Mark Rzepczynski, Author at IASG

Prior to co-founding AMPHI, Mark was the CEO of the fund group at FourWinds Capital Mgmt. Mark was also President and CIO at John W. Henry & Co., an iconic Commodity Trading Advisor. Mark has headed fixed income research at Fidelity Management and Research, served as senior economist for the CME, and as a finance professor at the Univ. of Houston Baer School of Business.

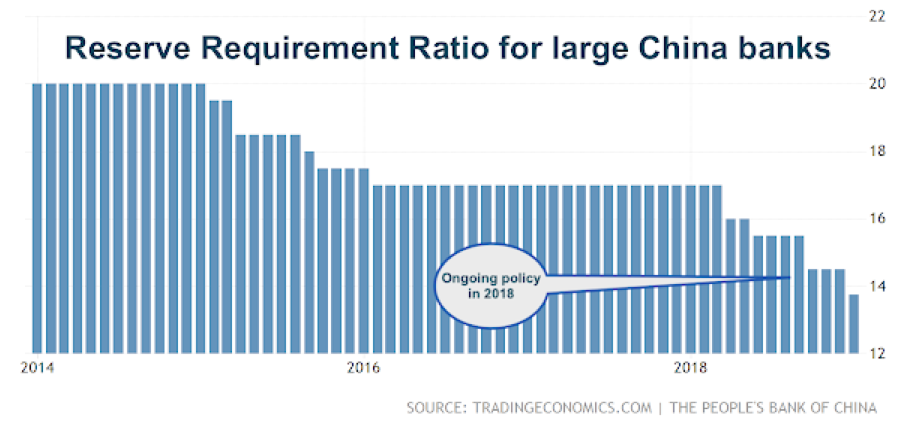

Just as important as Powell Put – China monetary action; PBOC on the move

One of our major themes for 2019 is that investors should more closely track monetary policy developments in China. The reasons are simple: the economy is big, its trade impact is global, and the PBOC at times has followed a monetary policy at odds with the Fed and ECB.

Facts and Stats – Some facts are interesting but not useful

The end of the year is usually filled with reviews and facts about what happened and speculation on what may happen in the future, yet investors can be cluttered with too many facts. Some facts can be very interesting and great for conversations, but that does not mean they are useful for plotting a course for 2019.

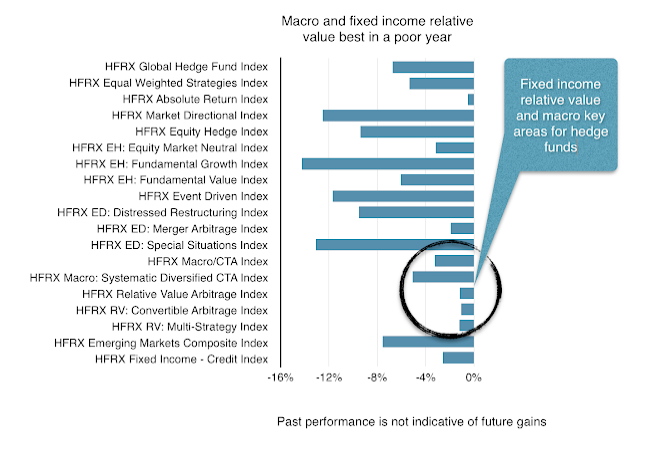

Hedge fund performance – Not great for those looking for absolute performance

The only hedge fund sectors that made significant returns in December were global macro and systematic CTAs. These are the divergence strategies that are supposed to generate returns when there are market dislocations. Macro and systematic managers, through casting a wide net across asset classes and going both long and short, should find opportunities when there are significant dislocations. The remaining hedge fund strategies lost money, but significantly less than the exposure to market beta. It was not a successful month for most hedge funds, but it was not as bad as exposure to equity beta. However, long duration Treasuries proved to be a better hedge.

Powell Put in place after AEA comments

Every Fed Chairman has their own variation on the market put strategy; Greenspan, Bernanke, Yellen and now Powell. We can call this new one the “everything on the table” put strategy where the guidance of yesterday tells us nothing of what might happen tomorrow. This may be a reluctant put. Powell may have tried to stay the course for tightening, but a bear market can change the mind of many a well-intentioned central banker.

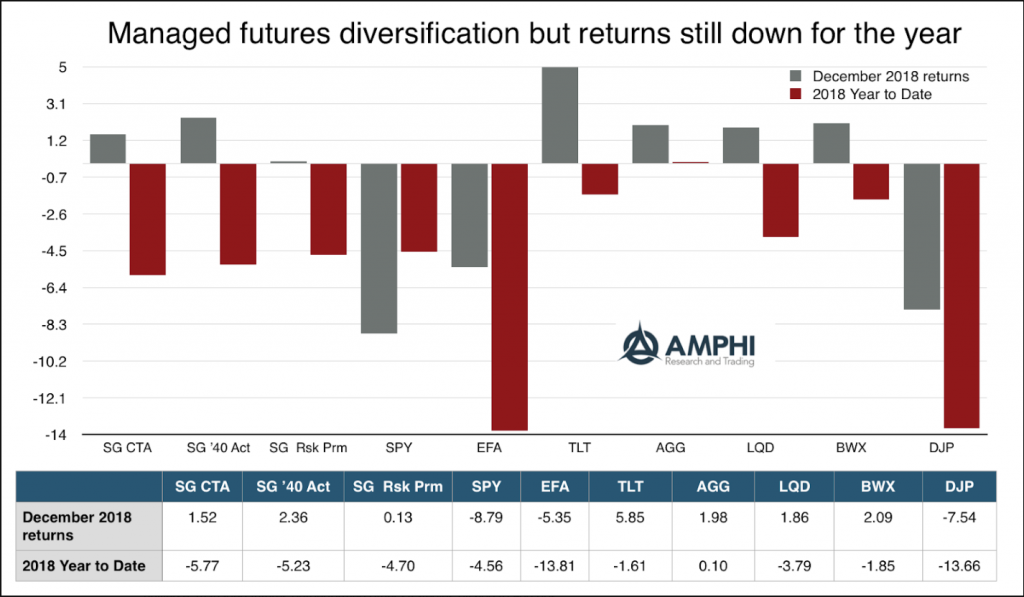

Managed futures – Provided return and diversification during difficult December

With strong trends in both bonds and equities, managed futures generated good positive returns for December. The index average does not do justice to the positive performance for some managers. For example, the CS Managed Futures Liquid Index was up around 6% for the month or four times greater than the SocGen CTA index. All of the CTA indices from BarclayHedge reported gains except for Agricultural traders. Managed futures also did well versus other hedge fund strategies and proved to be uncorrelated during the December market disruption. Versus other hedge fund strategies within the Credit Suisse liquid beta universe, managed futures outperformed other strategies by 600 to 900 bps.

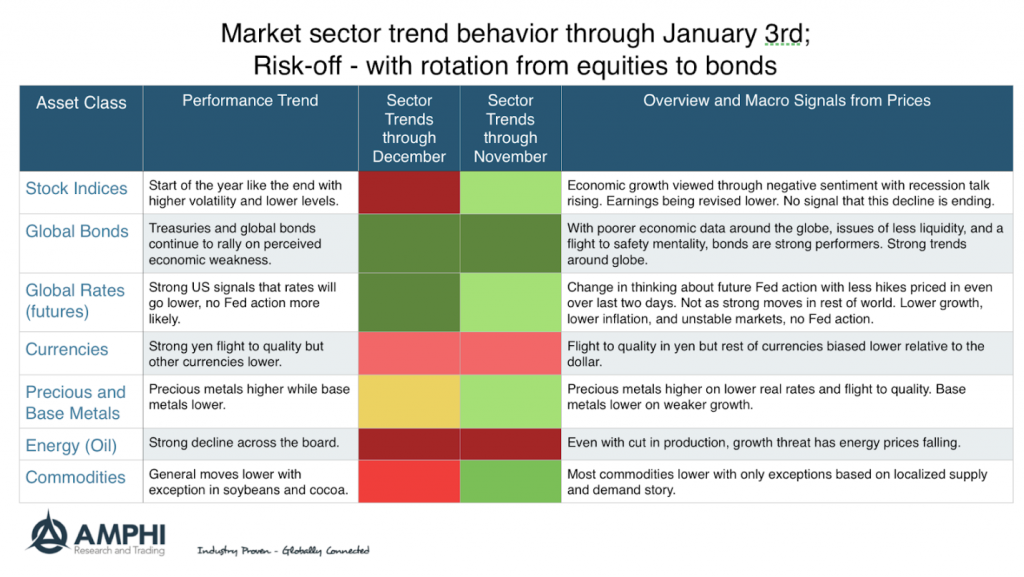

Strong trends across most market sectors

December was a great trend environment for those focused on intermediate to long-term timeframes. There were profitable opportunities in both equity indices and global bonds. Equity index trends flipped early in December and have accelerated albeit with greater intraday volatility. Bond trends continue on slower macroeconomic growth numbers and the perception of a more dovish Fed. Strong signals exist for short, intermediate and long-term timeframes.

If it keeps on rainin’ levee’s goin’ to break

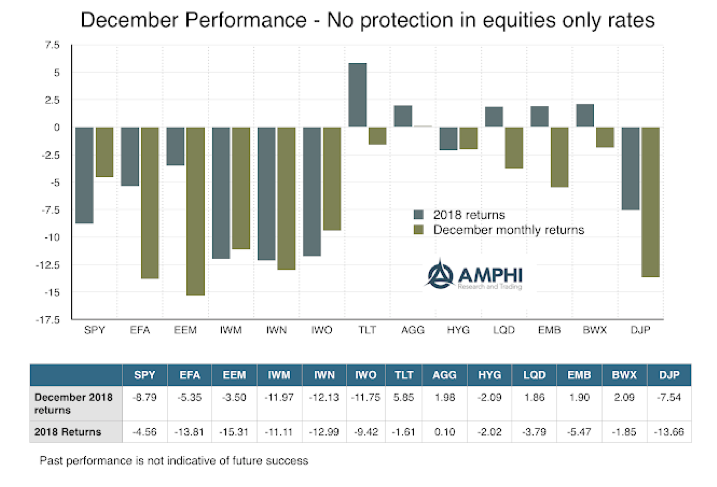

The levee broke in December with heavy selling of equities. Long duration Treasury bonds offered protection through its negative correlation with stock but there was little to make investors happy for the year. In some cases, the entire year’s return was swiped out in one month. Some analysts have suggested that this is the first time where almost all asset sectors and categories generated negative returns.

When Facing Ambiguity, Be a Skeptic

“On the road from the City of Skepticism, I had to pass through the Valley of Ambiguity.” Adam Smith

Most of finance focuses on measurable risk. Less focus is uncertainty or events that cannot be give an objective probability of occurring. Those events that are hard to measure provide the greatest opportunity.

Alternative Risk Premium versus Multi-Strategy Hedged Funds – A Process of Creative Destruction

There is growing competition with how investors access returns for different investment strategies. For example, hedge funds have developed multi-strategy approaches to investing. The multi-strategy approach has replaced fund of funds as a good means for accessing diversified hedge fund return exposures. On the other hand, there are the bundled offerings of alternative risk premia through banks who are now effectively competing in the multi-strategy hedge fund space.

Time Varying Alternative Risk Premia – Do You Want To Be Active Or Passive?

A big issue with building an alternative risk premia portfolio is whether you believe that it should be actively managed or whether it should just be a passive diversified portfolio. This is a variation of the old issue of whether there is investment skill with predicting returns. Investment skill is not just isolated to security selection but also can be applied to style rotation just like asset allocation decisions.

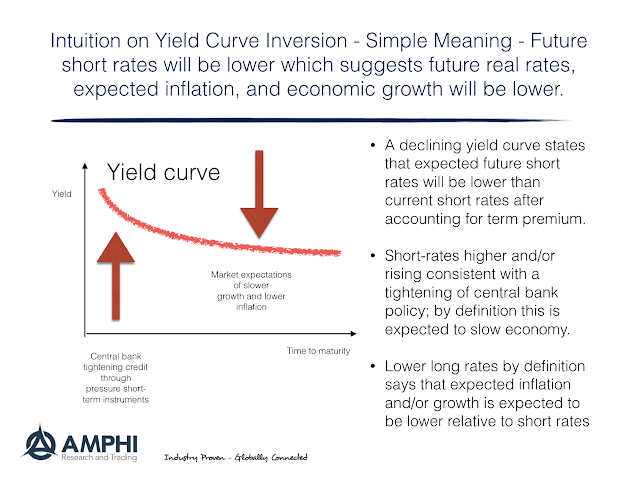

Yield Curve Inversion Hysteria – Give It a Rest

Everything you have heard about yield curve inversion is true; nevertheless, everything that is true may not harm your investments. Yield curve inversion is a good predictor of recession, and there is a link between this inversion, recession prediction, and equity declines. However, being the first to react to flattening or inversion may not win you portfolio success.

Bear Markets – Not Unusual, But Hard to Predict, so Stay Diversified

Everyone talks about bear markets; however, it is surprising that this downturn definition is so arbitrary. Commentators are somewhat cavalier with their discussion of bear markets. It is a down move of 20% from a high price point. A correction is a down move of 10%. A bear definition could be applied to a individual asset, a sector, or an asset class.

Are Risk Factors and Risk Premia the Same Thing?

There is a difference between risk factors and risk premia. This may be viewed as a subtle distinction, but it is important to think about the differences. Factors explain the return attributes of an asset. Those attributes may be either style or macroeconomic factors. Factors provide a description of what drives returns. A risk premium is what an investor receives for taking-on the risk associated with a factor. A risk premium is compensation for non-diversified risk which can come in the form of a style or a macro factor. A factor is a measurement of a characteristic. A premium is compensation for holding a characteristic. Investors want to be paid a premium for a persistent repeatable factor.