Archives

Life Just Became a Lot More Difficult for the Data Dependent Fed

After a truly disappointing US employment report, the market has priced out any rate hike in coming months, with only slightly more than a 50% probability of one rate rise by year end. In our opinion, Janet Yellen has always been a lot more dovish than a number of her colleagues and will not want to raise rates now. So, either the Fed ignores the poor US employment report (and the continuing weakness in the manufacturing sector and corporate profitability) and raise rates anyway, thereby risking upsetting the financial markets. Or, they shift back to a more dovish narrative, risking their credibility.

When Interest Rates Rise From Zero

The general rule of thumb in equity investing is that you do not Fight the Fed, and there is a lot to be said for that thesis. Naturally, one has to respect the idea that higher rates provide more competition for equities in the traditional equity/bond portfolio, and vice versa when rates are low. I have actually spent, who knows how many, hours trying to model equities vs interest rates and I learned several lessons in the process. Primarily that rates high and rising are indeed not conducive to higher equity prices. However, rates low and rising are not as reliably equity unfriendly. And one can make a case that rates Low and rising are initially actually very good for equities. My studies suggested a high correlation between equities and rates when rates were high, not as much when rates were low.

Markets Have to Adjust as Fed Alters Course

The Fed’s normalisation process has been a tortuous on/off affair primarily because their focus has been almost entirely on not upsetting the financial markets rather than doing the right thing for the long term health of the US economy. This week, the Federal Reserve machine cranked into action to persuade markets that they want to raise rates before the Summer and again before year end. So far, the reaction has been quite muted, but it is far from certain that this calm veneer will continue. Let’s dive in and think about what the Fed are doing and what this means for markets.

大宗商品交易顾问基金研讨会

拓展海外资产投资,深入了解大宗商品基金策略与投资 时间: 2016年8月20号-至29号 地点:芝加哥 主办单位: Institutional Advisory Services Group, USA

Investors in Search of Instant Gratification But Patience Needed

As most of us know, trying to predict financial markets is frustrating nearly all of the time, and downright impossible too much of the time. Part of the problem is that everyone wants instant gratification. As money managers, we are delighted when our trades become immediately profitable and frustrated when they don’t. The same goes for all market participants regardless of individual timeframes.

Kottke Commodities – A Half-Empty or Half-Full Glass?

We know of very few commercial entities or traders that were positioned last month to reflect much possibility that soybean prices at CME might be far too low. Plenty of different explanations have been offered as to the source of last month’s abrupt price explosion of grains and oilseeds prices. These can be roughly divided into two groups, “game theorists” and “statistical analysts.”

IASG Launches Broker Dealer to Serve an Expanding Audience for Managed Futures

IASG Alternatives was founded in 2015 by current IASG team members Perry Jonkheer, JonPaul Jonkheer, and portfolio managers, Tyler Resch and Greg Taunt. This new company adds to the services provided by Institutional Advisory Services Group (IASG) by offering futures fund and managed account platform products designed to fit the risk tolerance, diversification, and transparency needs of our customers. Our free portfolio review process consists of an initial consultation, research and evaluation of managers that fit prospective customer’s risk return profile, portfolio design, and ultimately daily monitoring and reporting once an investment is open. Through education and proper manager selection we believe futures are an option that everyone should be knowledgeable about as a potential diversifier for their traditional investments.

Investing in a Continuum of Change: Trading Futures Markets Amidst Rapid Transformations

Market Commentary from Kottke Commodities – Commodity Capital CTA – Kenneth Stein Most of our expectations are just knee-jerk reactions to day-to-day details, but today’s headlines rarely reflect tomorrow’s reality meaningfully. For example, how many tectonic changes in different areas of our lives have and continue to occur, only dimly perceived even by those attentive to […]

Bracketology – An Investing Lesson from the NCAA

“Bracketology”, a term coined by ESPN, is the study of the annual NCAA college basketball tournament. Interestingly the art or science of filling out an NCAA tournament bracket also provides insight into how investors select investment assets. Before explaining, we present you with a question: When filling out an NCAA bracket do you A) start by picking the expected national champion and work backward or B) analyze each matchup, and pick winners starting at the earliest rounds, working toward the championship game?

CTA Spotlight – Sandpiper Asset Management

Today we are profiling a CTA that is new to the IASG database: Sandpiper Asset Management. The Sandpiper Global Macro Program is a multi-strategy program employing systematic trend following and discretionary trading methods across 50 liquid futures markets. The Program produces returns across a wide range of economic cycles and exhibits a negligible correlation to other investable assets. Risk is managed […]

A Primer on Negative Interest Rates

In “Paradigm Shift” we suggested that the prevalence of negative interest rates on sovereign debt in Europe and Japan could indicate decline in the efficacy of central bank actions going forward. This article will elaborate on that premise by describing negative interest rate policy (NIRP) and why a central bank would employ such an unusual and experimental policy.

A look back at the Grain Markets

Wheat made new lows led by Matif, and corn and beans worked towards low end of the ranges. There were no real weather scares in SAm and both corn and bean prod’n ideas are getting bigger. For the month, corn lost 19-20 cents and beans were down 27. Meal was down $11.00 and oil down 25 points. Chgo was the biggest loser – down 35 cents with KC down 27 and Mpls down 16. Matif wheat was down $14.75 euros/tonne – 44 cents. French wheat is $20-25/ton below SRW and thus continues to bring Chgo down.

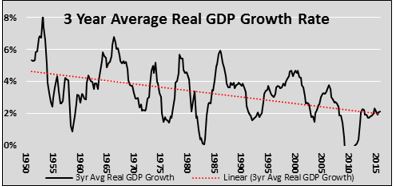

Paradigm Shift

The Absolute Return (AR) series of articles provides a primer on alternative investment styles to which few investors have access. Global markets and economies appear to be at the precipice of a paradigm shift making the timing of the AR series of unique value. In the 7 years since the financial crisis, most asset prices have experienced significant appreciation allowing for even the most inexperienced investor to increase his or her wealth. As the saying goes, “a rising tide lifts all boats”. For investors, understanding the tide of financial momentum is extremely important. Accordingly, we summarize 4 primary drivers of past returns to help gauge whether the tide can continue to rise or if retreat is more likely.