Mark Rzepczynski, Author at IASG

Prior to co-founding AMPHI, Mark was the CEO of the fund group at FourWinds Capital Mgmt. Mark was also President and CIO at John W. Henry & Co., an iconic Commodity Trading Advisor. Mark has headed fixed income research at Fidelity Management and Research, served as senior economist for the CME, and as a finance professor at the Univ. of Houston Baer School of Business.

Factor Investing – Not as easy as many expect

Investors can form exaggerated expectations on what can be the potential return performance from factors. Some have described a “zoo” of factors. There are now hundreds of factors that have been analyzed and reported in the academic literature. Nevertheless, many have been hard to replicate, show performance return declines after being researched, and have failed when tested out of sample under realistic market conditions. These poor results may be from data mining, not accounting for transaction costs, data mining, poor design, and potential crowding. There are successful factors that have stood the test of time, yet even their performance has been time varying and may be less successful factor after accounting for all costs. Don’t be disappointed if actual returns are less than what is reported in academic studies.

Risk Management – Controlling what you have not thought of

If you have an asset that has some market risk but a large portion that is unexplained, the risks you face are different. You still can either leave the market risk exposed or hedged, but the majority of the risk cannot be explained. Hence, it cannot be truly hedged. You can conduct further analysis to measure the risks from other factors but you may still be left with a high percentage unexplained. You may have thought of everything with respect to your risks, but there is a lot leftover.

Cognitive Priming and Trend-following – Not a Bad Thing

Cognitive priming is a real effect that has often not been discussed with investment decisions and behavioral finance. Suggestions can be used to steer the behavior of investors. Priming is the use of stimulus to create a memory effect or create a temporary increase in accessibility of thoughts and ideas. It is the non-conscious use of memory. It could be used to increase both positive and negative thoughts, ideas, and behavior. Businesses have constantly used priming in advertising to help steer or suggest positive memories. Psychologists have tested priming for years and find that the power of suggestion or linkage is real and extensive. At the extreme, think of Christopher Nolan’s movie Inception on the idea of implanting ideas in memory.

Liquidity Risk: Why Every Investor Needs an Exit Strategy

If there is an adverse market move and you want to change portfolio allocations and sell some securities, will you get a fair price? Any downside situations that investors will face will face a liquidity shortage. This is different than thinking about illiquid investments, where the knowledge concerning illiquidity is known. The IMF Global Financial […]

Be a Coach Belichick 5-tool Investment Leader

He (Bill Belichick) is a five-tool leader, adept at strategy, tactics, preparation, execution, and what you might call situational intuition, the rare ability to know which among the first four is required and when.

The Growing Impact of Industry Domination on Futures Markets

Few will disagree that competition through a diverse set of independent traders is good for futures markets trading. Still, this issue should be broadened to the subtle impact of general competition across firms in the economy, not just the futures markets themselves. A growing set of recent research suggests that the US is becoming less […]

Monetary regime change – A crisis catalyst is needed

Reviewing the first quarter financial performance, the dominant macro theme was the change in Fed policy actions. The same could be said about the EU—no rate increase and no solid trend for normalization. The new macro focus is on the choice of Fed governors. More important than any policy comments or change in Fed governors […]

Maximizing Investment Success: A Guide to Developing and Weighing Multiple Options

Paul Nutt, a leading decision-making researcher – Only 15% of the case studies saw decision-makers actively seek out new options than what was available at the outset. Only 29% of organizational decisions contemplated more than one alternative. (From Farsighted by Steve Johnson) There is more to decision-making than “whether or not”. Too often, decision-making is bereft of choices. Everything […]

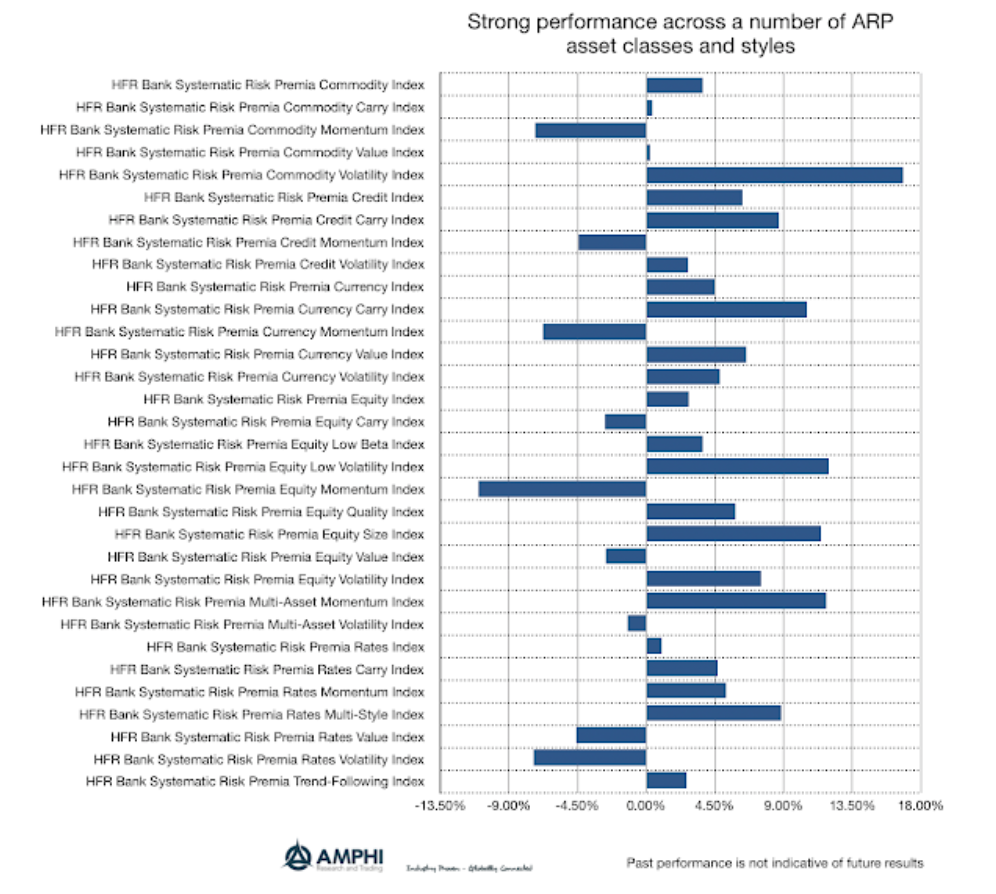

Strong first quarter returns for selected alternative risk premia

Selected alternative risk premia showed strong performance during the first quarter. There is significant tracking error with the HFR risk premium indices versus individual bank risk premia swaps, but they can provide some suggestive rankings. This strong performance should not be surprising given the large reversal of with equity beta and the strong moves in global bond markets. A couple of major themes emerged for the first quarter centered around positive equity beta risk and falling volatility.

Explaining Hedge Fund Performance: Market Risk vs. Style Performance

Hedge fund performance was dominated by the exposure to market risk as those fundamental equity funds that held more market risk dominated style performance. However, the average returns mask the large dispersion across styles. We still use indices for analysis because it does provide some information on what the average investor may expect. For example, while CTAs were down, on average, for the first quarter, anecdotal evidence from managers sending me reports show some up in the double digits for the first quarter. Winners made big money in the last quarter.

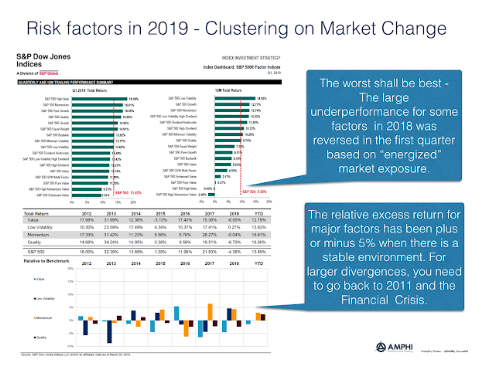

Equity Factor performance in 2019 – Clustering of Returns

An analysis of the first quarter tells us a lot abut factor investing in the short-run. Foremost, the worst factors last year are the best for this year. Factor risks change with the market environment as shown through the global factor indices from S&P Dow Jones. Factor rotation occurs, but not clear that it is predictable. Factors effects also can be swamped by the impact of large macro events.

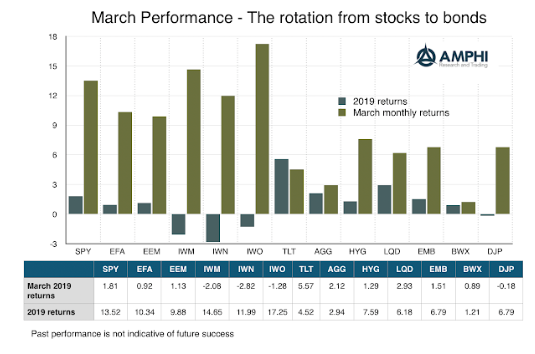

March – The big rotation from stocks to bonds

March was about asset class rotation from equity to bond demand with fixed income significantly out performing equities in March. Markets have moved from the January monetary euphoria to something more cautious and questioning. If the Fed potentially put all rate rises on hold for 2019 and the ECB is delaying a course on normalization, do they know something I don’t know?

Surviving Market Turbulence: Why Yesterday’s Logic Won’t Cut It

Market turbulence just does not happen. There is a catalyst, and the catalyst is a surprise turn of events. Now there are investment surprises everyday, the difference between expectations and realized results. A surprise creating market turbulence is more than just a micro surprise associated with a company but is a signal of a macro regime change.