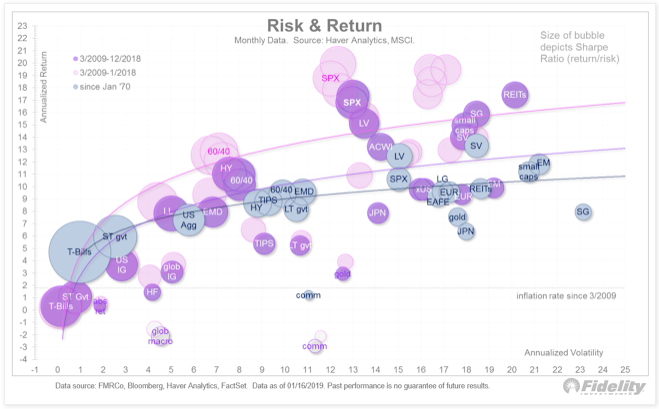

The Efficient Frontier – Not a Line but Cloudy Dream

This is a very interesting chart of the efficient frontier from Fidelity for a number of reasons. On one level the return to risk locations for different asset classes are relatively stable, but there has been a mean reversion of returns during the fourth quarter that is pulling return to risk ratios back to long-term averages. Excess returns by definition cannot last forever. The fourth quarter was a correction to the long run and by the evidence in January perhaps an over-reaction.

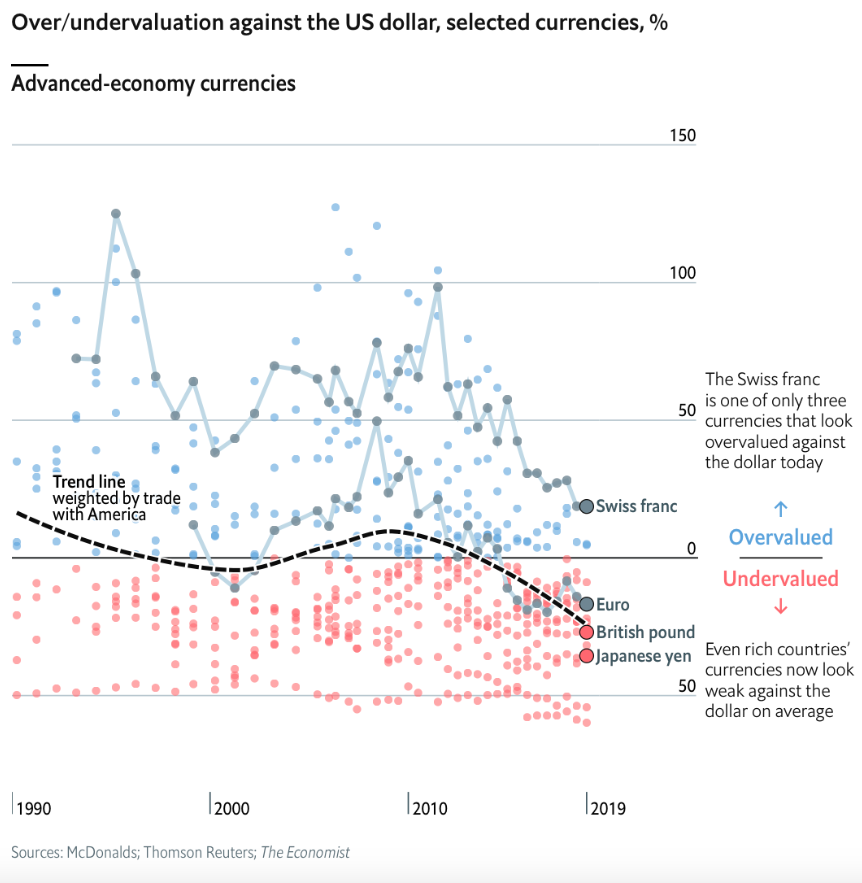

Dollar down – A big trade for 2019?

What was keeping the dollar moving higher? A simple difference in monetary policy has been a key driver. With the Fed tightening through raising rates and engaging in QT, the reserve currency provider was out of step with the rest of the world. However, recent comments by Fed Chairman Powell and other Fed bank presidents have changed policy expectations.

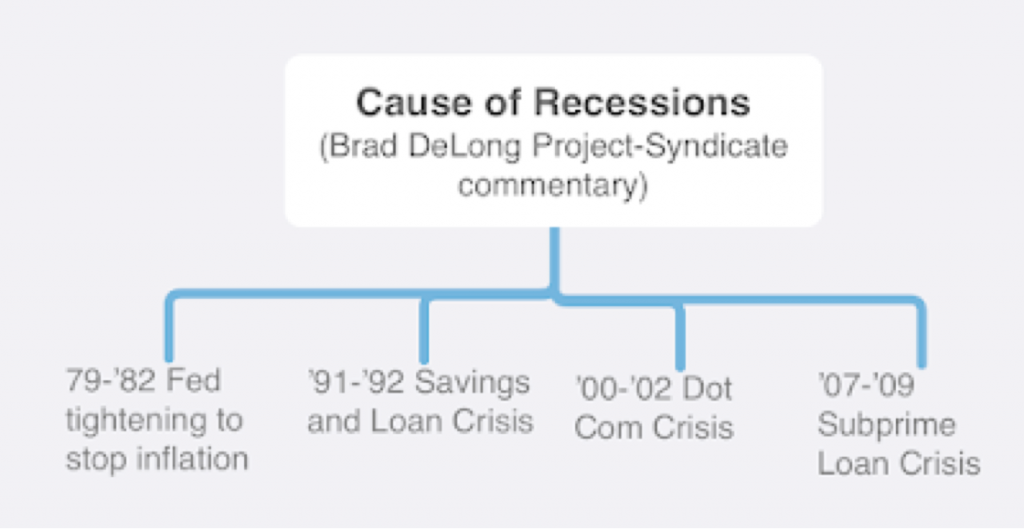

What will be the cause of the next recession?

There has been increased market talk about the next recession. Many are predicting it will occur this year albeit the dispersion of views is wide. To do a proper assessment for the cause of the next recession investors should go back to the causes of past recessions. This one will be different, but we should assume there will be common features with the past.

That marginal piece of information – What do you need to change you views?

Most data are confirming. New economic data are always occurring, but these announcements just reinforce what we already know. First, a lot of economic data moves together, so there is limited added or marginal information. Second, there is a bias with investors that they look for or see confirming information to their existing view.

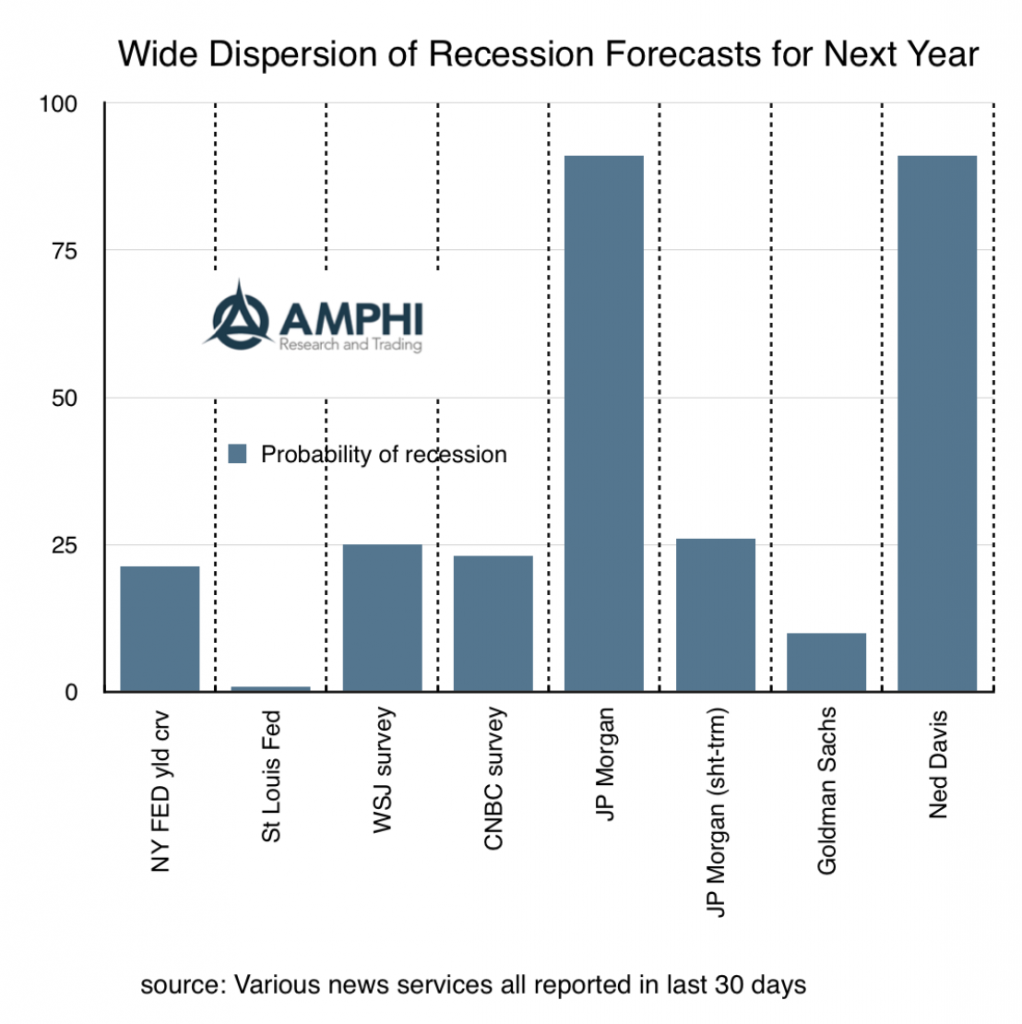

Recession probabilities – There is no consensus

What is the chance of a recession this year? Many have tried to build systematic models to give a probability number. This has been a good advancement in thinking about macro forecasting, but the variability of forecast is unusually wide. Different inputs will give different probabilities and there is no consensus on what should be the right inputs.

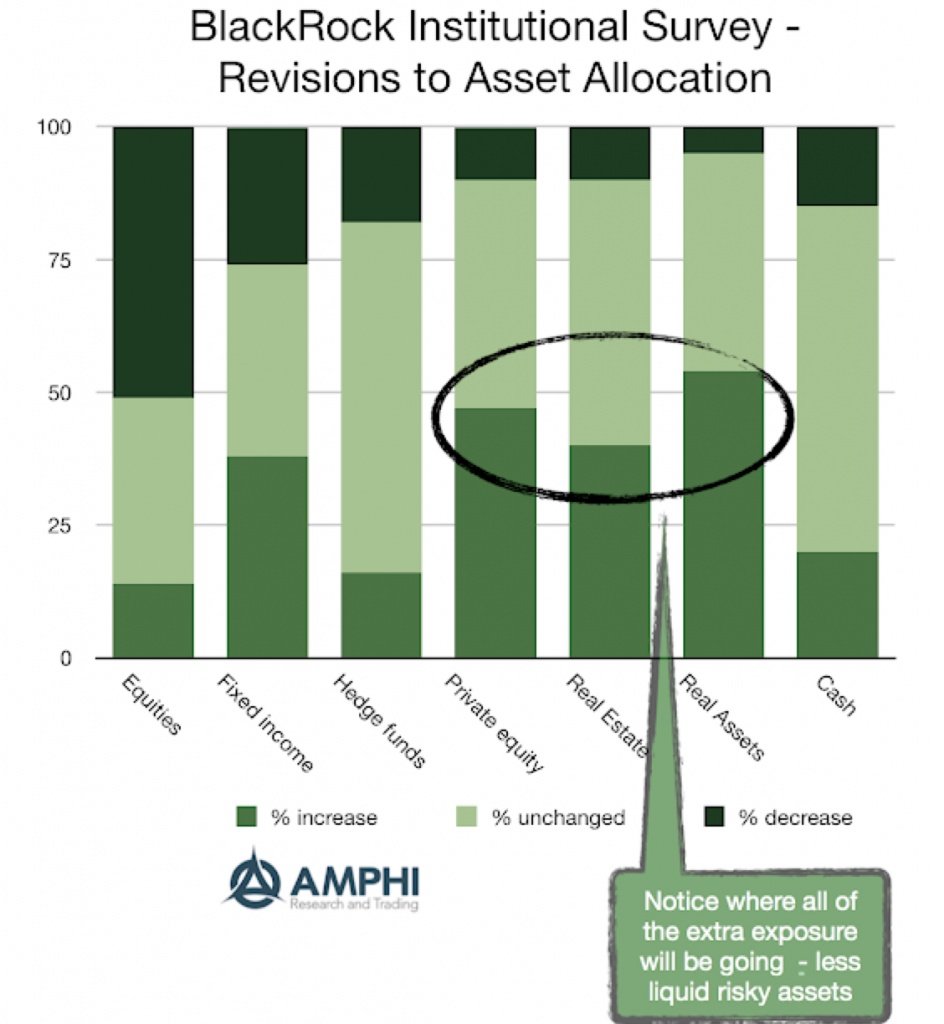

Where are institutional investors going to put their money? Not what you think

It was a tough year for money managers. All asset classes underperformed cash and most were negative for the year. Equities were a return disaster for December. Hedge funds did not do well for the year. So what will investors do?

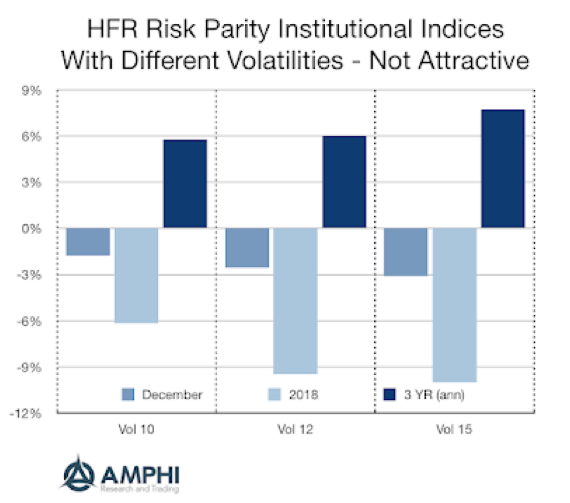

Risk Parity – A tough year for this diversification strategy

Risk parity was thought of as a portfolio strategy that would protect investors buffeted with uncertainty. Don’t think about dollar allocations, but risk allocations; it is a better way to manage a portfolio. Unfortunately, theory does not always work in practice. Using a simple benchmark of the average return for mutual funds with 50-70% equity allocation would have had slightly better returns than the 10% risk parity index and would have done much better than the higher vol indices in 2018.

What are shadow interest rates telling us?

We cannot forget that the zero bound on interest rates caused distortions in market price signals. Now in the US rates are above the zero bound so it seems like the concept of a shadow rate is not important; however, it is still relevant for many other central banks and it provides a good measure of where we have come over the last few years. Using the shadow rate as a historic measure of relative tightening, we can say that the Fed has actually been on a tightening policy since the end of quantitative easing.